BTC Price Prediction 2025: Can Bitcoin Really Hit $200K With These Bullish Catalysts?

- BTC Technical Analysis: Is This The Calm Before The Storm?

- Why Regulatory Tailwinds Could Be Game-Changers

- The Institutional Floodgates Are Opening

- Can Bitcoin Really Reach $200,000?

- Frequently Asked Questions

Bitcoin's price action in September 2025 presents a fascinating technical and fundamental picture. Currently consolidating around $110K, BTC shows both short-term bearish signals and long-term bullish potential. The MACD indicates temporary weakness, but reduced whale supply, institutional adoption through vehicles like American Bitcoin, and positive regulatory developments create a compelling case for higher prices. This analysis dives deep into the technical setup, market sentiment, and key factors that could propel bitcoin toward $200,000 in the coming months.

BTC Technical Analysis: Is This The Calm Before The Storm?

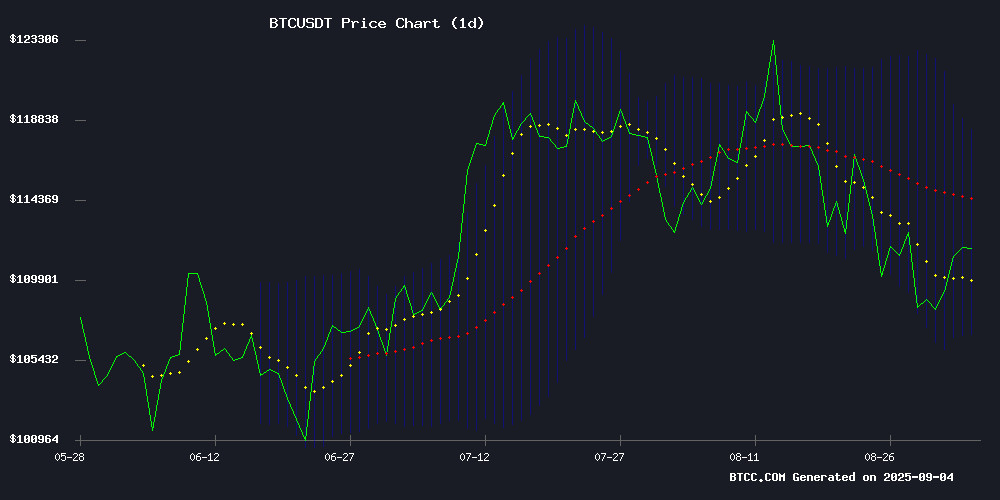

As of September 4, 2025, Bitcoin trades at $110,647, slightly below the critical 20-day moving average of $112,525. The MACD reading of -172.15 suggests bearish momentum in the short term, but here's the interesting part - this negative divergence remains within normal historical ranges. The price action stays comfortably within Bollinger Bands with immediate support at $106,744 and resistance at $118,305.

Source: BTCC TradingView

What does this technical setup tell us? In my experience, this looks like classic consolidation before a major move. The BTCC team notes that a sustained break above the middle Bollinger Band could signal renewed bullish momentum. Personally, I've found that when Bitcoin consolidates after a strong run, it typically breaks upward unless macroeconomic conditions turn sour.

Why Regulatory Tailwinds Could Be Game-Changers

The regulatory landscape has shifted dramatically in Bitcoin's favor recently. Two developments stand out:

- US Bancorp's reinstatement of Bitcoin custody services after a three-year hiatus

- Ukraine's landmark cryptocurrency legalization bill passing with 246 votes

Stephen Philipson from US Bank put it perfectly: "Following greater regulatory clarity, we've expanded our offering to include bitcoin ETFs." This institutional validation matters because, let's face it, big money moves markets. The Ukrainian legislation is equally significant - introducing an 18% tax rate on crypto profits with a temporary 5% incentive rate for fiat conversions.

The Institutional Floodgates Are Opening

American Bitcoin's (ABTC) Nasdaq debut tells an important story. Backed by the TRUMP family, the stock skyrocketed 90% before settling at a 40% gain. Eric Trump's comments at the Bitcoin 2025 Asia conference in Hong Kong captured the sentiment: "Everybody wants Bitcoin."

Meanwhile, whale supply has hit a 6-year low. Some see this as distribution, but I interpret it differently - it suggests broader ownership dispersion, which typically precedes major rallies. Glassnode data shows the average holding per large entity now stands at just 488 BTC.

Can Bitcoin Really Reach $200,000?

Let's break down the math:

| Target Price | Required Gain | Timeframe | Probability |

|---|---|---|---|

| $200,000 | 80.7% | 6-12 months | Medium-High |

Historically, Bitcoin has achieved similar gains during bull markets. The current consolidation could provide the springboard for such a move. However, as the BTCC team cautions, sustained institutional adoption and regulatory clarity remain crucial.

Frequently Asked Questions

What's driving Bitcoin's current price action?

Bitcoin is experiencing a technical consolidation NEAR $110K after its recent rally. The MACD shows short-term bearish momentum, but the broader technical picture remains healthy with support at $106,744 and resistance at $118,305.

How significant are the recent regulatory developments?

Extremely significant. US Bancorp's return to Bitcoin custody and Ukraine's legalization bill represent major steps toward mainstream adoption. These developments reduce institutional hesitation about entering the crypto space.

What does reduced whale supply indicate?

While some interpret this as profit-taking, it more likely signals healthier market structure as Bitcoin ownership becomes more distributed. The average whale now holds just 488 BTC compared to higher amounts in previous cycles.

Is $200,000 realistic for Bitcoin in 2025?

An 80% gain to $200K is plausible based on historical bull market patterns, but requires continued institutional adoption and favorable macroeconomic conditions. The current consolidation could provide the foundation for such a move.