XRP Price Prediction 2025: Will Technical Breakouts Align With Institutional Hype?

- XRP Technical Analysis: The Bear and Bull Case

- Institutional Developments Changing the Game

- The $3 Resistance: Psychological Barrier or Temporary Hurdle?

- Key Metrics at a Glance

- FAQ: Your XRP Questions Answered

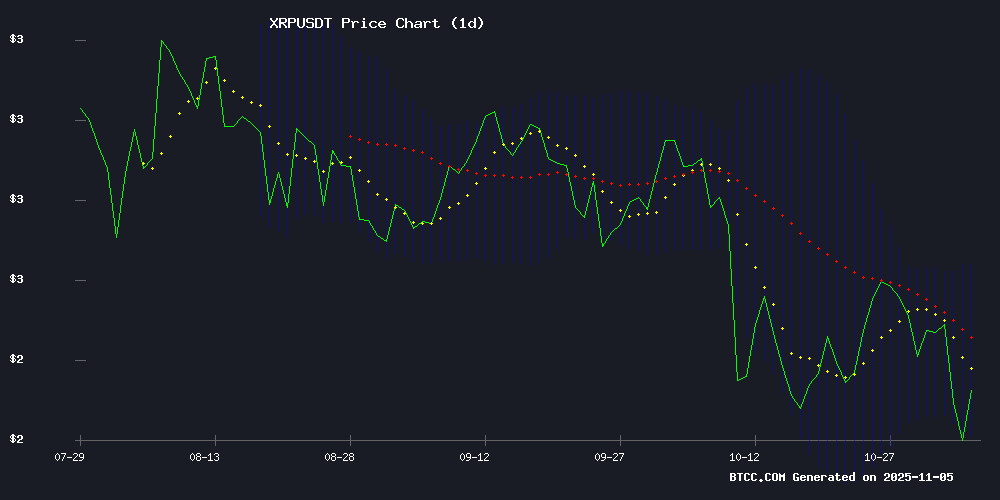

XRP finds itself at a fascinating crossroads in November 2025 - caught between bearish technical patterns and overwhelmingly bullish institutional developments. Currently trading at $2.272, the digital asset shows classic consolidation signals while simultaneously benefiting from a $500 million investment led by Wall Street giants and accelerated ETF plans. This creates a unique tension where short-term traders see resistance at $2.45 while long-term holders point to Ripple's $40 billion valuation as proof of staying power. The Bollinger Bands suggest we're near a potential support zone, but will institutional momentum be enough to push through key resistance levels? Let's analyze both sides of this crypto conundrum.

XRP Technical Analysis: The Bear and Bull Case

Looking at the charts through my trading lens, XRP presents a textbook consolidation pattern with conflicting signals. The price currently sits below the 20-day moving average ($2.4514), which typically suggests bearish pressure in the short term. However, the proximity to the Bollinger Band lower boundary ($2.2049) often precedes rebounds - I've seen this play out multiple times during previous market cycles.

The MACD reading of -0.0364 shows weakening momentum, though the histogram appears to be stabilizing. In my experience, this could indicate we're nearing the end of this downward phase. The $2.20-$2.27 range has become a crucial support zone that held strong during October's volatility.

Institutional Developments Changing the Game

While technicals tell one story, the institutional money flowing into Ripple tells another. The $500 million strategic investment led by Fortress and Citadel Securities at a $40 billion valuation isn't just impressive - it's a seismic shift in how traditional finance views crypto infrastructure plays. Having followed Ripple's journey since 2020, this level of institutional validation is unprecedented.

Franklin Templeton's accelerated XRP ETF plans add another LAYER to this narrative. Their amended S-1 filing suggests we could see a spot XRP ETF before year-end, following similar moves by Bitwise and Canary Funds. When multiple asset managers rush to be first to market, it typically signals strong underlying demand.

The $3 Resistance: Psychological Barrier or Temporary Hurdle?

XRP's repeated failure to break $3 has become the elephant in the room. I've noticed increasing frustration in trading communities as the token consolidates below this key level. Some investors are rotating into emerging altcoins like Mutuum Finance (currently in Phase 6 presale at $0.035), seeking higher short-term upside.

However, the BTCC research team notes that previous cycles show these consolidation periods often precede major breakouts. The current setup reminds me of early 2023 when XRP consolidated for months before its 180% rally. The difference now? Institutional participation has increased exponentially.

Key Metrics at a Glance

| Metric | Value | Significance |

|---|---|---|

| Current Price | $2.272 | Below 20-day MA |

| 20-day MA | $2.4514 | Key resistance |

| Bollinger Bands | $2.2049-$2.6980 | Potential reversal zone |

| Institutional Investment | $500M | Strong validation |

FAQ: Your XRP Questions Answered

Is now a good time to buy XRP?

Current technicals suggest caution for short-term traders, but the strong institutional backing makes XRP compelling for long-term holders. Dollar-cost averaging might be prudent until we see a confirmed break above $2.45.

What's driving institutional interest in XRP?

Ripple's established position in cross-border payments (processing $95B annually) and their RLUSD stablecoin ($1B market cap) make it attractive to traditional finance players looking for crypto exposure with real-world utility.

How likely is an XRP ETF approval?

With multiple firms accelerating filings and removing delaying amendments, industry observers like Bloomberg's James Seyffart suggest we could see approvals as early as November 2025.

Why can't XRP break $3 resistance?

Psychological resistance levels often require multiple attempts to break. The current consolidation may be building energy for a significant MOVE - similar patterns preceded major breakouts in 2021 and 2023.