SOL Price Prediction 2024: Expert Forecasts Through 2040 and What’s Driving Solana’s Growth

- Current SOL Market Overview: Where Does Solana Stand Today?

- What Technical Indicators Suggest About SOL's Near-Term Price Action?

- How Is Market Sentiment Shaping SOL's Price Trajectory?

- What Ecosystem Developments Are Driving Solana's Growth?

- SOL Price Predictions: 2025 Through 2040

- What Are the Key Risks to SOL's Growth Story?

- SOL Price Prediction FAQs

Solana (SOL) has emerged as one of the most talked-about cryptocurrencies in 2024, with its price showing impressive volatility and growth potential. In this comprehensive analysis, we'll examine SOL's current technical indicators, market sentiment, key ecosystem developments, and long-term price projections through 2040. From whale accumulation patterns to solana Mobile's global expansion and potential ETF speculation, we break down all the factors that could shape SOL's trajectory in the coming years.

Current SOL Market Overview: Where Does Solana Stand Today?

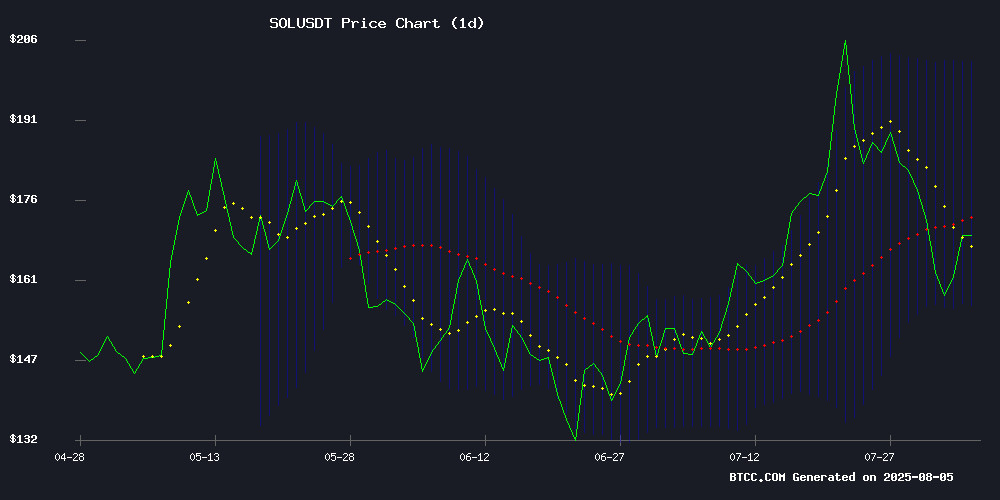

As of August 2024, SOL is trading at $164.82, presenting an interesting technical picture. The price sits below its 20-day moving average of $178.88, which typically suggests short-term bearish pressure. However, the MACD indicator shows a bullish crossover with the histogram at 11.9425, hinting at potential upward momentum. According to TradingView data, SOL is currently hovering NEAR the lower Bollinger Band ($155.80), which often acts as a support level.

The BTCC research team notes that while SOL faces immediate resistance at $168, a breakout could target the middle Bollinger Band at $178.88, with the upper band sitting at $201.96. "We're seeing classic signs of accumulation," says Robert from BTCC's analytics team. "The question isn't if SOL will move, but when and how sharply."

What Technical Indicators Suggest About SOL's Near-Term Price Action?

Technical analysis reveals several compelling patterns in SOL's price action. The formation of a golden cross pattern - when a shorter-term moving average crosses above a longer-term one - has caught the attention of many chartists. This typically signals the potential start of a new bullish phase.

Looking at Fibonacci retracement levels from SOL's recent swing from $182 to $155, the cryptocurrency has already surpassed the 23.6% level. The next significant hurdles lie at $170 (50% retracement) and $180 (61.8% retracement). A decisive close above $180 could open the door for extended upside, possibly toward the $200 psychological barrier.

Hourly charts show an emerging trend line with support around $165, suggesting buyers are stepping in at these levels. The 100-hour simple moving average has flipped to support, another positive development for bulls. However, traders should watch volume closely - while recent days have shown increased activity, sustained moves typically require growing participation.

How Is Market Sentiment Shaping SOL's Price Trajectory?

