Bitcoin Price Prediction 2025: Why $150K is Within Reach as Institutional Adoption Soars

- What's Driving Bitcoin's Bullish Momentum?

- Institutional Adoption: The Game Changer

- Smart Money Strategies in Current Market

- Network Strength at All-Time High

- Macroeconomic Crosscurrents

- Political Developments Boosting Crypto

- Price Targets and Key Levels

- Frequently Asked Questions

Bitcoin is showing strong bullish signals as institutional adoption reaches new heights. With technical indicators pointing upwards and major policy changes favoring crypto integration, analysts predict BTC could hit $150,000 by Q4 2025. This in-depth analysis examines the key factors driving Bitcoin's potential surge, from technical setups to macroeconomic trends.

What's Driving Bitcoin's Bullish Momentum?

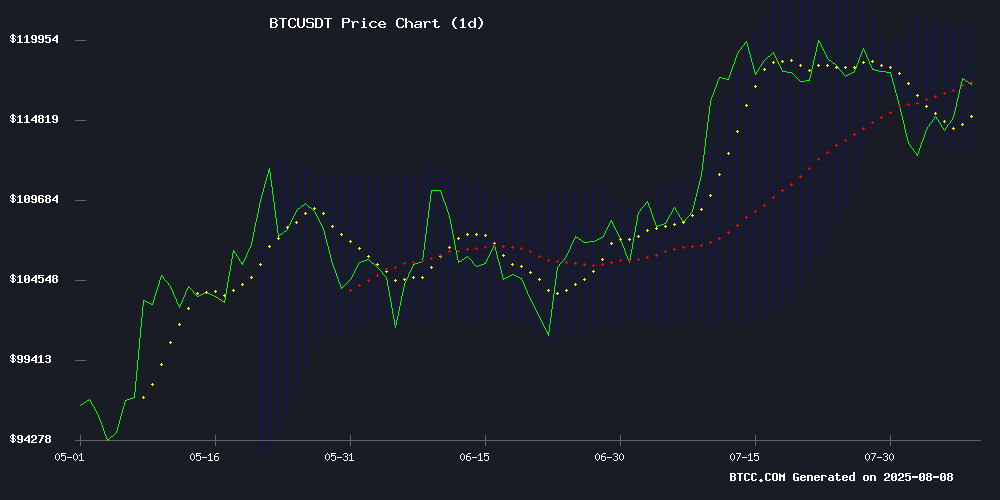

As of August 2025, Bitcoin's technical indicators paint an optimistic picture. The cryptocurrency currently trades at $116,852, slightly above its 20-day moving average of $116,740. The MACD shows strong bullish momentum with the histogram at 961.5, while price remains comfortably within Bollinger Bands (upper $120,776/middle $116,740/lower $112,705).

Source: BTCC Trading Platform

"This technical setup suggests consolidation with upside potential," notes the BTCC research team. "We're seeing classic accumulation patterns with miners holding strong, institutional adoption accelerating, and smart DCA strategies emerging during this 'undervalued' phase."

Institutional Adoption: The Game Changer

The crypto landscape has transformed dramatically in 2025 with several major institutional developments:

| Institution | Action | Impact |

|---|---|---|

| US Government | 401(k) crypto policy | Potential $50B+ inflow |

| Satsuma Technology | 60% of £163.6M note in BTC | 2nd largest UK holder |

| Bhutan Government | $60M BTC movement | Signals market activity |

Smart Money Strategies in Current Market

Bitcoin's price hovers NEAR $116,300 after rebounding from a brief dip to $112,200, still below its on-chain fair value of $117,700. The market has seen the rise of "Smart DCA" strategies that automate purchases when BTC trades below short-term realized prices.

"The method aims to neutralize emotional decision-making," explains CryptoQuant contributor BorisVest. "We're seeing this approach prove particularly effective during the current consolidation period."

Network Strength at All-Time High

Bitcoin's seven-day average hashrate surged to 952.5 exahashes per second, eclipsing previous records despite recent price volatility. This 7% increase from late-summer lows suggests miners continue demonstrating conviction through infrastructure expansion.

"The current divergence between price action and mining activity mirrors patterns seen during previous accumulation phases," observes the BTCC team. "Historically, such setups have preceded bullish reversals."

Macroeconomic Crosscurrents

Friday's startling US jobs report revisions have created macroeconomic uncertainty. The Bureau of Labor Statistics revealed combined downward revisions of 258,000 jobs for May and June - a statistical anomaly comparable only to pandemic-era disruptions.

"This abrupt labor market cooling contradicts previous reacceleration narratives," notes Bloomberg Economics' Anna Wong. "Traders are having to reassess risk assets across the board."

Political Developments Boosting Crypto

President Trump's recent actions have significantly impacted the crypto space:

- Executive order opening 401(k)s to crypto investments

- Nomination of pro-crypto Stephen Miran to Fed Board

- Winklevoss twins investing in Trump-linked mining venture

These developments coincide with Bitcoin's rally above $117,000, signaling renewed momentum in both political and crypto spheres.

Price Targets and Key Levels

Based on current analysis, here are the critical levels to watch:

| Level Type | Price | Significance |

|---|---|---|

| Support | $112,700 | Bollinger lower band |

| Resistance | $120,776 | Bollinger upper band |

| Target | $150,000 | 1.618 Fib extension |

Frequently Asked Questions

What is the Bitcoin price prediction for 2025?

Analysts predict bitcoin could reach $130K-$150K by Q4 2025 based on technical indicators, institutional adoption trends, and historical halving cycle patterns.

Why is institutional adoption important for Bitcoin's price?

Institutional adoption brings significant capital inflows, improves market liquidity, and enhances legitimacy - all factors that can drive price appreciation.

What are the key support and resistance levels for BTC?

Current key levels include support at $112,700 (Bollinger lower band) and resistance at $120,776 (Bollinger upper band), with a potential breakout target of $150,000.

How does the hashrate affect Bitcoin's price?

While not directly correlated, increasing hashrate indicates miner confidence and network security, often preceding price rallies as it suggests long-term commitment to the network.

What risks could derail Bitcoin's bullish trajectory?

Potential risks include macroeconomic shocks, regulatory changes, and unexpected geopolitical events that could impact risk asset sentiment broadly.