Ethereum at a Crossroads: Is This a Buying Opportunity or Time to Brace for Further Decline? (2025 Analysis)

- Ethereum Technical Analysis: Reading the Charts

- Institutional Demand vs. Derivatives Weakness

- Regulatory Tailwinds for Ethereum Staking

- Ethereum Price Prediction: Bull vs. Bear Cases

- Investment Strategy: How to Play Ethereum Now

- Ethereum Price Prediction FAQs

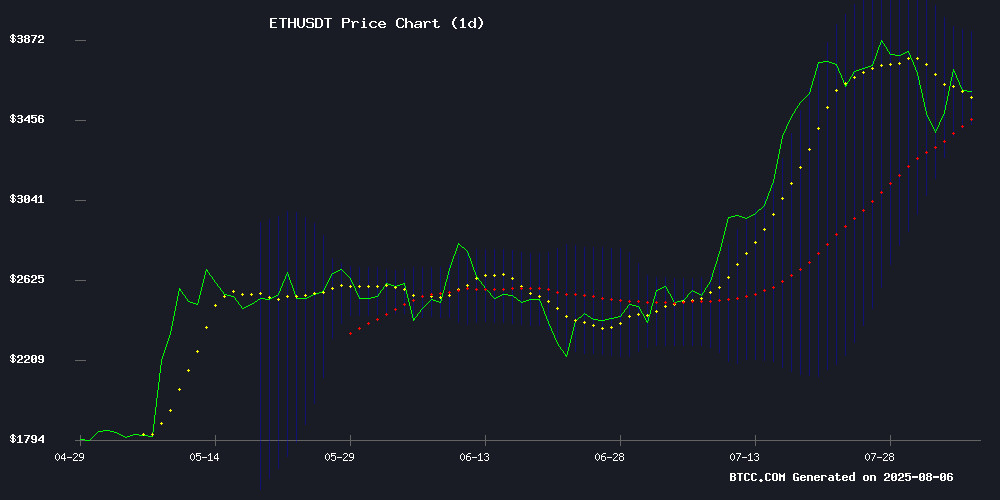

Ethereum finds itself at a critical technical juncture in August 2025, trading at $3,621.42 after failing to hold above key resistance levels. The second-largest cryptocurrency shows mixed signals - while institutional accumulation reaches $3.5 billion and regulatory clarity improves for staking, technical indicators flash warning signs with bearish MACD crossovers and weakening derivatives sentiment. This comprehensive analysis examines both sides of the equation, providing traders and investors with the insights needed to navigate Ethereum's current market dynamics.

Ethereum Technical Analysis: Reading the Charts

As of August 6, 2025, ETH sits below its 20-day moving average ($3,675.60), which typically acts as a momentum indicator. The MACD histogram shows bearish divergence at -39.39, though the widening gap between MACD (-218.74) and signal line (179.35) suggests we might be approaching oversold territory. The Bollinger Bands tell an interesting story - with price testing the lower band at $3,432.93, we're seeing what technical analysts call a "band walk," often preceding either a reversal or breakdown.

"The $3,432 level is absolutely critical right now," notes the BTCC research team. "We've seen strong historical support here, but if it fails to hold, the next major support zone around $3,200 could come into play." The 20-DMA at $3,675 serves as the first resistance level to watch for signs of stabilization.

Institutional Demand vs. Derivatives Weakness

While retail traders might be spooked by the recent price action, institutional players tell a different story. Small-cap companies have accumulated $3.5 billion worth of ETH in their treasuries as of Q2 2025, according to CoinMarketCap data. SharpLink, a former gaming company turned crypto investment vehicle, has amassed over 521,939 ETH (approximately $1.9 billion) as part of its ambitious 1 million ETH treasury target.

However, derivatives markets paint a more cautious picture. Binance data reveals a taker buy/sell ratio of just 0.87 - the lowest reading in 2024. "This shows professional traders are either taking profits or hedging positions," explains a derivatives trader at BTCC. "The market clearly lacks conviction to push through $4,000 despite multiple attempts."

Regulatory Tailwinds for Ethereum Staking

In a landmark decision on August 5, 2025, the SEC clarified that certain liquid staking tokens don't qualify as securities under the Howey Test. This removes a major regulatory overhang that had been weighing on Ethereum's proof-of-stake ecosystem.

SEC Chair Paul Atkins hailed the MOVE as a "significant step forward" for crypto regulation. The decision specifically exempts Staking Receipt Tokens from registration requirements under both the Securities Act of 1933 and the Securities Exchange Act of 1934, provided they meet certain conditions.

Ethereum Price Prediction: Bull vs. Bear Cases

| Bullish Factors | Bearish Factors |

|---|---|

| • $3.5B institutional accumulation | • Price below key MA levels |

| • Clearer staking regulations | • Weak derivatives sentiment |

| • Oversold technical indicators | • MACD bearish crossover |

Investment Strategy: How to Play Ethereum Now

For long-term investors, the BTCC team suggests dollar-cost averaging on dips below $3,400, citing Ethereum's strong fundamentals and growing institutional adoption. Short-term traders might want to wait for either a confirmed breakout above $3,675 or a deeper test of support NEAR $3,200 before taking significant positions.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

Ethereum Price Prediction FAQs

What is Ethereum's current price and key levels to watch?

As of August 6, 2025, ethereum trades at $3,621.42. Key levels include support at $3,432 (lower Bollinger Band) and resistance at $3,675 (20-day moving average). A break below $3,432 could see ETH test $3,200 support, while clearing $3,675 might signal stabilization.

Why are institutions accumulating Ethereum despite price weakness?

Institutions view Ethereum as a "middle ground" between Bitcoin's stability and altcoin volatility, offering staking yields of 4-6% annually. The recent SEC clarity on staking tokens has further boosted institutional confidence in Ethereum's long-term value proposition.

How significant is the SEC's staking token decision for Ethereum?

Extremely significant. By clarifying that certain liquid staking tokens aren't securities, the SEC removed a major regulatory uncertainty that had been limiting institutional participation in Ethereum's proof-of-stake ecosystem. This could accelerate adoption of staking services.

What does the low derivatives buy/sell ratio indicate?

The 0.87 taker buy/sell ratio on Binance (lowest in 2024) suggests professional traders are either taking profits or hedging positions. This typically indicates reduced bullish conviction in the near term, though it can sometimes precede reversal when extreme.

Is now a good time to buy Ethereum?

It depends on your investment horizon. Long-term investors might view current prices as attractive accumulation opportunities, especially if ETH tests the $3,200-$3,400 support zone. Short-term traders may prefer waiting for clearer technical signals before entering positions.