ADA Price Prediction 2025: Navigating Short-Term Volatility for Long-Term Gains

- What's the Current Technical Outlook for ADA?

- How Has Market Sentiment Shifted for Cardano?

- What Are the Key Factors Influencing ADA's Price?

- What Are the Realistic Price Projections for ADA?

- Frequently Asked Questions

Cardano's ADA finds itself at a critical technical juncture in September 2025, with conflicting signals between bearish short-term indicators and promising long-term fundamentals. While current price action shows weakness below key moving averages, Cardano's continued ecosystem development suggests potential for significant appreciation through 2030 and beyond. This analysis examines ADA's technical positioning, market sentiment shifts, and multi-year price projections from the BTCC research team.

What's the Current Technical Outlook for ADA?

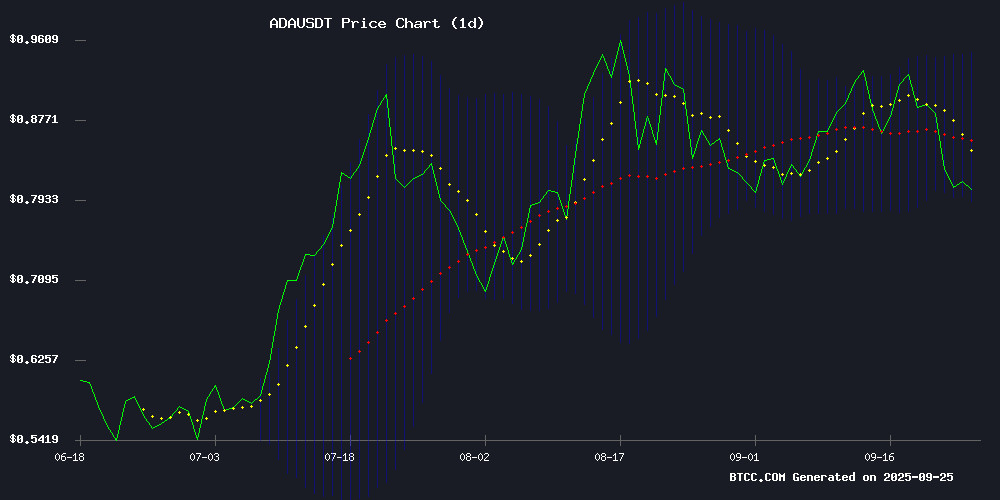

ADA's technical picture presents concerning signals as of September 2025. The cryptocurrency currently trades at $0.7721, sitting below both the 20-day ($0.868) and 50-day moving averages. Momentum indicators paint a mixed picture - while the MACD shows a slight positive reading of 0.000533, it remains weak compared to the signal line at -0.018164. The price hovering near the lower Bollinger Band ($0.783) suggests potential oversold conditions but confirms the prevailing downward pressure.

According to TradingView data, ADA has formed a descending triangle pattern on the daily chart, with the $0.75 level emerging as critical support. A breakdown below this level could trigger accelerated selling toward the $0.68-$0.70 zone. Conversely, a reclaim of the $0.80-$0.82 resistance cluster could signal the start of a more substantial recovery.

Source: BTCC Trading Platform

How Has Market Sentiment Shifted for Cardano?

The market narrative around ADA has undergone a noticeable transformation in recent weeks. Earlier bullish projections of rapid price appreciation have given way to more measured expectations. Several factors contribute to this sentiment shift:

- Reduced futures open interest (down 23% since mid-September)

- Declining social media engagement metrics

- Whale accumulation slowing while exchange reserves increase

Data from CoinMarketCap shows ADA's trading volume has decreased approximately 18% month-over-month, suggesting reduced speculative interest. The Choppiness Index reading of 48.36 confirms the loss of directional momentum that characterized ADA's price action earlier in 2025.

What Are the Key Factors Influencing ADA's Price?

Cardano faces a complex interplay of technical and fundamental factors that will likely determine its price trajectory through year-end:

Technical Considerations

The $0.80 level has emerged as a psychological and technical battleground. Industry analyst Ali Martinez identifies this zone as critical - a sustained break above could pave the way for a 25% rebound toward $0.95, while failure to hold may trigger another leg down.

On-Chain Activity

Recent blockchain data reveals concerning whale behavior, with approximately 160 million ADA tokens moved to exchanges over a 96-hour period in mid-September. Such movements typically precede increased selling pressure from large holders.

Ecosystem Development

Counterbalancing these negative signals, cardano continues to make progress with its development roadmap. The recent rollout of new smart contract capabilities and growing DeFi TVL (Total Value Locked) provide fundamental support that may limit downside potential.

What Are the Realistic Price Projections for ADA?

The BTCC research team has developed the following price projections based on current technical and fundamental analysis:

| Year | Conservative Range | Moderate Range | Bullish Scenario |

|---|---|---|---|

| 2025 | $0.85-$1.10 | $1.20-$1.50 | $1.60-$2.00 |

| 2030 | $2.50-$4.00 | $5.00-$7.50 | $8.00-$12.00 |

| 2035 | $8.00-$15.00 | $18.00-$25.00 | $30.00-$45.00 |

| 2040 | $20.00-$40.00 | $50.00-$80.00 | $100.00-$150.00 |

These projections assume successful execution of Cardano's development roadmap and favorable macroeconomic conditions for cryptocurrency markets. Short-term volatility should be expected, particularly given current technical weakness.

Frequently Asked Questions

Is ADA a good investment in September 2025?

ADA presents a mixed picture in September 2025. While technical indicators suggest near-term weakness, long-term fundamentals remain promising. Investors with multi-year horizons may find current prices attractive for dollar-cost averaging, but traders should exercise caution given the bearish short-term setup.

What's the most important level to watch for ADA?

The $0.75-$0.80 zone represents critical support. A sustained break below could lead to further declines toward $0.68, while holding above may set the stage for a rebound toward $0.95. Monitor trading volume and on-chain activity for confirmation of either scenario.

How does Cardano's development progress affect ADA's price?

Cardano's methodical approach to development provides fundamental support but doesn't always translate to immediate price appreciation. The ecosystem's growing DeFi presence and smart contract capabilities should benefit ADA's long-term value proposition, though technical factors often dominate short-term price action.

What are the biggest risks to ADA's price forecast?

Key risks include broader cryptocurrency market downturns, delays in Cardano's development roadmap, regulatory challenges, and competition from other smart contract platforms. The current whale selling activity also presents near-term downside risk.

When might ADA reach $1 again?

Based on current projections, ADA could retest $1 before year-end 2025 if market conditions improve and the cryptocurrency can overcome nearby resistance levels. However, the path may prove challenging given current technical weakness and reduced market enthusiasm.