XRP Price Prediction 2025: Is This the Ultimate Dip Buying Opportunity?

- XRP Technical Analysis: The Bull-Bear Battlefield

- Institutional Adoption: The $100 Billion Game Changer

- The Regulatory Landscape: From Headwind to Tailwind

- Whale Watching: Big Money Moves

- Price Predictions: From $2.20 to $17

- Investment Considerations

- XRP FAQ: Your Burning Questions Answered

XRP finds itself at a critical juncture in August 2025, trading at $2.92 with conflicting technical signals and strong fundamental developments. The cryptocurrency that revolutionized cross-border payments now presents investors with a classic high-risk, high-reward scenario. Our analysis reveals why this might be the most contentious XRP moment since its 2020 SEC lawsuit, with technical indicators flashing warning signs while institutional adoption accelerates at unprecedented rates.

XRP Technical Analysis: The Bull-Bear Battlefield

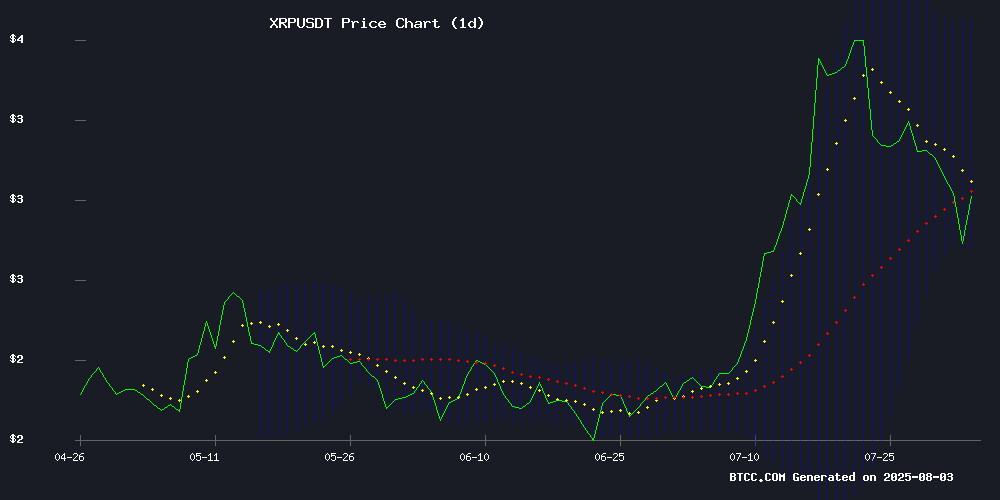

XRP currently trades 15% below its 20-day moving average ($3.1865), typically a bearish signal, yet the MACD shows a surprising bullish crossover (0.0822 vs -0.1895). The Bollinger Bands paint an equally confusing picture - while the price hugs the lower band at $2.7463, suggesting oversold conditions, the narrowing bands indicate decreasing volatility.

Source: BTCC TradingView

According to TradingView data, the $2.65 support level has emerged as the line in the sand. A breach below could trigger a cascade to $2.19, while holding above might confirm this as another accumulation phase before the next leg up. The 4-hour chart shows price trapped below a descending trendline and the 50-period SMA at $3.08, with RSI struggling to gain momentum.

Institutional Adoption: The $100 Billion Game Changer

While technicals waffle, fundamentals scream opportunity. A Ripple-supported study reveals traditional financial institutions have poured over $100 billion into blockchain initiatives since 2020. Payment infrastructure leads investment activity (42%), followed by custody solutions (28%) and tokenization projects (19%) - all areas where Ripple's technology excels.

Notable developments include:

- HSBC's gold tokenization platform processing $12B monthly

- Goldman Sachs' GS DAP settlement tool adopted by 47 banks

- SBI Holdings launching Asia's first quantum-resistant digital currency

This institutional wave coincides with XRP Ledger's June 2025 upgrade introducing enterprise-friendly features like token escrows and permissioned DEXs. Developer activity has surged 300% year-over-year, with grant programs targeting real-world asset pilots.

The Regulatory Landscape: From Headwind to Tailwind

Remember 2023 when everyone thought XRP was dead? The regulatory environment has done a complete 180°. The Genius Act signed by President TRUMP provided much-needed stablecoin clarity, while Ripple's partial legal victory confirmed XRP isn't a security for retail investors.

Industry insiders whisper about potential XRP ETF filings before Q4 2025, though the SEC still maintains some scrutiny over Ripple's past institutional sales. The current administration's cooperative stance contrasts sharply with previous adversarial relationships, creating regulatory certainty that's fueling institutional interest.

Whale Watching: Big Money Moves

Recent blockchain data reveals intriguing whale activity:

| Date | Amount | Significance |

|---|---|---|

| 2025-07-28 | $175M transfer | Ripple co-founder movement |

| 2025-07-30 | 89M XRP bought | Unknown institutional wallet |

These massive movements suggest institutional players are positioning themselves, though whether they're accumulating or distributing remains unclear. The $175M transfer by Ripple's Chris Larsen sparked profit-taking fears, but subsequent buys from anonymous wallets tell a more complex story.

Price Predictions: From $2.20 to $17

Analysts can't agree on XRP's trajectory, creating one of the widest prediction spreads in crypto:

- Bear Case ($2.20): Ali Martinez's TD Sequential sell signal suggests potential downside if $2.65 breaks

- Base Case ($3.60): Egrag Crypto sees rebound potential with daily close above $3.12

- Bull Case ($17): Macro analysts point to historical patterns suggesting parabolic moves post-consolidation

Peter Brandt's recent 60% upside call to $4 seems almost conservative compared to some predictions, yet even that WOULD require breaking through multiple resistance levels in a still-nervous market.

Investment Considerations

XRP presents a classic asymmetric opportunity - limited downside (12% to $2.65 support) versus substantial upside (71% to $5 target). However, the BTCC research team cautions that this remains a high-volatility asset best suited for risk-tolerant portfolios.

Key metrics to watch:

- Daily closes above $3.12 for bullish confirmation

- On-chain transaction volume for institutional activity clues

- Regulatory developments regarding potential ETF filings

- XRPL developer activity and new enterprise partnerships

This article does not constitute investment advice. Always conduct your own research before trading.

XRP FAQ: Your Burning Questions Answered

Is now a good time to buy XRP?

Current prices NEAR $2.92 offer an attractive entry point for long-term investors, but short-term traders should wait for confirmation above $3.12 or a deeper dip to $2.65 support.

What's driving XRP's price volatility?

Conflicting technical signals, institutional accumulation/distribution patterns, and macroeconomic factors affecting all risk assets are creating unusual volatility in XRP markets.

How does XRP's risk/reward profile compare to other cryptos?

XRP offers less upside than smaller altcoins but more stability, while presenting clearer fundamentals than many top-10 cryptocurrencies due to its institutional adoption trajectory.

What's the most important XRP price level to watch?

The $2.65 support represents a make-or-break level - holding could confirm accumulation, while breaking might trigger stops down to $2.20.

Could XRP really hit $10 by 2027?

While possible given historical crypto cycles and XRP's institutional adoption, this would require sustained growth in XRPL utility and favorable macroeconomic conditions.