BTC Price Prediction 2025: Technical Breakdown & Market Sentiment for Smart Crypto Investing

- BTC Technical Analysis: The Battle Between Bulls and Bears

- Market Sentiment: The Push and Pull Factors

- The Renewable Energy Revolution in Bitcoin Mining

- Institutional Adoption: From Skepticism to Embrace

- Regulatory Landscape: Stablecoins Take Center Stage

- Cycle Analysis: Will History Rhyme Again?

- Investment Outlook: Navigating Uncertain Waters

- Frequently Asked Questions

As we navigate September 2025, Bitcoin presents a fascinating technical picture - currently trading at $110,625.75 with bullish MACD momentum yet facing resistance at the 20-day MA. The cryptocurrency shows strong fundamental support from institutional adoption and renewable energy mining, though regulatory uncertainties and potential cycle corrections warrant caution. This analysis combines hard technical data with market psychology to help investors make informed decisions in these volatile conditions.

BTC Technical Analysis: The Battle Between Bulls and Bears

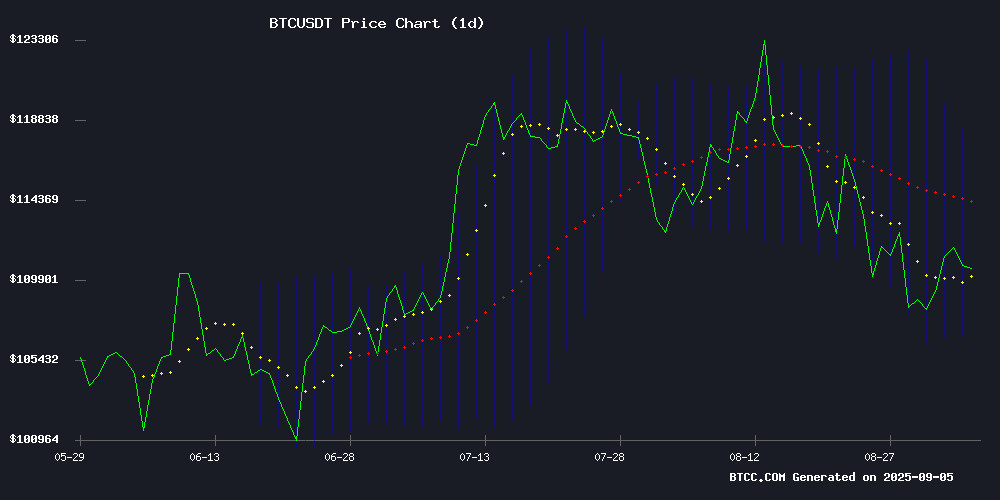

Bitcoin's current technical setup tells a story of conflicting signals. The price sits just below the 20-day moving average ($112,191.39), which typically acts as resistance in bearish scenarios. However, the MACD reading of 114.64 suggests underlying bullish momentum hasn't been broken yet. The Bollinger Bands paint an interesting picture - with price hovering NEAR the middle band ($112,191.39), flanked by support at $106,814.29 and resistance at $117,568.49.

Source: BTCC Trading Platform

What does this mean for traders? We're seeing classic consolidation behavior within a defined range. The BTCC research team notes that a decisive break above $117,568 could trigger the next leg up, while failure to hold $106,814 might signal deeper correction territory. Interestingly, the Relative Strength Index (RSI) sits at 54.72 as of September 5 - neither overbought nor oversold, suggesting room for movement in either direction.

Market Sentiment: The Push and Pull Factors

Current market sentiment resembles a tug-of-war between bulls and bears. On the bullish side:

- Institutional adoption continues growing (Eric Trump's recent endorsement)

- Mining efficiency improvements through renewable energy

- Potential Fed easing after weak August jobs data

Bearish pressures include:

- Regulatory uncertainty (Fed's upcoming Payments Innovation Conference)

- Cycle structure questions (VDD mirroring historic tops)

- Miner selling pressure as hash rate hits record highs

Marathon Digital's mining output (705 BTC in August) shows the network's health, but also introduces potential selling pressure as miners cover operational costs. The BTCC team suggests watching two key metrics: the hash rate (now at 1 zetahash/second) and miner reserve levels, which can signal impending price movements.

The Renewable Energy Revolution in Bitcoin Mining

One of 2025's most significant developments is bitcoin mining's green transformation. Over 50% of network power now comes from sustainable sources - wind, solar, and hydro. This isn't just good PR; it's becoming a strategic advantage:

| Energy Source | Percentage of Network | Key Regions |

|---|---|---|

| Wind | 22% | Texas, Scandinavia |

| Solar | 18% | Southwest US, Australia |

| Hydro | 15% | Canada, Sichuan |

This shift achieves two things: it reduces operational costs (some miners report 30-40% savings) and insulates the network from energy price shocks. As Hut 8 CEO Asher Genoot noted, "Our Texas wind farm operations give us a cost basis that's half the market price - that's sustainable advantage."

