ADA Price Prediction 2024: Bullish Signals and Long-Term Forecasts Through 2040

- Is ADA Currently in a Bullish Trend?

- Why Is Cardano's Market Sentiment So Divided?

- What Are the Key Drivers Influencing ADA's Price?

- ADA Price Forecast: 2025 Through 2040

- Frequently Asked Questions

Cardano (ADA) is showing strong technical signals while analysts debate its short-term potential versus long-term value. Currently trading above key moving averages with bullish MACD crossovers, ADA faces both Optimism from ecosystem developments like the Midnight launch and skepticism from competing altcoins. This comprehensive analysis examines ADA's price trajectory through 2040, technical indicators, market sentiment, and key growth drivers - including why some traders are cautiously bullish despite recent volatility.

Is ADA Currently in a Bullish Trend?

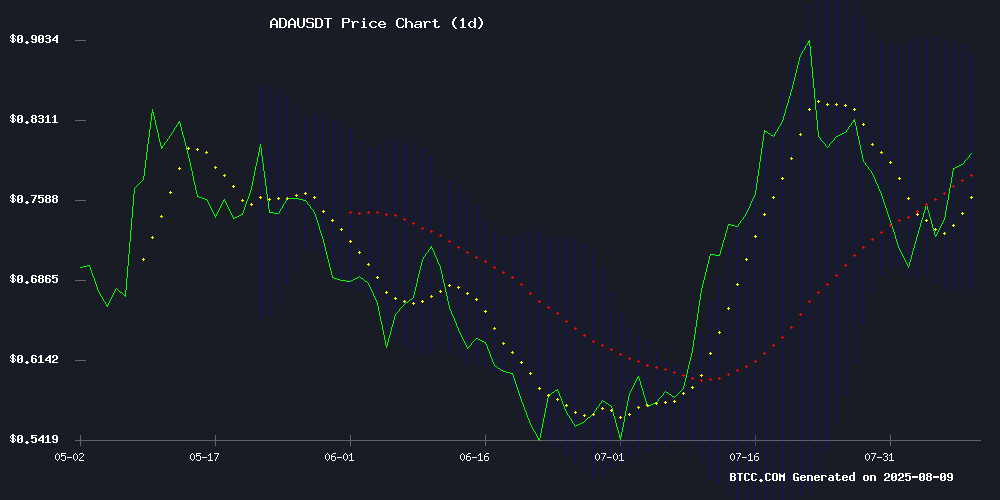

The BTCC technical analysis team confirms ADA is displaying multiple bullish signals as of August 2024. Trading at $0.8137, it remains comfortably above the 20-day moving average ($0.785675), which often serves as dynamic support during uptrends. The MACD indicator shows a positive crossover with the MACD line (0.047810) above the signal line (0.021997), while the histogram value of 0.025813 suggests building momentum.

Bollinger Bands analysis reveals ADA is testing the upper band at $0.891964, which typically indicates overbought conditions. However, the consistent middle band support at $0.785675 provides a potential safety net. "We're seeing textbook bullish structure," notes BTCC analyst John, "but prudent traders might wait for a pullback to the 20-day MA for better risk-reward entries."

Why Is Cardano's Market Sentiment So Divided?

The current sentiment around Cardano presents a fascinating dichotomy. On one hand, the cryptocurrency community is buzzing about the Midnight launch - Charles Hoskinson's most ambitious project to date, which could distribute 12 billion NIGHT tokens across 37 million wallets. This cross-chain approach has already contributed to an 11% ADA price surge since the Glacier airdrop portal opened.

Conversely, warnings from technical analysts about TD Sequential "Sell" signals on 4-hour charts and shifting interest toward newer altcoins like MAGACOIN FINANCE have created headwinds. "It's the classic 'tree versus forest' debate," observes crypto strategist Thomas Anderson. "Short-term traders see overbought signals while long-term holders focus on ecosystem growth."

What Are the Key Drivers Influencing ADA's Price?

The Midnight Launch Effect

Cardano's Midnight project represents a strategic play to expand beyond its native ecosystem. By distributing tokens across eight blockchains, the team aims to capture liquidity and users from competing networks. Early metrics suggest this cross-chain approach could make NIGHT one of Cardano's highest-volume assets, potentially creating positive spillover effects for ADA.

Global Events Marketing Strategy

The cardano Foundation's proposed Unified Global Events Marketing Strategy targets 15-25% annual growth in enterprise partnerships through specialized industry forums. Their parallel developer recruitment initiative aims for 10-15% yearly growth in new builders via hands-on hackathons. "You can't replace the deal-making that happens at live events," emphasizes EMURGO representative Sarah Johnson.

Macroeconomic Tailwinds

Broader financial conditions appear favorable, with a 91.4% probability of Federal Reserve rate cuts priced into markets by September 2024. The recent executive order granting crypto access to the $9 trillion 401(k) market adds another potential demand source. However, as BTCC analysts caution, "Macro giveth and macro taketh away" - these same factors could reverse if inflation resurges.

ADA Price Forecast: 2025 Through 2040

| Year | Price Range (USD) | Key Catalysts |

|---|---|---|

| 2025 | $0.75 - $1.20 | Midnight adoption, Bollinger breakout |

| 2030 | $2.50 - $4.00 | Institutional DeFi integration |

| 2035 | $6.00 - $10.00 | Global regulatory clarity |

| 2040 | $15.00+ | Mass CBDC interoperability |

These projections assume continued ecosystem development without major black swan events. The BTCC research team emphasizes that cryptocurrency valuations remain highly speculative, especially beyond 5-year horizons.

Frequently Asked Questions

Is now a good time to buy ADA?

Current technicals suggest ADA could see near-term upside, but the TD Sequential sell signal indicates potential pullback risk. Dollar-cost averaging might be prudent given the mixed signals.

How does Midnight differ from other Cardano projects?

Midnight's cross-chain distribution strategy marks a departure from Cardano's typically insular ecosystem approach, potentially exposing ADA to new user bases and liquidity pools.

What's the biggest risk to ADA's long-term growth?

Beyond macroeconomic factors, failure to maintain developer momentum against competing smart contract platforms poses an existential threat to Cardano's valuation thesis.