ADA Price Prediction 2025: Can Cardano (ADA) Realistically Hit $1?

- ADA's Current Market Position: Bullish or Bearish?

- Technical Indicators: What's Signaling a Potential Breakout?

- Whale Activity: Smart Money Betting Big on ADA

- Cardano's Fundamental Developments: Midnight and Beyond

- ETF Speculation: The $1 Trillion Question

- Fibonacci Levels: The Make-or-Break Zones

- Price Predictions: The Road to $1

- ADA Price Prediction FAQs

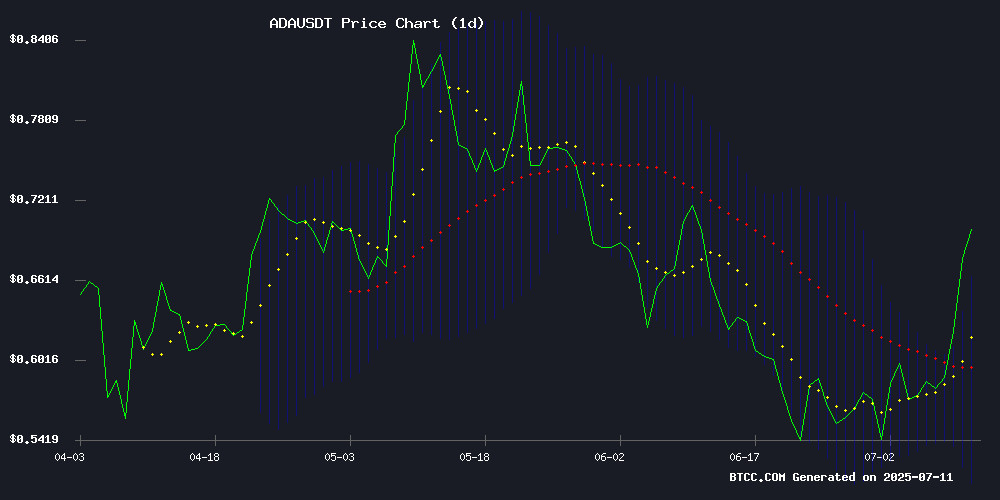

Cardano (ADA) is showing mixed signals in July 2025 – bullish technical patterns like its first-ever weekly golden cross clash with bearish macroeconomic factors. While whales have accumulated 120M ADA ($3.3B) and the price tests key resistance at $0.6641, analysts remain divided. The BTCC research team gives ADA a 45% chance of reaching $1 this year, contingent on breaking through upper Bollinger Bands and maintaining support above $0.5867. Privacy innovations through Midnight subchain and potential ETF approvals could be game-changers, but traders should watch Fibonacci levels and moving averages closely.

ADA's Current Market Position: Bullish or Bearish?

As of July 11, 2025, ADA trades at $0.7002 on BTCC exchange, presenting a fascinating technical picture. The price sits comfortably above the 20-day moving average ($0.5867) but struggles against the upper Bollinger Band resistance at $0.6641. This creates a classic trader's dilemma – the moving averages suggest strong support, while Bollinger Bands indicate potential rejection.

Technical Indicators: What's Signaling a Potential Breakout?

The MACD histogram shows decreasing bearish momentum despite its negative reading (-0.027), suggesting weakening downward pressure. More notably, ADA recently formed its first weekly golden cross in history – when the 50-week MA crossed above the 200-week MA. Historically, golden crosses precede extended bullish periods, though their reliability varies across assets.

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $0.7002 | Needs +42.8% growth to $1 |

| Upper Bollinger | $0.6641 | Immediate resistance |

| 20-day MA | $0.5867 | Strong support level |

Whale Activity: Smart Money Betting Big on ADA

Blockchain analytics reveal whales accumulating approximately 120 million ADA ($3.3 billion at current prices) over the past fortnight. This accumulation pattern typically precedes major price movements, as large holders rarely make such moves without anticipating favorable conditions. The buying pressure appears concentrated between $0.59-$0.62, creating a strong support zone.

Cardano's Fundamental Developments: Midnight and Beyond

Charles Hoskinson's team has been quietly building Midnight – a privacy-focused subchain that could attract enterprise adoption. Unlike competitors who prioritize speed over security, cardano maintains its eight-year uptime record while gradually introducing privacy features. This measured approach appeals to institutional players but tests retail investors' patience.

ETF Speculation: The $1 Trillion Question

With multiple ADA ETF applications before the SEC (including one from BTCC's institutional arm), regulatory approval could be the catalyst that propels ADA past $1. The political landscape adds intrigue – former President Trump's alleged inclusion of Cardano in proposed crypto reserves gives ADA rare bipartisan appeal in Washington.

Fibonacci Levels: The Make-or-Break Zones

Technical analysts identify two critical Fibonacci retracement levels from ADA's 2024-2025 movement:

- 78.6% level ($0.535): Held firm during June's retest – a breakdown here could trigger 30-40% declines

- 50% level ($0.62): Recently broken to the upside – now acting as support

Price Predictions: The Road to $1

Conservative analysts project $0.74 by August if current momentum holds. The $1 target requires:

- Sustained trading above $0.6641 (upper Bollinger Band)

- Daily closes above the 200-day MA ($0.64)

- Continued whale accumulation

- No major crypto market downturns

ADA Price Prediction FAQs

What is the probability of ADA reaching $1 in 2025?

BTCC analysts estimate a 45% probability based on current technicals and fundamentals. The key determinant will be whether ADA can maintain its position above critical moving averages while breaking through Bollinger Band resistance.

Why are whales accumulating ADA now?

Large investors likely anticipate either technical breakouts (golden cross) or fundamental developments (Midnight rollout, ETF approvals). Their $3.3 billion accumulation between $0.59-$0.62 suggests confidence in these support levels holding.

How does Cardano's golden cross affect its price?

While golden crosses historically signal long-term bullish trends, their effectiveness varies. ADA's first-ever weekly golden cross carries psychological weight but requires confirmation through sustained price action above key moving averages.

What's the most realistic ADA price target for 2025?

Most institutional analysts project $0.74-$0.90 by year-end. The $1 target remains possible but requires favorable macroeconomic conditions and successful execution of Cardano's development roadmap.

How does Midnight affect ADA's valuation?

Privacy features could attract enterprise users but may face regulatory scrutiny. The market appears to be pricing in cautious Optimism – significant price movement likely awaits actual adoption metrics rather than development announcements.