Market sentiment around SOL has turned noticeably more positive in recent weeks. Several factors are contributing to this shift:

- Whale Activity: Large investors have been accumulating SOL, with one notable transaction seeing $12 million worth of SOL moved from Binance to staking on Kamino Finance.

- Retail Participation: The buy-sell differential has turned positive for three consecutive days, with August 5 showing $553K in buy volume versus $532K in sells.

- Derivatives Market: Funding rates have flipped positive after weeks of negative sentiment, indicating growing optimism among leveraged traders.

Perhaps most interestingly, rumors of a potential SOL ETF have begun circulating. While no formal application has been submitted, the mere speculation has added fuel to SOL's recent rally. "The combination of strong fundamentals and speculative ETF HYPE could propel SOL toward $200," notes the BTCC analysis team.

What Ecosystem Developments Are Driving Solana's Growth?

Solana's ecosystem continues to expand rapidly, with several notable developments in 2024:

Solana Mobile's Global Expansion

Solana Mobile has begun shipping its second-generation Seeker smartphone globally, fulfilling over 150,000 pre-orders across 50+ countries. Priced between $450-$500, the Android-based device features:

- MediaTek 8-core processor and 8GB RAM

- Integrated Seed Vault Wallet for secure crypto storage

- Dedicated Web3 app store

- TEEPIN security framework for enhanced protection

This represents a sevenfold increase over its Saga predecessor's sales and could significantly expand Solana's retail user base, particularly in emerging markets where mobile-first crypto adoption is accelerating.

DeFi and NFT Ecosystem Growth

Solana's decentralized finance ecosystem continues to mature:

- Velo Universe Hybrid DEX recently crossed $1 billion in USDV volume, combining CEX-like speed with DEX security

- Notable artist Takashi Murakami launched NFT card packs on Base blockchain, bringing cultural attention to Solana's ecosystem

- Daily active addresses remain consistently high, indicating strong network usage

SOL Price Predictions: 2025 Through 2040

Based on current technicals, ecosystem growth, and broader market trends, here are potential SOL price targets:

| Year | Price Target (USD) | Key Catalysts |

|---|---|---|

| 2025 | $180-$250 | ETF speculation, Seeker phone adoption, DeFi growth |

| 2030 | $500-$800 | Mass DeFi adoption, scalability solutions, institutional use cases |

| 2035 | $1,200-$2,000 | Institutional integration, Web3 dominance, potential as global payment rail |

| 2040 | $3,000+ | Mainstream adoption, NFT/metaverse utility, potential as reserve asset |

These projections assume sustained network upgrades and no major regulatory setbacks. As the BTCC team cautions, "SOL's ability to maintain low fees during high throughput periods will be critical to these long-term valuations."

What Are the Key Risks to SOL's Growth Story?

While the outlook appears positive, several risks could impact SOL's trajectory:

- Regulatory Uncertainty: Potential SEC actions or changing global regulations could create headwinds

- Competition: Emerging Layer 1 solutions and Ethereum's ongoing upgrades present alternatives

- Network Performance: Past outages have raised questions about reliability during peak demand

- Macro Factors: Broader crypto market sentiment and traditional financial conditions influence SOL

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

SOL Price Prediction FAQs

What is the SOL price prediction for 2025?

Based on current analysis, SOL could reach between $180-$250 by 2025, driven by potential ETF speculation, growing adoption of Solana Mobile devices, and continued DeFi ecosystem expansion.

Can SOL reach $500 by 2030?

Analysts suggest SOL could potentially reach $500-$800 by 2030 if current growth trajectories continue, particularly in areas like decentralized finance adoption and institutional use cases.

What factors could drive SOL's price higher?

Key drivers include institutional adoption, successful scaling solutions, growing DeFi and NFT activity on Solana, potential ETF approval, and broader crypto market bull runs.

Is now a good time to buy SOL?

Market conditions change rapidly. While technical indicators currently show potential upside, investors should always conduct thorough research and consider their risk tolerance before investing.

How does Solana compare to Ethereum?

Solana offers faster transaction speeds and lower fees than Ethereum, though ethereum has greater decentralization and a more established developer ecosystem. The two networks serve somewhat different use cases.

What's the long-term outlook for SOL?

Long-term projections suggest SOL could reach $1,200-$2,000 by 2035 and $3,000+ by 2040 if it establishes itself as a leading platform for Web3 applications and digital asset infrastructure.