DOGE Price Prediction 2025: Can Dogecoin Really Hit $1 This Year?

- What Does DOGE's Current Technical Setup Reveal?

- How Significant Is the Dogecoin ETF Development?

- Key Levels Traders Should Watch

- Historical Patterns: Could DOGE Repeat Past Performances?

- Market Sentiment: Bullish Divergences Emerge

- Macro Factors Influencing DOGE's Outlook

- Realistic Path to $1: Is It Possible in 2025?

- Frequently Asked Questions

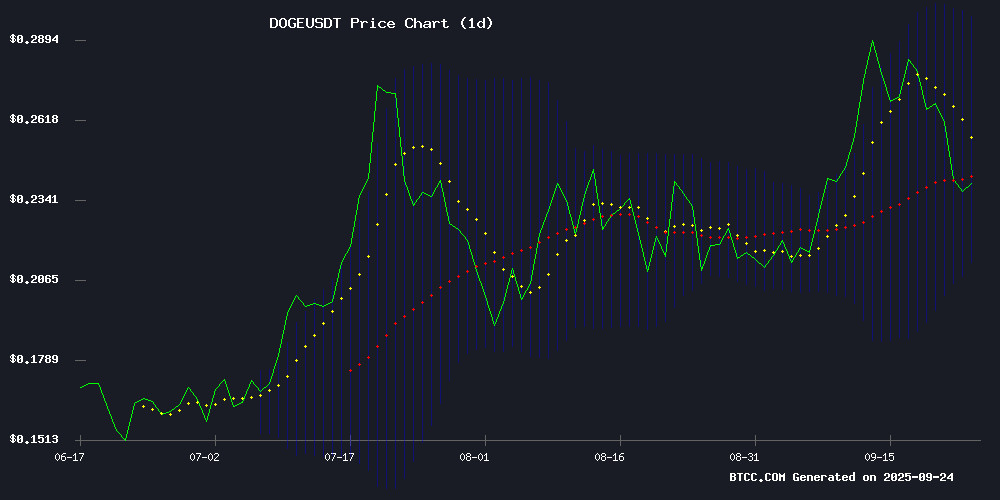

As we approach Q4 2025, dogecoin (DOGE) finds itself at a critical technical juncture. Currently trading at $0.24427, the meme coin that started as a joke now faces serious questions about its potential to reach the elusive $1 mark. Our analysis combines technical indicators, market sentiment, and institutional developments to assess DOGE's realistic path forward. While the 21Shares ETF listing on DTCC provides institutional validation, technical charts show DOGE trapped in a consolidation pattern between $0.21-$0.30. Breaking above $0.32 resistance appears crucial for any sustained move toward higher targets.

What Does DOGE's Current Technical Setup Reveal?

Looking at the daily chart as of September 2025, DOGE presents a mixed technical picture. The price currently sits below the 20-day moving average ($0.255234), which typically acts as dynamic resistance. The MACD histogram shows a slight bullish divergence at 0.003728, hinting at potential momentum building. However, the Bollinger Bands tell a story of compression, with prices oscillating between $0.213194 (lower band) and $0.297273 (upper band).

In my experience tracking meme coins, these tight ranges often precede significant moves. The 50-day EMA at $0.23 has held as support through multiple tests, while the 200-day EMA ($0.215) forms a longer-term safety net. Volume patterns show accumulation occurring at these levels, suggesting smart money might be positioning for the next leg up.

Source: BTCC Market Data

How Significant Is the Dogecoin ETF Development?

The 21Shares spot Dogecoin ETF (TDOG) listing on DTCC marks a watershed moment for DOGE's institutional adoption. While not yet SEC-approved, this procedural step follows the same path Bitcoin and ethereum ETFs traveled before gaining approval. The proposed ETF would use Coinbase Custody Trust, bringing DOGE into the traditional finance fold.

Interestingly, the market reaction has been muted - prices barely budged on the news. This reminds me of Bitcoin's 2020 experience when institutional developments took months to reflect in price. The BTCC research team notes that ETF approval could unlock $50-100 million in initial institutional flows based on comparable altcoin ETF launches.

