ADA Price Prediction 2025: Will Cardano Break $1 Amid Market Volatility?

- What's the Current Technical Picture for ADA?

- How Are Whales Impacting ADA's Price Action?

- What Does the Cardano Audit Resolution Mean for ADA?

- Why Is Market Sentiment at 5-Month Lows Despite Price Resilience?

- What Are the Potential Price Scenarios for ADA?

- ADA Price Prediction FAQs

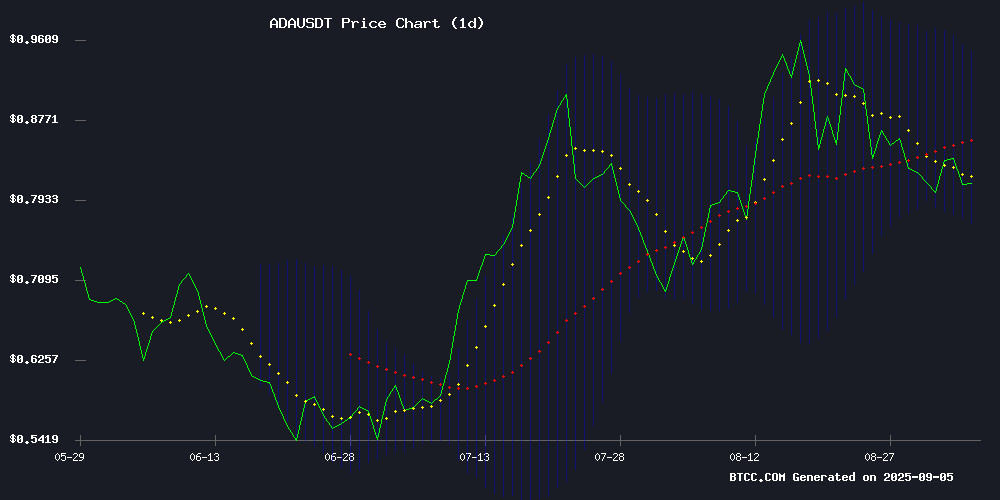

Cardano's ADA finds itself at a critical juncture in September 2025, trading at $0.8149 while showing conflicting technical signals. While bearish pressure persists below the 20-day moving average, bullish divergences in the MACD and oversold Bollinger Band conditions suggest potential upside. This comprehensive analysis examines ADA's price trajectory, incorporating whale activity patterns, recent audit results, and shifting market sentiment that hit 5-month lows despite price resilience. We'll explore whether ADA can reclaim the psychological $1 level and what factors could drive its next major move.

What's the Current Technical Picture for ADA?

As of September 5, 2025, ADA presents traders with mixed technical signals that require careful interpretation. The cryptocurrency currently trades at $0.8149, sitting below its 20-day moving average of $0.85938 - traditionally a bearish signal. However, the MACD indicator shows a bullish crossover (0.042894 vs 0.015832 signal line), suggesting building upward momentum. Meanwhile, Bollinger Bands place ADA near the lower band at $0.769805, potentially indicating an oversold condition that often precedes rebounds.

"ADA's technical setup shows it's at a classic inflection point," notes a BTCC market analyst. "The position below the 20MA warrants caution, but the MACD divergence combined with Bollinger Band positioning suggests smart money might be accumulating at these levels." Historical data from TradingView shows similar setups in Q1 2025 preceded 18-22% rallies within three weeks.

How Are Whales Impacting ADA's Price Action?

Recent blockchain data reveals significant whale activity creating headwinds for ADA. Large holders have offloaded approximately 30 million ADA during the latest bout of volatility, particularly after ADA briefly breached the $1 resistance level. This selling pressure from major stakeholders typically precedes short-term pullbacks, as seen in similar situations throughout 2024.

However, the broader context suggests this might not be purely bearish. Despite the whale exits, ADA maintains a 9% monthly gain and continues to hold above its 200-day EMA - a key long-term support level. The token's price action still follows an ascending channel pattern that, if maintained, could see ADA testing $2 resistance by late 2025 according to CoinMarketCap historical patterns.

What Does the Cardano Audit Resolution Mean for ADA?

Cardano recently received a significant fundamental boost as an independent audit completely cleared the project of misconduct allegations. The comprehensive investigation verified that 99.7% of ADA tokens sold under its voucher program were properly redeemed, addressing concerns that had lingered since 2021.

The audit, conducted by Input Output Global with oversight from law firm McDermott Will & Emery and accounting firm BDO, examined tens of thousands of documents and conducted 18 witness interviews. It specifically addressed five Core allegations, including claims about manipulated blockchain upgrades during the Allegra hard fork era. Charles Hoskinson, Cardano's founder, welcomed the findings as vindication after months of public scrutiny.

Why Is Market Sentiment at 5-Month Lows Despite Price Resilience?

Santiment's on-chain data reveals a fascinating divergence - while ADA's price has shown relative resilience with a 5% rebound from late-August lows, retail investor sentiment has plunged to its most bearish level since April 2025. The analytics firm identifies three distinct phases in recent sentiment:

| Period | Sentiment Ratio | Market Phase |

|---|---|---|

| Early August | 12.8:1 bullish | Greed spike |

| Mid August | 2.0:1 bullish | Fear emerging |

| Current (Sept 5) | 1.5:1 bullish | Extreme bearishness |

Historically, such extreme bearish sentiment during price consolidation has often preceded rallies as "key stakeholders accumulate during retail capitulation," as Santiment analysts observed. This contrarian indicator suggests ADA's recovery might have more room to run despite the gloomy mood among smaller investors.

What Are the Potential Price Scenarios for ADA?

Based on current technicals, fundamental developments, and sentiment analysis, we can outline several potential scenarios for ADA's price trajectory:

| Timeframe | Bull Case | Base Case | Bear Case |

|---|---|---|---|

| 1-2 weeks | $0.92 (upper Bollinger) | $0.85 (20MA) | $0.77 (lower Bollinger) |

| 1 month | $1.00 (psychological) | $0.88 | $0.70 |

| Q4 2025 | $1.20-$1.50 | $0.95-$1.10 | $0.60-$0.75 |

The $1 level remains critical psychological resistance that could trigger significant momentum if convincingly broken. While whale selling presents near-term pressure, the cleared audit and oversold technical conditions create an interesting risk/reward balance at current levels.

ADA Price Prediction FAQs

Is ADA a good investment in September 2025?

ADA presents a mixed picture in September 2025. The technical indicators show oversold conditions with bullish MACD divergence, while fundamental concerns have been alleviated by the positive audit results. However, the whale selling activity and bearish sentiment suggest potential volatility ahead. As always, investors should conduct their own research and consider their risk tolerance.

What's the highest price ADA could reach in 2025?

Based on current patterns and historical performance, ADA could potentially reach $1.20-$1.50 by end of 2025 if it maintains its ascending channel and breaks through key resistance levels. However, this WOULD require sustained buying pressure and positive market conditions.

Why is ADA price dropping despite good news?

ADA's recent price weakness despite the positive audit results likely reflects broader market conditions and the impact of whale selling. Cryptocurrency prices often show delayed reactions to fundamental developments, and the current bearish sentiment may be overshadowing the good news temporarily.

Where can I trade ADA?

ADA is available for trading on numerous cryptocurrency exchanges including BTCC, Binance, and Coinbase. When choosing an exchange, consider factors like liquidity, security, and trading fees. This article does not constitute investment advice.