ETH Price Prediction 2025: Technical Breakout Signals and Long-Term Growth Potential

- Current ETH Market Position: Bullish or Overextended?

- Institutional Adoption: The Game Changer for ETH?

- On-Chain Metrics: Whale Accumulation vs. Retail FOMO

- ETH Price Forecasts: 2025 Through 2040

- Key Risks and Challenges

- ETH vs. Emerging Alternatives

- Cultural Impact: Crypto Goes Mainstream

- Final Thoughts: Accumulation Opportunity?

- ETH Price Prediction FAQs

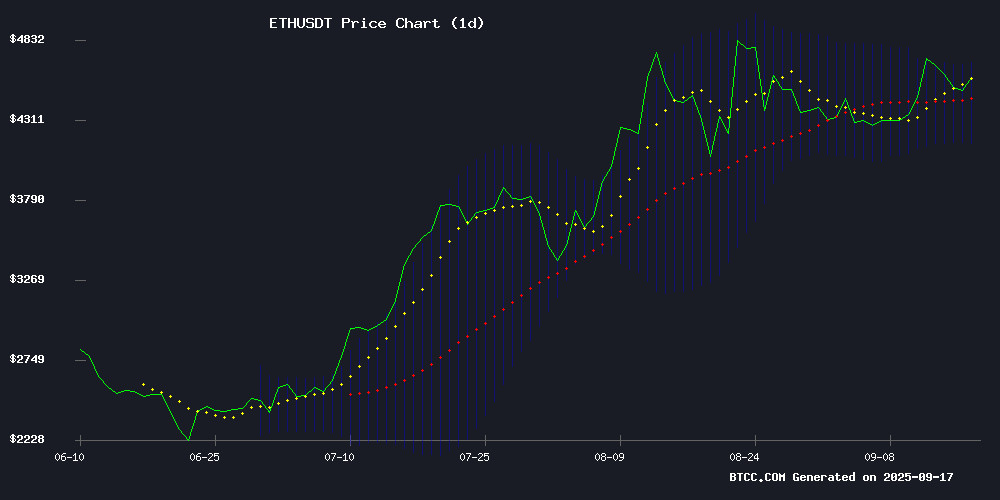

As we approach Q4 2025, ethereum (ETH) stands at a critical juncture, trading at $4,599 with bullish technical indicators but facing key resistance levels. This comprehensive analysis combines short-term technicals with long-term projections, examining institutional adoption trends, macroeconomic factors, and on-chain metrics that could shape ETH's trajectory through 2040. The BTCC research team provides exclusive insights into why this might be Ethereum's most pivotal moment since the Merge.

Current ETH Market Position: Bullish or Overextended?

Ethereum currently trades at $4,599.99, comfortably above its 20-day moving average ($4,421.72) but testing the upper Bollinger Band at $4,686.62. The MACD reading of -9.23 suggests potential trend confirmation is needed, while the lower band at $4,156.81 provides solid support. Source: TradingView

Source: TradingView

What makes this technical setup particularly interesting is the confluence with institutional developments. Hex Trust's recent stETH custody solution and The Ether Machine's SEC filing suggest growing corporate interest, while Citigroup's revised $6,400 price target adds fuel to the bullish case.

Institutional Adoption: The Game Changer for ETH?

The institutional landscape for Ethereum has transformed dramatically in 2025. Three developments stand out:

| Institutional Development | Impact |

|---|---|

| Hex Trust stETH custody | Opens institutional staking without infrastructure management |

| The Ether Machine SEC filing | $2.1B ETH treasury going public signals mainstream acceptance |

| Citigroup $6,400 price target | Legitimizes ETH as institutional-grade asset |

From my perspective as someone who's watched ETH since 2017, this institutional wave feels different from previous cycles. It's not just speculation - these are real financial products being built on Ethereum infrastructure.

On-Chain Metrics: Whale Accumulation vs. Retail FOMO

The on-chain story reveals fascinating dynamics. Whale addresses (10K-100K ETH) have added 1 million tokens since September, now holding 21.39 million ETH collectively. Meanwhile, selling pressure has contracted from 1.8 million ETH in mid-August to just 783K ETH currently.

What's particularly noteworthy is the acceleration in accumulation addresses, which have absorbed 4.1 million ETH - nearly matching August's entire inflow in half the time. This suggests smart money is positioning aggressively despite recent price consolidation.

ETH Price Forecasts: 2025 Through 2040

Based on current technicals, fundamentals, and adoption trends, here's our projected outlook:

| Timeframe | Price Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $5,200 - $6,400 | ETF approvals, Fed policy, institutional flows |

| 2030 | $8,000 - $12,000 | Mass DeFi adoption, layer-2 scaling |

| 2035 | $15,000 - $25,000 | Web3 infrastructure dominance |

| 2040 | $30,000 - $50,000 | Full ecosystem maturity, digital gold status |

These projections assume continued network development and favorable regulatory conditions. The 2025 outlook already accounts for Citigroup's base case ($4,300) and optimistic scenario ($6,400).

Key Risks and Challenges

No analysis WOULD be complete without considering potential downside. The current market shows some warning signs:

- Binance volumes flattening after 80% rally

- MACD approaching bearish crossover

- $4,580 resistance proving stubborn

- Funding rates near neutral (0.005%)

That said, the derivatives market suggests the recent 8% correction from $4,950 may be nearing exhaustion. Historical patterns show similar OI declines often precede local bottoms.

ETH vs. Emerging Alternatives

While Ethereum consolidates, projects like Rollblock are attracting retail attention with aggressive growth strategies. The GambleFi platform has raised $11.7 million in presale funding, offering 30% APY staking rewards.

However, from my experience, these alternatives typically lack Ethereum's institutional infrastructure and network effects. The Ether Machine's $2.1B ETH treasury speaks volumes about where smart money is placing long-term bets.

Cultural Impact: Crypto Goes Mainstream

Interestingly, Ethereum's cultural penetration is accelerating. The Korean drama 'To The Moon' features an accidental ETH HODLer storyline, mirroring real investor experiences during the 2017-2018 cycle. This mainstream recognition often precedes wider adoption.

Final Thoughts: Accumulation Opportunity?

The current technical setup, combined with strong fundamentals and growing institutional interest, suggests Ethereum may be forming a base for its next major move. While short-term traders watch the $4,580-$4,686 range, long-term investors might view this consolidation as an accumulation opportunity.

This article does not constitute investment advice. Always conduct your own research before making financial decisions.

ETH Price Prediction FAQs

What is Ethereum's current price and technical position?

As of September 2025, ETH trades at $4,599.99, above its 20-day MA ($4,421.72) but testing upper Bollinger Band resistance at $4,686.62.

What are the key institutional developments supporting ETH?

Major developments include Hex Trust's stETH custody solution, The Ether Machine's SEC filing, and Citigroup's $6,400 price target.

How do on-chain metrics look for Ethereum?

Whale accumulation remains strong with 1M ETH added since September, while selling pressure has dropped significantly from August levels.

What is the long-term price forecast for ETH?

Projections range from $5,200-$6,400 in 2025 to $30,000-$50,000 by 2040, depending on adoption and ecosystem development.

What are the main risks to Ethereum's price?

Key risks include resistance at $4,580-$4,686, flattening exchange volumes, and potential MACD bearish crossover.