Bitmine’s Ethereum Appetite Explodes With Massive $70 Million Acquisition

Mining giant doubles down on ETH holdings as institutional demand surges

The Strategic Move

Bitmine just dropped another $70 million into Ethereum—because apparently traditional treasury management wasn't risky enough for their taste. The latest purchase signals aggressive confidence in ETH's long-term value proposition despite regulatory headwinds.

Market Implications

This isn't their first rodeo—Bitmine's been accumulating digital assets while traditional finance executives still struggle to pronounce 'blockchain'. The move puts pressure on competitors to either step up their crypto strategies or get left watching from the sidelines.

Institutional Adoption Accelerates

While Wall Street debates yield curves, crypto-native companies keep stacking digital assets. Bitmine's latest buy proves that when you believe in the technology, you put real money behind it—not just PowerPoint presentations.

Because nothing says 'financial innovation' like betting millions on internet money while bankers still use fax machines.

Purchase Broken Into Four Tranches

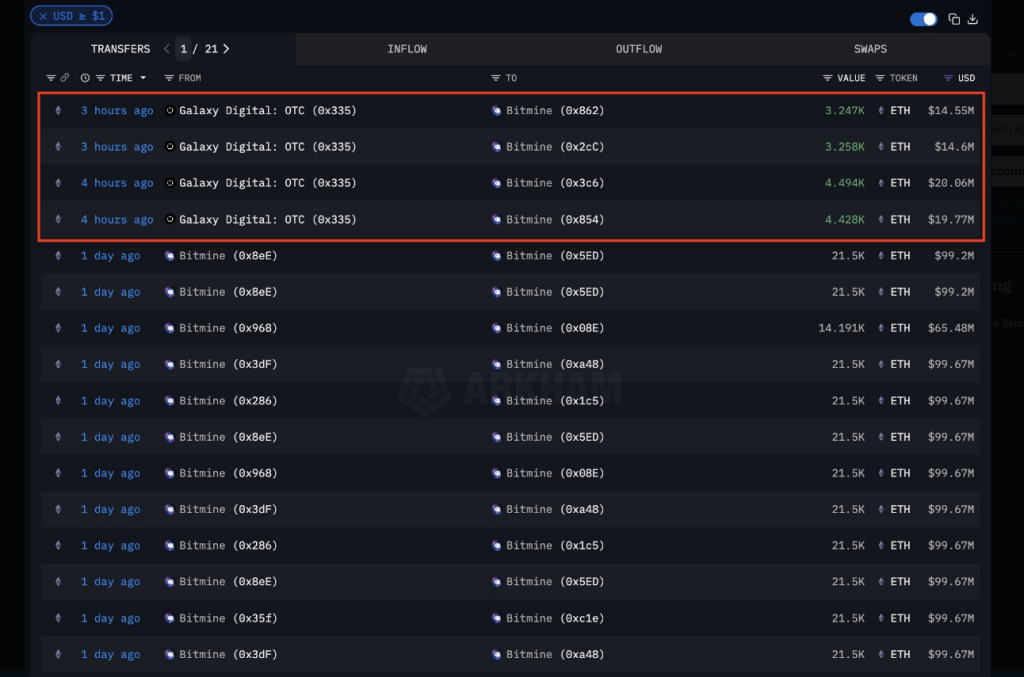

The recent buys were split into four settlements: 3,247 ETH ($14.50 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20 million), and 4,428 ETH ($19.75 million).

That totals about 15,427 ETH, which sums to roughly $69 million at the prices reported. According to public trackers cited in the coverage, these were likely coordinated OTC trades designed to avoid moving the spot market.

