Is XRP Primed for Its Most Explosive Rally Yet? Analysts Target $20

XRP bulls are charging—analysts spot a runway to twenty bucks.

The Setup

Market watchers are buzzing as technical and fundamental factors align. A major court win against the SEC last year cleared regulatory fog, and institutional adoption is ticking up. Whispers of a $20 price target aren’t just hopium—they’re backed by chart patterns echoing previous breakouts.

The Catalysts

Real-world utility is finally kicking in. Cross-border settlements are accelerating, and Ripple’s partnerships with banks are moving from pilot to production. Liquidity is deepening, and shorts are looking nervous.

The Skeptic’s Corner

Sure, Wall Street still loves its slow, expensive rails—but remember Blockbuster? Disruption doesn’t ask for permission. One cynical take: TradFi might be late to the party, but they’ll still overcharge for the entry ticket.

Bottom line: XRP’s momentum is building. Don’t blink.

Analysts See Breakout Potential

Trader Javon Marks posted a chart showing what he called a large accumulation pattern. Based on his view, XRP could climb by 226% to reach $9.90, and if that zone is cleared the path to $20 could open.

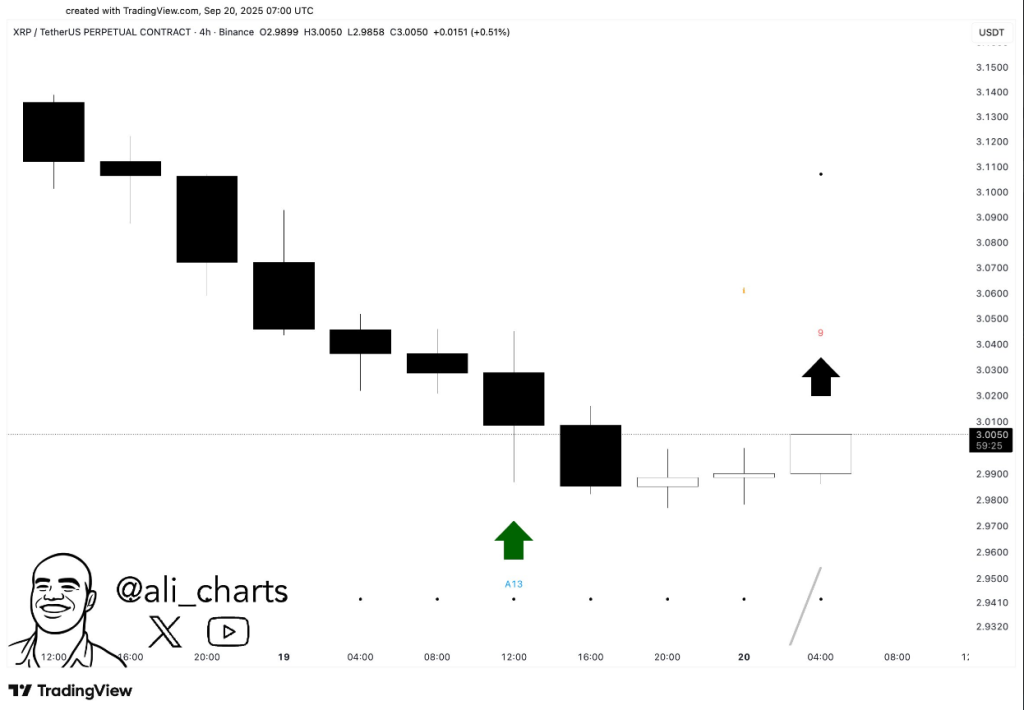

$XRP is a BUY, according to the TD Sequential! pic.twitter.com/fY7GTgXEB0

— Ali (@ali_charts) September 20, 2025

Marks compared today’s price structure to prior long swings that led to sharp gains after extended sideways periods. Based on reports from Martinez, the TD Sequential on the four-hour chart flashed a buy signal.

That indicator is used by many traders to spot when a trend may stop and reverse. Martinez said recent consolidation improved the odds for buyers, and that the shorter-term trend now favors upward movement. Both analysts emphasized patterns and indicators rather than a fixed timetable for any rally.

Institutional Moves Add Liquidity

Reports have disclosed that the first US spot XRP ETF began trading this week, a development many see as a sign of growing institutional access. At the same time, the CME Group has plans to launch futures options for XRP and Solana, which could bring more professional traders and deeper liquidity.

$XRP looks to be preparing here for ANOTHER +226% SURGE TO $9.90+ and a break above could send it towards $20 and higher! pic.twitter.com/ia5jJOcdkp

— JAVON![]() MARKS (@JavonTM1) September 19, 2025

MARKS (@JavonTM1) September 19, 2025

Tokenized fund plans on the XRP Ledger have also surfaced; those funds WOULD trade like tokens and give investors regulated exposure with faster settlement, according to sources.

Market reaction has been cautious. XRP has been holding above $3, but price action slowed as it neared resistance. Traders are now watching whether the token can push beyond the next supply zone or retreat back into consolidation.

Meanwhile, there is a separate line of discussion that links XRP to tokenized carbon credits. Based on a Precedence Research projection cited in reports, the carbon credit market could expand from about $933 billion in 2025 to more than $16 trillion by 2034.

Other research pointed to the carbon offsets segment being around $1.06 trillion in 2023 and possibly rising past $3 trillion by 2032.

If tokenization of credits gains scale, those working on market plumbing say fast, low-cost rails could be useful. The XRP Ledger is reported to be carbon neutral, which supporters argue could make it an attractive option for moving tokenized credits.

Still, this is a hypothetical demand case and no clear model ties that potential directly to a specific xrp price level.

Featured image from Meta, chart from TradingView