XRP Price Prediction 2025: Will the Bull Case Overcome Market Volatility?

- Where Does XRP Stand Technically in December 2025?

- What's Driving XRP's Market Sentiment?

- Could XRP Really Reach $23?

- How Are Institutions Impacting XRP's Outlook?

- What's the Retail Investor Situation?

- Are There Alternatives Drawing Attention From XRP?

- What's the Bottom Line for XRP Investors?

- XRP Price Prediction: Your Questions Answered

As we approach the end of 2025, XRP finds itself at a critical juncture. The digital asset, currently trading around $2.10, presents investors with both significant opportunities and notable risks. Our analysis reveals a market caught between bullish institutional developments and bearish technical signals, creating what traders call a "high-conviction, high-volatility" setup. The coming weeks could determine whether XRP breaks toward $23 or corrects to $1.20, making this one of the most watched assets in crypto right now.

Where Does XRP Stand Technically in December 2025?

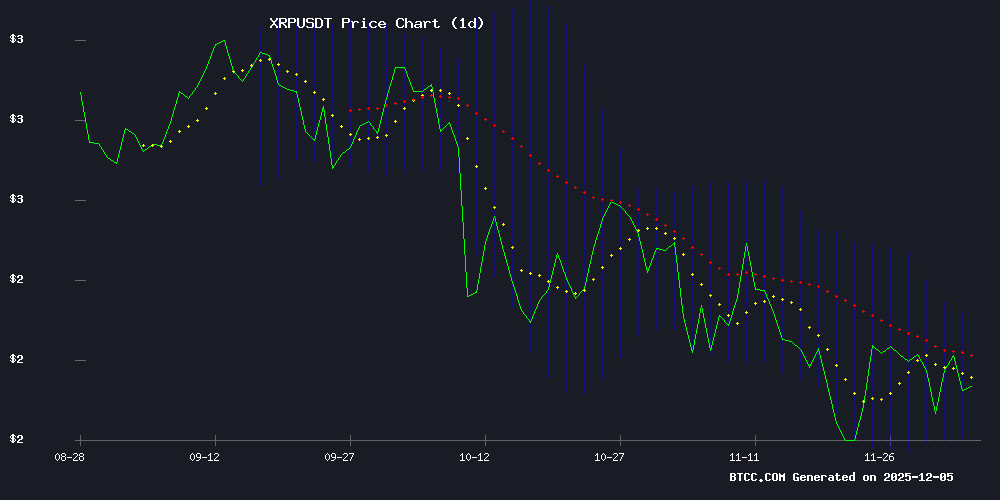

According to TradingView data, XRP is currently trading at $2.1059, slightly below its 20-day moving average of $2.1314. This positioning suggests a moment of equilibrium in the market. The MACD indicator shows a bearish crossover with a value of -0.0161, indicating potential short-term selling pressure. However, the price remains comfortably above the lower Bollinger Band at $1.9540, which acts as a key support level.

The middle band at $2.1314 and the upper band at $2.3087 define the immediate trading range. A sustained break above the 20-day MA could signal a shift towards testing the $2.30 resistance. Interestingly, this technical setup comes at a time when on-chain activity has hit yearly highs, suggesting increased network utilization despite the price consolidation.

What's Driving XRP's Market Sentiment?

The current sentiment around XRP is what market veterans call "cautious euphoria." On one hand, we have bullish catalysts like Ripple's Singapore license expansion and ongoing ETF speculation. On the other, there are clear warning signs including whale sell-offs and trader indecision.

Here's the sentiment breakdown:

| Bullish Factors | Bearish Factors |

|---|---|

| Ripple's regulatory progress in Singapore | Whale sell-offs creating volatility |

| Record on-chain activity | Split trader sentiment on direction |

| ETF speculation gaining traction | Only 4% of holders control significant supply |

This mixed sentiment creates what I like to call the "trader's dilemma" - when fundamentals and technicals tell slightly different stories. In my experience, these are the markets where the biggest opportunities (and risks) emerge.

Could XRP Really Reach $23?