TOM LEE IS BUYING EVEN MORE $ETH

Tom Lee’s Bitmine just bought another $69M of ETH from Galaxy Digital. They now hold $8.66 BILLION of ETH.$BMNR is bullish on $ETH. pic.twitter.com/t9BWh9btPR

— Arkham (@arkham) September 19, 2025

How Much Of Ethereum Does BitMine Hold

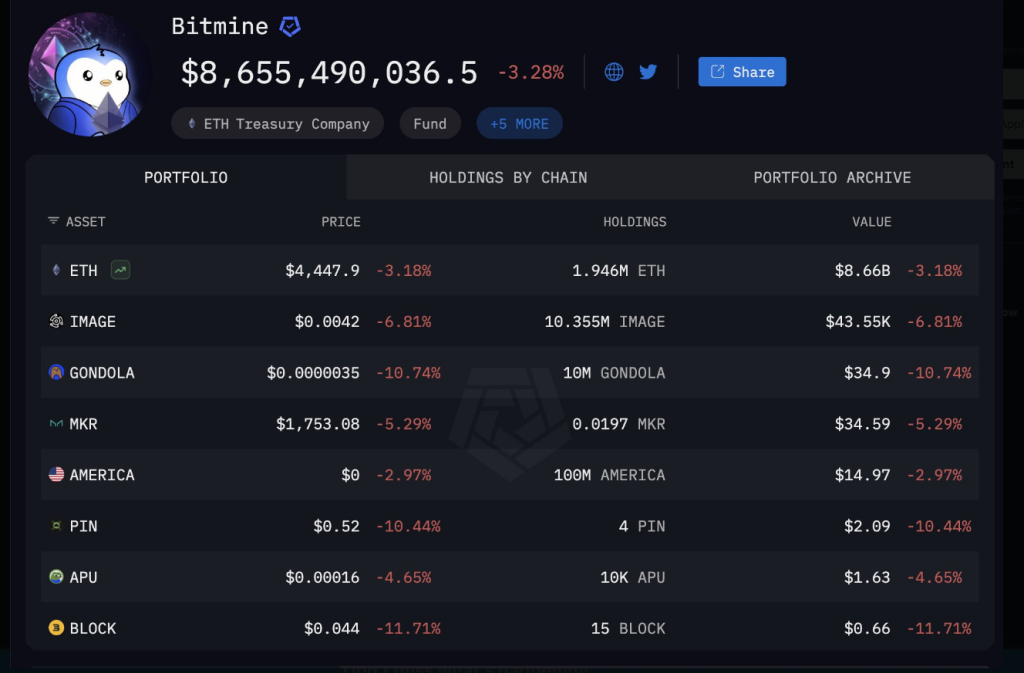

Reports have disclosed that BitMine now holds about 1.95 million ETH. That holding is valued at about $8.66 billion using the same pricing used in the coverage.

Analysts tracking corporate treasuries say that corporate and institutional ETH reserves together amount to a few percent of circulating supply, and BitMine is listed among the largest single holders.

The figures can look large when compared with total ETH supply, but the share depends on which supply measure is used — circulating, staked, or otherwise locked.

Buying large amounts on OTC desks is common for public companies and big players. It reduces slippage and keeps big orders off public order books.

The ETH here moved without obvious price spikes. Some transfers were visible on chain; the private terms of OTC trades usually remain confidential.

Based on reports citing blockchain trackers like Arkham, the on-chain flows matched the size and timing described.

Holding vast amounts of a volatile token carries real risks. A sharp fall in ETH WOULD hit BitMine’s balance sheet. At the same time, steady accumulation signals a clear strategic bet on future appreciation.

Market observers compare this approach to other firms that hold crypto as part of their corporate treasury, and regulators and accountants will watch how such holdings are reported in quarterly filings.

Corporate Accumulation Goes BigSome details remain unclear. Reports cite Arkham and Strategic Ether Reserve as the primary sources, but OTC trades do not reveal full pricing details and the exact terms are often private.

Because those settlements happen off-exchange, public records show transfers but not every pricing details. Large holders’ activity tends to attract extra attention when ETH moves sharply up or down.

Based on these numbers, the MOVE is one more sign of large corporate accumulation of ETH.

Featured image from Unsplash, chart from TradingView