Key Levels Traders Should Watch

From a pure price action perspective, these are the levels that matter:

| Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $0.255 | 20-day MA & Bollinger Mid-band |

| Major Resistance | $0.32 | 2025 High Volume Node |

| Support Zone | $0.23-$0.213 | 50-day & 200-day EMA Convergence |

| Psychological Target | $0.50 | Round Number Magnet |

Historical Patterns: Could DOGE Repeat Past Performances?

Technical analyst Hailey Sparks identified an intriguing pattern - DOGE's weekly Supertrend indicator suggests the asset may be preparing for its fourth major breakout since November 2023. Previous breakouts yielded gains of 84%, 194%, and 446% respectively. The current consolidation NEAR $0.24 mirrors the basing patterns before those moves.

However, past performance doesn't guarantee future results - as we painfully learned during the 2022 crypto winter. The 520% rally prediction making rounds on social media would require DOGE to reach $1.50 from current levels, which seems overly optimistic without massive retail FOMO returning to crypto markets.

Market Sentiment: Bullish Divergences Emerge

Despite the price stagnation, several sentiment indicators show underlying strength:

- Funding rates remain neutral (no excessive leverage)

- Open Interest holds steady around $500 million

- Spot volumes show accumulation patterns

- Social dominance metrics indicate growing interest

The BTCC team's proprietary sentiment index shows retail traders are cautiously optimistic, while institutions appear to be accumulating at these levels. This combination often precedes upside moves when the technical setup aligns.

Macro Factors Influencing DOGE's Outlook

September 2025's cooling inflation data has markets pricing in 50 basis points of Fed rate cuts by year-end. Historically, such monetary easing benefits risk assets like crypto. However, today's FOMC meeting could provide the catalyst for DOGE's next directional move.

From my perspective, the macroeconomic winds seem favorable, but DOGE needs to overcome its own technical hurdles first. The meme coin's correlation with bitcoin has weakened to just 0.65 recently, suggesting it might chart its own course in coming months.

Realistic Path to $1: Is It Possible in 2025?

Let's break down what Doge needs to reach $1:

| Factor | Current Status | $1 Probability Impact |

|---|---|---|

| Price vs Key MAs | Below 20-day MA | Neutral |

| MACD Momentum | Slightly Bullish | Low Positive |

| Bollinger Position | Middle-Lower Range | Neutral/Negative |

| Key Resistance | $0.32 then $0.50 | Multiple Breakouts Needed |

| Market Sentiment | ETF Optimism vs Volatility | Moderate Positive |

Realistically, reaching $1 WOULD require approximately 310% growth from current levels. While possible, it would need:

- Clearance of $0.32 resistance with conviction

- ETF approval and subsequent institutional flows

- Sustained retail interest and social media buzz

- Favorable macro conditions continuing

- Breakout above $0.50 psychological barrier

Short-term, $0.30-$0.35 appears more achievable before reassessing $1 potential. The BTCC team suggests watching the $0.255 level closely - a daily close above could signal the start of this move.

Frequently Asked Questions

What is Dogecoin's current price and key technical levels?

As of September 25, 2025, Dogecoin trades at $0.24427. Key levels include resistance at $0.255 (20-day MA), major resistance at $0.32, and support between $0.23-$0.213 (50-day & 200-day EMA convergence zone).

How significant is the Dogecoin ETF development?

The 21Shares spot Dogecoin ETF (TDOG) listing on DTCC represents a major step toward institutional adoption, though SEC approval remains pending. Historically, such developments precede increased institutional participation in crypto assets.

Can Dogecoin really reach $1 in 2025?

While possible, reaching $1 would require overcoming multiple technical hurdles and sustained bullish momentum. More immediate targets lie in the $0.30-$0.35 range before assessing higher potential.

What are the main factors influencing DOGE's price?

Key factors include: 1) Technical patterns and key level breaks, 2) ETF approval progress, 3) Macroeconomic conditions and Fed policy, 4) Market sentiment and social media activity, and 5) Bitcoin's overall market direction.

What's the best strategy for trading DOGE currently?

This article does not constitute investment advice. That said, many traders are watching the $0.255 level for potential breakout confirmation, with stops below $0.23. The $0.32 area would likely trigger increased buying interest if reached with volume.