The $23 price target making rounds in crypto circles isn't just random speculation. Technical analysts point to XRP forming what appears to be a bull pennant pattern, with historical cycles suggesting potential for significant upside. The token's price action since 2013 shows consistent bullish cycles, with the current momentum mirroring previous breakout formations.

However, as any seasoned trader will tell you, patterns are just one piece of the puzzle. The $23 scenario depends on several factors:

- Sustained institutional adoption through Ripple's payment solutions

- Successful launch of XRP ETFs creating new demand channels

- Resolution of any remaining regulatory uncertainties

- Continued growth in on-chain activity and real-world usage

While the technical case exists, investors should remember that crypto markets can remain irrational longer than you can remain solvent, as the old saying goes.

How Are Institutions Impacting XRP's Outlook?

The institutional landscape for XRP has changed dramatically in recent months. Five major asset managers—21Shares, Bitwise, Grayscale, Franklin Templeton, and Canary Capital—now compete in the US spot ETF arena. According to CoinMarketCap data, aggregate inflows have exceeded $824 million within weeks, with zero net outflows recorded since launch.

This institutional interest is creating what analyst Pumpius calls a "structural supply-demand imbalance." Exchange reserves are thinning just as ETF buying accelerates, potentially setting the stage for a supply shock if this trend continues. Ripple's growing institutional partnerships further fuel speculation that we may be entering a new phase for XRP's market dynamics.

What's the Retail Investor Situation?

An interesting development in the XRP market is the emergence of the "10K XRP club." Data shows only 4% of wallets hold at least 10,000 XRP (worth about $22,000 at current prices). With over 6 million wallets containing 500 tokens or fewer, there's clear stratification in the investor base.

Edoardo Farina of Alpha Lions Academy notes that rising prices have effectively priced out accumulation strategies for most retail investors. This creates an interesting dynamic where:

- Whales control significant supply

- Mid-sized holders are becoming rare

- Small holders dominate by numbers but not by volume

In my view, this distribution could lead to increased volatility as large holders' actions disproportionately impact the market.

Are There Alternatives Drawing Attention From XRP?

While XRP dominates headlines, platforms like GeeFi are capturing investor interest with their all-in-one DeFi solutions. GeeFi's presale phases have been selling out rapidly, suggesting some capital rotation may be occurring. However, it's worth noting that these are fundamentally different propositions—XRP as an institutional payment solution versus newer platforms targeting retail DeFi users.

Similarly, cloud mining services like LeanHash are gaining traction among risk-averse participants seeking stable returns amid XRP's volatility. This diversification of crypto investment options is healthy for the ecosystem but does create competition for investor attention and capital.

What's the Bottom Line for XRP Investors?

XRP presents what I'd call a "high-stakes asymmetric bet" as we close out 2025. The potential upside is significant (with $23 targets in play), but the near-term volatility can't be ignored. Here's my take:

The institutional developments and regulatory progress suggest XRP could have staying power. Dollar-cost averaging might make sense for those with multi-year horizons.

The current technical setup offers clear levels to watch ($2.13 resistance, $1.95 support). Position sizing and stop-losses are crucial in this environment.

Consider whether you're comfortable with the volatility. As always, never invest more than you can afford to lose.

This article does not constitute investment advice. The crypto market is highly volatile, and investors should conduct their own research before making decisions.

XRP Price Prediction: Your Questions Answered

What is the current XRP price as of December 2025?

As of December 5, 2025, XRP is trading at $2.1059 according to TradingView data, slightly below its 20-day moving average of $2.1314.

What are the key support and resistance levels for XRP?

The immediate support level is at $1.95 (lower Bollinger Band), while resistance sits at $2.13 (20-day MA) and $2.30 (upper Bollinger Band).

Could XRP really reach $23?

While some technical analyses suggest this possibility based on historical patterns, reaching $23 WOULD require sustained institutional adoption and favorable market conditions.

What percentage of XRP holders own significant amounts?

Only about 4% of wallets hold 10,000 XRP or more, representing approximately $22,000 at current prices.

How are institutions impacting XRP's market?

Five major asset managers now offer XRP ETFs, with over $824 million in inflows and thinning exchange reserves creating potential supply-demand imbalances.