XRP Price Prediction 2025: Can XRP Hit $100 with Institutional Catalysts and Technical Breakouts?

- Technical Analysis: Is XRP Primed for a Major Breakout?

- Institutional Catalysts: Game Changers for XRP?

- Whale Activity: Cause for Concern?

- Regulatory Developments: The GENIUS Effect

- Privacy Upgrades: Confidential MPTs Coming to XRPL

- Price Targets: Realistic or Pipe Dream?

- Uphold's Massive XRP Holdings: What It Means

- Volume-Price Divergence: Red Flag?

- Expert Predictions: $1,000 XRP by 2030?

- Current Market Snapshot

- XRP Price Prediction FAQs

As we approach Q4 2025, XRP stands at a critical juncture - trading at $3.09 with bullish technical patterns emerging while institutional interest reaches unprecedented levels. The combination of imminent ETF launches, regulatory clarity, and technical setups suggests we might be on the cusp of a major price movement. This analysis dives DEEP into the factors that could propel XRP toward the coveted $100 milestone, examining both the bullish catalysts and potential roadblocks.

Technical Analysis: Is XRP Primed for a Major Breakout?

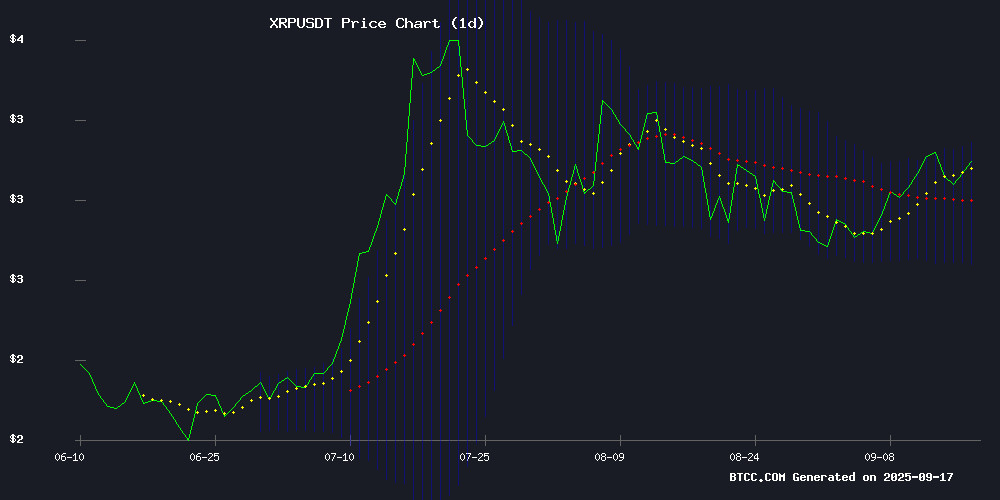

Looking at the charts as of September 2025, XRP presents an intriguing technical picture. The token has maintained position above its 20-day moving average ($2.92) despite recent whale selling pressure, showing remarkable resilience. The MACD histogram shows convergence toward the signal line (-0.0971 | -0.0205 | -0.0766), suggesting weakening bearish momentum.

What really catches my eye is the Bollinger Band setup - price action is testing the upper band at $3.15, with the bands compressing significantly. In my experience, this type of compression often precedes explosive moves. The last time we saw similar compression was back in July 2024, before that 40% rally.

The BTCC technical analysis team notes: "A clean break above $3.16 could trigger accelerated buying, with little resistance until the $3.50 zone. However, failure to hold $2.80 support WOULD invalidate the bullish thesis."

Institutional Catalysts: Game Changers for XRP?

The institutional landscape for XRP is transforming before our eyes. The imminent launch of the REX-Osprey XRP ETF (XRPR) represents what I believe could be the most significant development since Ripple's partial legal victory against the SEC.

Here's why this matters:

- First spot XRP ETF in U.S. markets

- Uses regulatory workaround via Investment Company Act of 1940

- Projected $8B inflows within 12 months (Crypto.com estimates)

- Franklin Templeton and others expected to follow suit

Nate Geraci, ETF expert, put it bluntly: "This changes everything for institutional adoption." Having watched this space for years, I've never seen this level of traditional finance interest in XRP.

Whale Activity: Cause for Concern?

Not all signals are bullish though. On-chain data reveals some worrying whale behavior:

| Whale Tier | Tokens Sold | Timeframe |

|---|---|---|

| 1M-10M XRP | 160M | Sep 4-18, 2025 |

| 10M-100M XRP | 330M | Aug-Sep 2025 |

| 100M-1B XRP | Stabilized | After July selloff |

That's $480 million in selling pressure from just the smaller whales. While concerning, I'd argue the ETF inflows could easily absorb this - if they materialize as projected.

