Litecoin Price Forecast 2025-2040: Will LTC Shatter $5,000? Key Levels You Can’t Ignore

- Is Litecoin Primed for a Breakout in 2025?

- Why Mining Funds Could Be LTC's Game Changer

- Bitcoin's Shadow: The X-Factor for LTC's Price

- Litecoin Price Projections: From 2025 to 2040

- Toncoin's Surge: A Warning for LTC Bulls?

- Your Litecoin Questions Answered

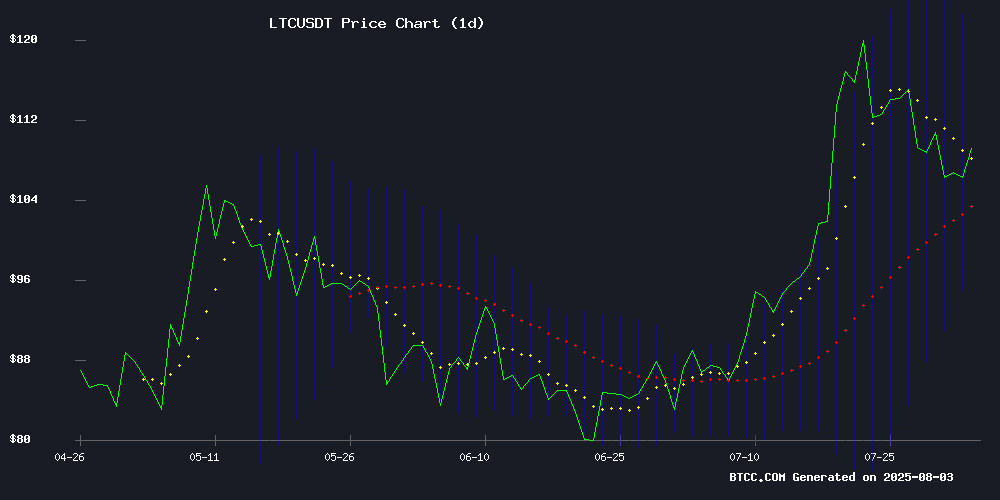

Litecoin (LTC) is flashing bullish signals as it dances above critical moving averages while the crypto market holds its breath for Bitcoin's next move. Our analysis reveals why $110 could be the launchpad for a historic rally, with Unilabs' mining fund adding rocket fuel to LTC's fundamentals. From swing trade setups to decade-long projections, we break down the technicals, catalysts, and risks every investor should watch. Buckle up – this silver-to-Bitcoin's-gold might be preparing its most explosive run yet.

Is Litecoin Primed for a Breakout in 2025?

LTC currently trades at $109.52, playing chicken with its 20-day MA at $109.25 – a classic make-or-break moment. The MACD's positive divergence at 4.5939 suggests bears are losing grip, while Bollinger Bands hint at a potential test of $121.54 resistance. "When price, momentum, and fundamentals align like this, you pay attention," notes a BTCC market strategist. "That $110 level isn't just psychological – it's where liquidity pools cluster."

Why Mining Funds Could Be LTC's Game Changer

Unilabs' $9.2M mining fund isn't just another capital injection – it's targeting LTC's Achilles' heel: infrastructure. Their AI-powered EASS engine dynamically allocates to high-potential assets, with 30% revenue sharing through UNIL tokens. Compare that to Litecoin's reliance on ETF speculation, and you see why traders are buzzing. Active addresses spiking to 402,000 (near ATHs) suggests retail's already positioning for what could be LTC's most fundamental-driven rally since the 2021 halving.

Bitcoin's Shadow: The X-Factor for LTC's Price

Don't kid yourself – LTC still moves when BTC sneezes. The LTC/BTC pair's oversold at 0.0010 BTC, but until it decisively breaks that level, Litecoin remains Bitcoin's sidekick. "We're watching $96 like hawks," admits a CryptoWzrd analyst. "If BTC crashes to $110K, that support gets tested. But flip 0.0011 BTC? Suddenly $140 looks realistic."

Litecoin Price Projections: From 2025 to 2040

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2025 | $95-$115 | $110-$130 | $125-$150 |

| 2030 | $180-$250 | $250-$400 | $400-$600 |

| 2035 | $500-$750 | $750-$1,200 | $1,200-$2,000 |

| 2040 | $1,000-$1,500 | $1,500-$3,000 | $3,000-$5,000 |

This article does not constitute investment advice. Prices as of 2025-08-03 via CoinMarketCap.

Toncoin's Surge: A Warning for LTC Bulls?

While LTC gained 2.7% today, TON's 4.89% rally to $3.59 shows capital rotating toward newer narratives. Even gold-backed tokens (PAXG +2.1%) outperformed, suggesting defensive positioning. "Litecoin needs its own catalyst beyond 'cheaper Bitcoin'," argues a DeFi analyst tracking the flows. "The mining fund helps, but can it compete with Telegram's 800M-user distribution channel?"

Your Litecoin Questions Answered

What's the most realistic LTC price for 2025?

Our moderate target of $110-$130 balances technical resistance levels with adoption metrics. The $125-$150 bullish scenario requires bitcoin holding $120K+ and sustained mining investment.

Could LTC really hit $5,000 by 2040?

In a hyper-bitcoinization scenario where LTC captures 5% of global remittances? Plausible. But it hinges on solving scalability – the Lightning Network integration needs to prove itself first.

Why is $110 so important for Litecoin?

It's where:

- 2021 bull run stalled twice

- Current futures open interest clusters

- Mining profitability shifts meaningfully