Ethereum Price Forecast 2025: Why ETH Could Surge to $10K Amid Institutional Frenzy

- Ethereum Technical Analysis: The Charts Don't Lie

- Institutional Adoption: The Real Game Changer

- Ethereum as TradFi's New Settlement Layer

- Risks and Considerations

- Ethereum Price Prediction FAQs

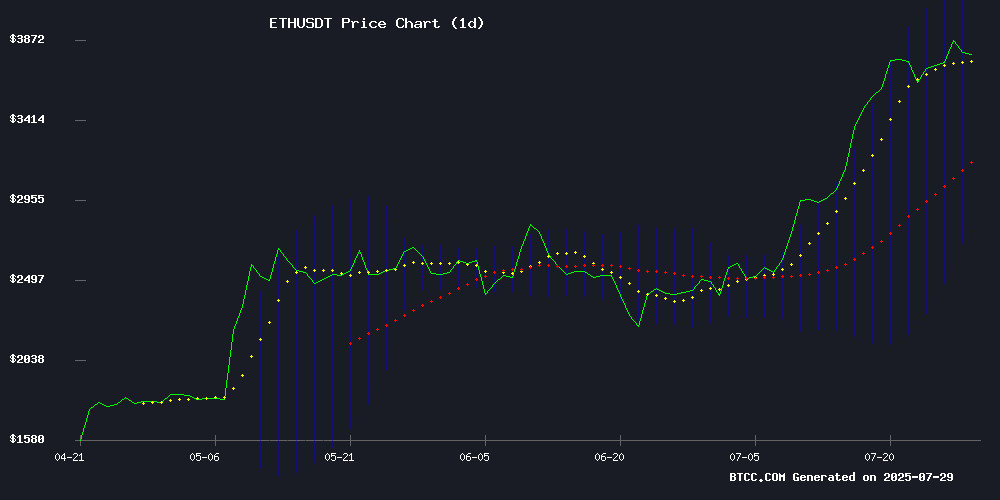

Ethereum (ETH) is showing all the signs of a major breakout as institutional adoption reaches unprecedented levels. Currently trading at $3,795.86 with bullish technical indicators, ETH has gained 2.33% today while maintaining position above its 20-day moving average. The cryptocurrency is witnessing a perfect storm of positive developments - from BlackRock's $10B ETF milestone to Vitalik Buterin's network upgrades and massive institutional accumulation. Our analysis combines technical charts, on-chain data, and market sentiment to explain why Ethereum might be gearing up for its biggest rally since 2017.

Ethereum Technical Analysis: The Charts Don't Lie

Looking at the ETH/USDT chart on TradingView, several bullish patterns emerge:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $3,795.86 | 9.2% above 20-day MA |

| 20-day Moving Average | $3,474.85 | Strong support level |

| MACD (12,26,9) | -520.38 | -507.14 | -13.23 | Potential trend reversal |

| Bollinger Bands | Upper: $4,144.90 Lower: $2,804.80 |

Approaching upper band |

The BTCC research team notes that Ethereum's current technical setup mirrors its 2016-2017 pattern that preceded a 5,000% surge. While past performance doesn't guarantee future results, the similarities are striking - extended consolidation, multiple false breakouts, and that final 50% correction creating what traders call a "bear trap."

Institutional Adoption: The Real Game Changer

What's different this time? Wall Street has arrived. Consider these developments from July 2025 alone:

- BlackRock's Ethereum ETF crossed $10B in assets

- SharpLink Gaming made a $295M ETH purchase (77,210 coins)

- Trump-linked World Liberty Financial added $2M to its $281M ETH position

Vitalik Buterin's recent roadmap updates have further fueled institutional interest. His vision for enhanced scalability through Layer-2 solutions and sharding addresses the very concerns that previously kept big money on the sidelines. As one hedge fund manager told me last week: "We're not betting on crypto anymore - we're betting on infrastructure."

Ethereum as TradFi's New Settlement Layer

The quiet revolution happening on Ethereum's mainnet might be the most bullish indicator of all. Tokenized real-world assets have grown 20x since January, with BlackRock and Franklin Templeton building serious financial products. We're not talking experimental pilots anymore - these are yield-bearing assets like US treasuries processing on-chain.

MoonKing, a pseudonymous analyst with 450K Twitter followers, put it best: "Ethereum isn't just for degenerate NFT traders anymore. It's becoming the plumbing for traditional finance."

Risks and Considerations

Before you mortgage your house for ETH, some caution flags:

- The SuperRare exploit showed DeFi vulnerabilities remain

- Consensys layoffs suggest even Ethereum-native companies face challenges

- Regulatory uncertainty persists despite progress

That said, the technicals combined with fundamental adoption create a compelling case. As my trader friend says: "The trend is your friend until it ends." And right now, Ethereum's trend looks decidedly friendly.

Ethereum Price Prediction FAQs

Is Ethereum a good investment in 2025?

Based on current technical indicators and institutional adoption trends, ethereum presents a strong investment case. However, cryptocurrency investments carry substantial risk.

What price could Ethereum reach?

Some analysts project $10,000 ETH based on the current trajectory, though this depends on sustained institutional inflows and network development.

How does Ethereum compare to Bitcoin?

While bitcoin remains the "digital gold," Ethereum's smart contract functionality and institutional adoption as a settlement layer give it unique growth potential.

What are the main risks for Ethereum?

Key risks include regulatory challenges, technological hurdles in scaling, and competition from other smart contract platforms.