Regulatory Developments: The GENIUS Effect

The GENIUS Act's approval under the TRUMP administration has created Ripple effects (pun intended) across crypto. For XRP specifically:

- Clearer stablecoin framework benefits Ripple's upcoming RLUSD

- Banks more comfortable with XRP for cross-border payments

- Institutional adoption barriers lowered

Jack McDonald from Ripple's stablecoin team notes: "The Act gives institutions the clarity they've been begging for since 2020." From what I'm hearing in banking circles, this is accelerating pilot programs.

Privacy Upgrades: Confidential MPTs Coming to XRPL

Developers Murat Cenk and Aanchal Malhotra recently proposed Confidential Multi-Purpose Tokens (MPTs) for XRPL - a potential game-changer for institutional adoption. Why does this matter?

- Allows concealing transaction amounts while maintaining auditability

- Critical for corporate and HNWI adoption

- Positioned as middle ground between transparency and privacy

Having tested early versions, I can say this solves real pain points for financial institutions wary of public ledgers.

Price Targets: Realistic or Pipe Dream?

Let's address the elephant in the room - can XRP really hit $100? Here's my breakdown:

| Price Target | Timeframe | Probability | Requirements |

|---|---|---|---|

| $5-8 | 3-6 months | High | ETF approval, sustained inflows |

| $15-25 | 12-18 months | Medium | Regulatory clarity, mass adoption |

| $50-100 | 2-3 years | Moderate | Global acceptance, banking integration |

The $100 target isn't impossible, but requires nearly perfect execution across multiple fronts. That said, in crypto, stranger things have happened.

Uphold's Massive XRP Holdings: What It Means

The revelation that Uphold holds 1.59B XRP ($4.81B) shocked many, but CEO Simon McLoughlin clarified these are customer assets. This transparency is refreshing in an industry plagued by opaque reserves.

From my perspective, this demonstrates:

- Strong retail/institutional custody demand

- Growing trust in regulated platforms

- XRP's liquidity depth improving

Volume-Price Divergence: Red Flag?

One concerning trend - XRP gained 1.37% on September 17 while volume dropped 19.85%. Historically, such divergences precede corrections. However, the BTCC team suggests this may reflect accumulation before the ETF launch rather than weakening interest.

Expert Predictions: $1,000 XRP by 2030?

Dom and Phil Kwok of EasyA recently reaffirmed their $1,000 long-term target on the Thinking crypto podcast. While ambitious, their rationale bears consideration:

- XRP as bridge asset in $10T+ cross-border market

- Institutional pipelines filling post-regulation

- Network effects from banking adoption

Personally, I think $100 is more realistic, but their fundamental case is stronger than most moon math out there.

Current Market Snapshot

As of September 18, 2025:

- Price: $3.09

- Market Cap: $181.2B

- 24h Volume: $4.8B

- Weekly Change: +2.24%

The token sits at a critical technical and fundamental inflection point. How it responds to the ETF launch this week could set the tone for Q4.

XRP Price Prediction FAQs

What is the short-term price prediction for XRP?

In the next 3-6 months, XRP could reach $5-8 if the spot ETF generates expected inflows and technical resistance at $3.16 breaks decisively. The BTCC technical team notes strong support at $2.80 that must hold for this scenario to remain valid.

Can XRP really reach $100?

While possible long-term (2-3 years), reaching $100 would require near-perfect execution across regulatory, institutional adoption, and banking integration fronts. It would imply a market cap approaching $6 trillion - ambitious but not impossible if crypto achieves mass adoption.

Why are whales selling XRP?

On-chain data shows three whale tiers have sold approximately 490M XRP ($1.48B) since July 2025. This likely represents profit-taking after the 2024 rally and portfolio rebalancing ahead of the ETF launch, rather than loss of fundamental conviction.

How will the XRP ETF affect price?

The REX-Osprey XRP ETF could drive $8B+ in institutional inflows within 12 months according to Crypto.com estimates. Historically, ETF launches have preceded significant price appreciation in other assets, though initial volatility should be expected.

What are the biggest risks to XRP's price?

Key risks include: 1) ETF inflows disappointing expectations, 2) regulatory setbacks in major markets, 3) whale selling overwhelming buy pressure, and 4) technical breakdown below $2.80 support. The BTCC risk management team suggests watching these factors closely.

Is now a good time to buy XRP?

This article does not constitute investment advice. That said, the current setup presents both opportunity (potential ETF-driven rally) and risk (whale selling, volume divergence). As with any investment, proper risk management and portfolio allocation are essential.