XRP Price Prediction 2025: Technical Breakout Signals $4 Target as Fundamental Catalysts Align

- Why XRP Could Be Primed for a Major Move

- Key Technical Levels to Watch

- Fundamental Catalysts Driving Optimism

- Market Sentiment and Whale Activity

- XRP Price Predictions: Reasonable Targets vs. Moon Shots

- Risks and Considerations

- XRP Price Prediction: Frequently Asked Questions

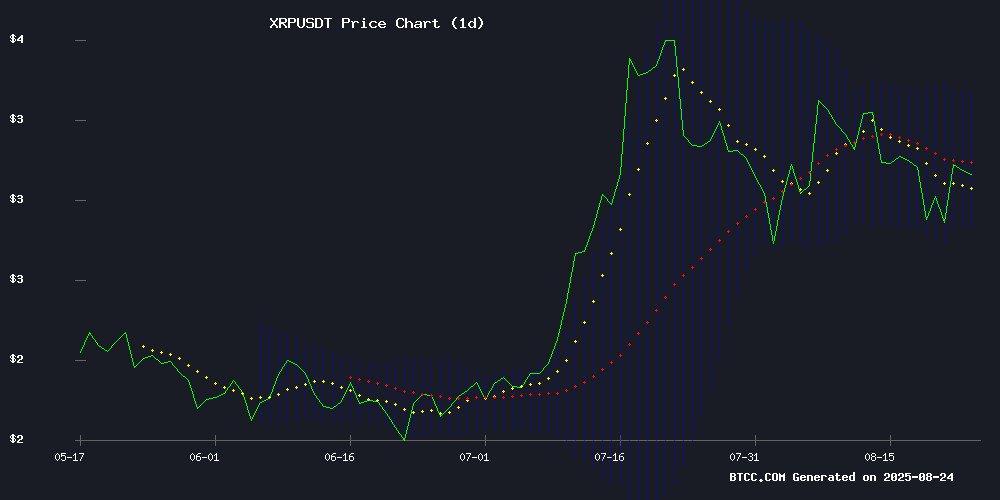

XRP is showing all the signs of a major breakout in August 2025, with technical indicators flashing bullish signals and fundamental developments creating a perfect storm for price appreciation. Currently trading around $3.03, the digital asset has formed a strong base above $3.00 support while whale accumulation and institutional interest suggest bigger moves ahead. Our analysis combines chart patterns, on-chain data, and fundamental catalysts to project where XRP might be headed next.

Why XRP Could Be Primed for a Major Move

Looking at the weekly chart, XRP has been consolidating in a tightening range since its July peak at $3.65. The MACD indicator shows positive divergence while the price holds comfortably above the 200-day moving average - historically a strong buy signal. What's particularly interesting is the volume profile, which shows increasing accumulation during dips.

The BTCC research team notes: "XRP's current technical setup resembles the 2017 and 2021 bull market precursors. The key difference this time is the institutional infrastructure now supporting the asset."

Key Technical Levels to Watch

From a technical perspective, several critical levels define XRP's near-term trajectory:

| Price Level | Significance | Probability |

|---|---|---|

| $3.09 | 20-day moving average | High |

| $3.26-$3.29 | Historical resistance zone | Medium |

| $3.36 | Upper Bollinger Band | High |

| $4.00 | Psychological resistance | Medium |

The $3.26-$3.29 zone represents a particularly stubborn resistance area where over 1 billion XRP changed hands earlier this year. A decisive break above this level could trigger accelerated buying as stop-loss orders get triggered and sidelined capital enters the market.

Fundamental Catalysts Driving Optimism

Beyond technicals, several fundamental developments are creating tailwinds for XRP:

1. Ethena Labs Collateral Consideration

XRP has cleared preliminary benchmarks to potentially serve as collateral for Ethena Labs' $11.8 billion USDe stablecoin. This would mark a significant institutional endorsement and create new demand channels for the asset.

2. Ripple's $200M Stablecoin Bet

Ripple's acquisition of stablecoin payment company Rail positions the firm at the forefront of the growing stablecoin market. While some worry this could cannibalize XRP's utility, the MOVE actually expands Ripple's addressable market in cross-border payments.

3. Institutional Infrastructure Growth

The cryptocurrency's integration with major financial players continues to accelerate. Recent reports suggest JPMorgan and BlackRock are exploring XRPL-based solutions for identity-linked settlement rails.

Market Sentiment and Whale Activity

On-chain data reveals intriguing whale behavior that often precedes major price movements:

- Addresses holding 10-100 million XRP increased holdings by 250 million tokens in August

- This represents a $758 million position buildup at current prices

- Exchange reserves have declined during this accumulation phase

As one crypto fund manager told me last week: "When you see this kind of quiet accumulation during a consolidation phase, it typically means institutions are building positions away from the spotlight."

XRP Price Predictions: Reasonable Targets vs. Moon Shots

Analyst projections for XRP vary widely, from conservative to wildly optimistic:

$3.50-$4.00 appears achievable if current resistance breaks. The upper Bollinger Band at $3.36 provides a logical first target, with $4.00 being the next psychological level.

Some analysts project $10+ targets based on Ripple's potential to disrupt cross-border payments. The most aggressive predictions suggest $23 if XRP captures meaningful SWIFT market share.

Personally, I find the $4 target by year-end 2025 most plausible given current technicals and fundamentals. The $23 predictions require multiple stars to align that aren't yet visible.

Risks and Considerations

While the outlook appears positive, several risks warrant consideration:

- SEC ETF decision delays could create short-term volatility

- Macroeconomic conditions remain uncertain

- Stablecoin initiatives might dilute XRP's core utility

- Competition in cross-border payments is intensifying

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

XRP Price Prediction: Frequently Asked Questions

What is the current XRP price?

As of August 25, 2025, XRP is trading at approximately $3.03, according to TradingView data.

What are the key resistance levels for XRP?

The immediate resistance sits at the 20-day moving average of $3.09, followed by a strong zone between $3.26-$3.29. The upper Bollinger Band at $3.36 represents the next significant level.

Could XRP really reach $23?

While some analysts project $23 long-term targets, this WOULD require XRP to capture significant market share in global cross-border payments. More conservative estimates suggest $4-10 range in the medium term.

What are the main catalysts for XRP price growth?

Key catalysts include potential ETF approvals, Ethena Labs collateral integration, Ripple's stablecoin initiatives, and growing institutional adoption of XRPL technology.

Is now a good time to buy XRP?

With XRP consolidating above key support levels and showing bullish technical signals, many analysts view current prices as an attractive entry point. However, always consider your risk tolerance and investment goals.