Institutional Adoption: From Skepticism to Embrace

The institutional landscape has transformed dramatically since 2023. Eric Trump's endorsement of Bitcoin as the "gold standard" reflects a broader trend - American Bitcoin now holds over 2,000 BTC while maintaining production costs 50% below market rates. Citadel Securities' 5.4% stake in Hive Digital Technologies signals Wall Street's growing interest in Bitcoin infrastructure plays.

What's driving this shift? Three factors:

- Regulatory clarity (U.S. stablecoin framework enacted)

- Infrastructure maturity (custody solutions, ETFs)

- Demonstrated resilience through multiple market cycles

However, the BTCC research team cautions that institutional flows can be fickle - the same players buying aggressively today might become forced sellers during liquidity crunches.

Regulatory Landscape: Stablecoins Take Center Stage

All eyes are on the Federal Reserve's upcoming Payments Innovation Conference (October 21), where stablecoins will be a key focus. This comes after:

- Enactment of first U.S. stablecoin regulatory framework

- SEC approval for spot crypto trading on registered exchanges

- Growing scrutiny of DeFi projects following Hollywood Ponzi scheme

Fed Governor Christopher J. Waller's comments about balancing innovation with stability suggest regulators want to avoid stifling growth while protecting consumers. For Bitcoin investors, the main takeaway is that regulatory acceptance is growing, but the rules are still being written.

Cycle Analysis: Will History Rhyme Again?

Bitcoin's four-year cycle theory faces its toughest test yet. After hitting $124,000 in August, the pullback to $110,958 has analysts divided:

- Institutional flows may have altered cycle dynamics

- Global liquidity conditions remain favorable

- Halving effects typically manifest 12-18 months post-event

- Value Days Destroyed (VDD) mirrors historic tops

- Miner selling pressure increasing

- Traditional cycle predicts $50K correction by late 2026

Alphractal founder Joao Wedson maintains that "cycles persist until they don't," warning against dismissing historical patterns too quickly. The BTCC team suggests watching two metrics: Coin Days Destroyed (CDD) for signs of long-term holder distribution, and futures open interest for clues about leverage positioning.

Investment Outlook: Navigating Uncertain Waters

Given this complex landscape, how should investors approach Bitcoin in September 2025? Here's a balanced framework:

| Strategy | Pros | Cons |

|---|---|---|

| Dollar-Cost Averaging | Reduces timing risk Smooths volatility |

May underperform in strong trends |

| Breakout Trading | Captures momentum Clear risk levels |

Whipsaw risk in rangebound markets |

| Value Investing | Focuses on fundamentals Long-term orientation |

Requires strong conviction |

The BTCC research team recommends "strategic patience" - maintaining Core positions while keeping powder dry for potential better entries. They identify $106,814 as critical support - a break below which could signal deeper correction ahead.

Frequently Asked Questions

What is Bitcoin's current price and technical outlook?

As of September 6, 2025, Bitcoin trades at $110,625.75, showing mixed technical signals - bullish MACD momentum but facing resistance at the 20-day moving average ($112,191.39). The Bollinger Band range between $106,814.29 and $117,568.49 defines the current battleground between bulls and bears.

How is renewable energy changing Bitcoin mining?

Over 50% of Bitcoin mining now uses renewable energy sources like wind, solar, and hydro power. This transition reduces operational costs by 30-40% for many miners while addressing environmental concerns. Regions like Texas and Scandinavia have become hotspots for green Bitcoin mining operations.

What are the key regulatory developments affecting Bitcoin?

The U.S. recently enacted its first stablecoin regulatory framework, and the SEC has approved spot crypto trading on registered exchanges. The Federal Reserve will host a Payments Innovation Conference in October where stablecoin regulation will be a key focus, signaling growing institutional acceptance of cryptocurrency.

Could Bitcoin really correct to $50,000 by 2026?

Some analysts, like Alphractal's Joao Wedson, believe Bitcoin's historical four-year cycle could lead to a correction near $50,000 by late 2026. However, unprecedented institutional demand and changing market structures may alter these traditional cycle dynamics.

What's the best investment strategy for Bitcoin now?

Given current market conditions, many experts recommend dollar-cost averaging combined with clear risk management (like stop-losses near $106,800). The BTCC research team suggests maintaining CORE long-term positions while keeping some liquidity available for potential better entries during volatility.