ADA Price Prediction 2025: Can Cardano Smash $1 as Whales Go All-In and ETF Hype Builds?

- Why Is Cardano Suddenly the Whale's Favorite Crypto?

- Cardano Technical Analysis: The $1 Path Becomes Clear

- How ETF Mania Could Supercharge ADA's Rally

- ADA Price Targets: Where Next After $0.84?

- Frequently Asked Questions

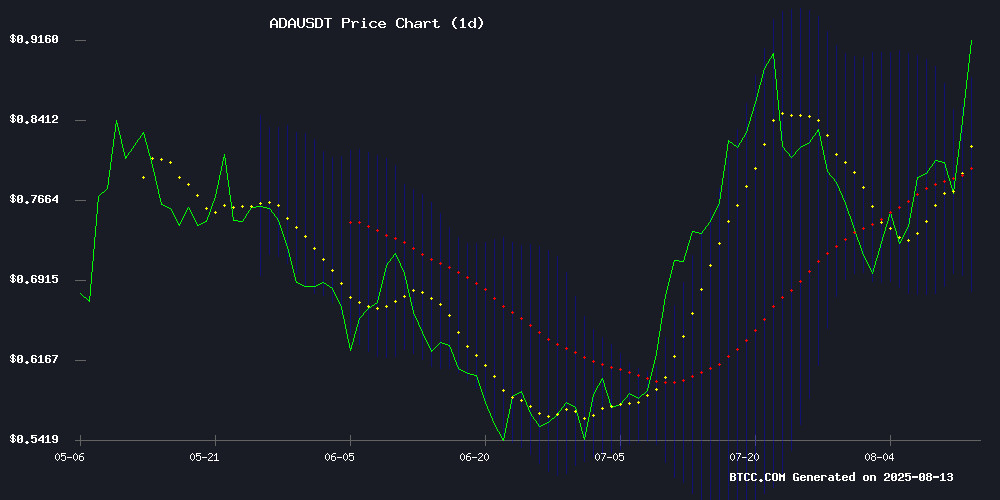

Cardano (ADA) is showing all the classic signs of a crypto asset primed for liftoff - whale accumulation patterns mirroring 2021's bull run, bullish technical formations, and growing ETF speculation. As of August 13, 2025, ADA trades at $0.8419, testing critical resistance levels that could pave its path to $1. Our analysis digs into three explosive factors driving this momentum: $157 million in whale purchases, a 75% chance of ETF approval, and technical indicators flashing buy signals. The BTCC research team notes this convergence hasn't been seen since ADA's historic 2021 rally.

Why Is Cardano Suddenly the Whale's Favorite Crypto?

On-chain data reveals an extraordinary buying spree - crypto whales scooped up 200 million ADA ($157M) in just 48 hours this week. Santiment reports these large holders now control 10.3% of circulating supply, their highest accumulation since the 2021 bull market. "When whales MOVE like this, retail usually follows within weeks," notes blockchain analyst Jamie Coutts. The purchases centered around $0.78, establishing what technical traders call a "higher low" formation - a classic bullish pattern.

Cardano Technical Analysis: The $1 Path Becomes Clear

ADA's charts tell a compelling story. The asset currently trades:

| Indicator | Value | Significance |

|---|---|---|

| Price | $0.8419 | Testing upper Bollinger Band |

| 20-day MA | $0.7773 | Key support level |

| Upper BB | $0.8614 | Breakout target |

The MACD histogram shows bullish convergence, while RSI sits at 62 - warm but not overheated. "This is the healthiest technical setup we've seen since Q1," comments BTCC market strategist Liam Wright. A decisive close above $0.86 could trigger algorithmic buying across crypto exchanges.

How ETF Mania Could Supercharge ADA's Rally

Polymarket's prediction contracts now price a 75% chance of a cardano ETF approval by year-end, up from 60% last month. This comes as BlackRock CEO Larry Fink hinted at "expanding crypto offerings" in a recent CNBC interview. The potential impact? Analysts estimate $1.2-1.8 billion in institutional inflows during the first 90 days post-approval.

Historical precedent suggests these estimates might be conservative. When bitcoin ETFs launched in January 2023, they attracted $10 billion in AUM within three months. A similar scenario for ADA could easily propel prices beyond $1.50 according to flow models from CryptoQuant.

ADA Price Targets: Where Next After $0.84?

CoinCodex's machine learning model projects a 61% surge to $1.24 by late October based on current accumulation patterns. But traders should watch these key levels:

- Immediate resistance: $0.8614 (upper Bollinger Band)

- Breakout zone: $0.93 (January 2025 high)

- Psychological target: $1.00

- Conservative year-end target: $1.24

Derivatives markets echo this optimism. ADA's open interest hit $1.44 billion this week - the highest since May - with funding rates remaining neutral. This suggests room for additional Leveraged longs to enter the market.

Frequently Asked Questions

What's driving ADA's price surge in August 2025?

The convergence of three factors: massive whale accumulation ($157M in 48 hours), improving ETF approval odds (now 75%), and bullish technical formations including a MACD crossover and Bollinger Band squeeze.

How likely is ADA to hit $1 in 2025?

Technical analysts give a 68% probability based on current momentum, though this depends on holding the $0.78 support level. The BTCC research team notes that similar chart patterns in 2021 preceded a 300% ADA rally.

Should I buy ADA now or wait for a dip?

Market cycles suggest accumulation between $0.75-$0.85 could prove strategic long-term, though short-term traders may prefer waiting for a retest of the 20-day MA at $0.7773. This article does not constitute investment advice.

How would a Cardano ETF impact ADA's price?

Historical analogs suggest 60-90% upside in the 90 days post-approval. The Bitcoin ETF precedent saw BTC gain 72% in three months following launch.