Bitcoin’s Bullish Momentum Holds Strong—Glassnode Reveals The Critical Metric Keeping The Rally Alive

Bitcoin's uptrend remains intact as long as this single metric doesn't break—Glassnode's latest analysis points to surprising resilience despite recent volatility.

The make-or-break indicator

Market participants are laser-focused on Bitcoin's network momentum gauge, which continues flashing green despite pullbacks. The metric—closely watched by institutional traders—has held firm through recent selling pressure, suggesting underlying strength that casual observers might miss.

Institutional accumulation continues

Whale addresses keep adding positions while retail hesitates—classic bull market behavior that's fooled skeptics through every cycle. Exchange outflows tell the real story: coins moving to cold storage signal conviction, not capitulation.

The cynical take

Traditional finance still can't decide whether Bitcoin's a inflation hedge, tech play, or digital gold—meanwhile, the network keeps processing settlements worth billions while bankers debate definitions.

Bottom line: until this key metric breaks, the path of least resistance remains up. The market's pricing in what Wall Street still struggles to understand—decentralized finance isn't coming, it's already here.

Bitcoin Is Still Maintaining Above Short-Term Holder Realized Price

In a new post on X, Glassnode has discussed about the Realized Price of the Bitcoin short-term holders. The “Realized Price” here refers to an indicator that keeps track of the cost basis of the average investor or address on the BTC network.

When the value of the metric is greater than BTC’s spot price, it means the investors as a whole are sitting on some net unrealized profit. On the other hand, it being under the asset’s value implies the overall market is in a state of net loss.

In the context of the current topic, the Realized Price of a specific segment of the userbase is of interest: the short-term holders (STHs). This cohort includes the investors who purchased their tokens within the past 155 days.

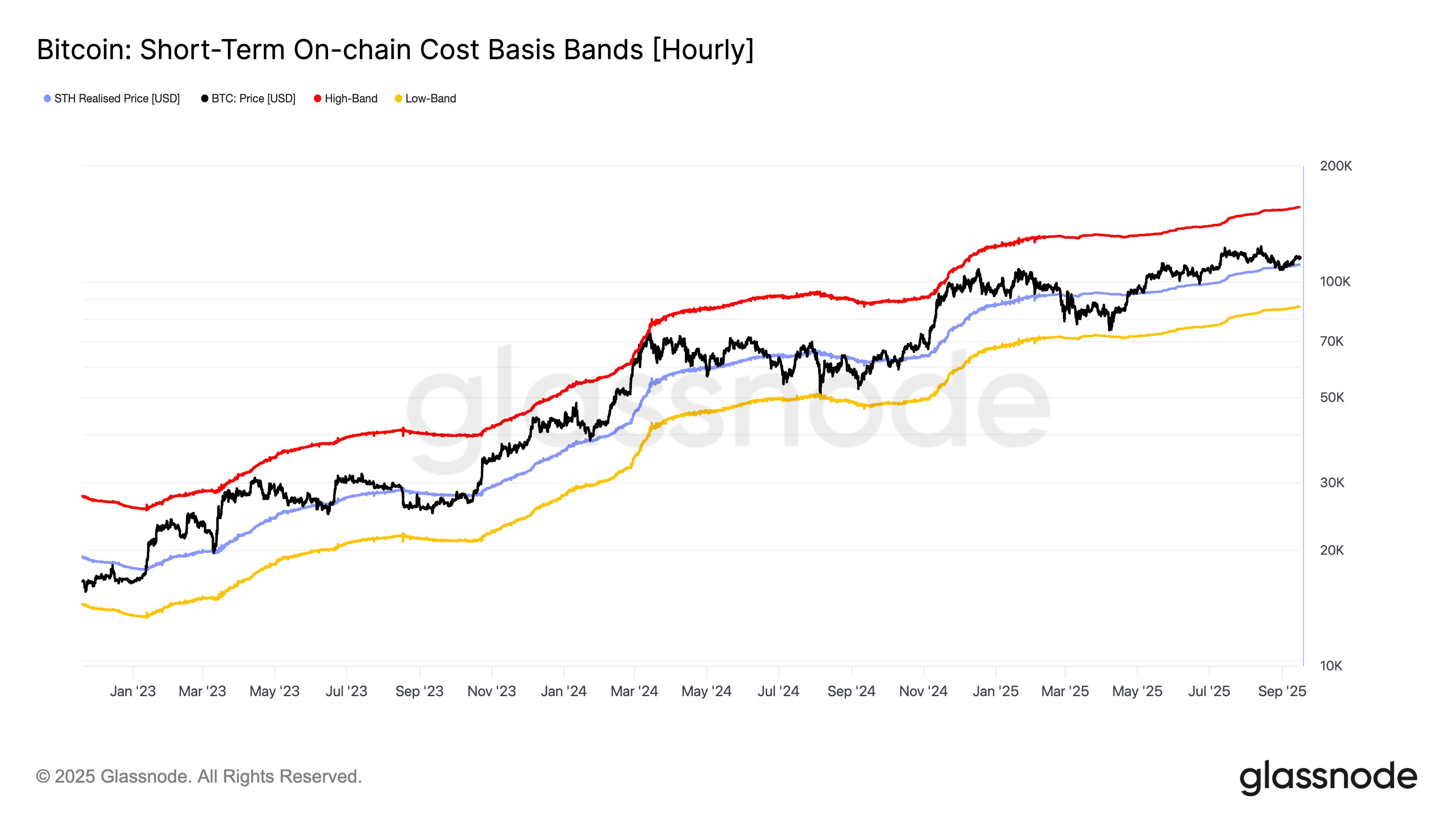

Now, here is the chart shared by Glassnode that shows the trend in the bitcoin Realized Price for the STHs over the last few years:

As displayed in the above graph, Bitcoin retested the STH Realized Price at the start of the month and found support at it. Since then, the coin’s price has seen some recovery.

This pattern of the STH Realized Price acting as a support barrier has actually been seen many times through this bull market. The reason behind the pattern may lie in investor psychology.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell them in the future. Since the STHs have a relatively low holding time, however, they don’t tend to be resolute, and thus, easily make panic moves when shifts occur in the market.

The STHs can particularly be susceptible to panic when the cryptocurrency retests their break-even level. When the market mood is bullish, the reaction comes in the form of buying. This is because the STHs look at drawdowns to their cost basis as dip-buying opportunities.

Similarly, STHs react to surges to their Realized Price by selling during bearish periods instead, fearing that the asset WOULD decline again in the near future and send them back into a state of loss.

For now, Bitcoin is maintaining above the STH Realized Price. “As long as the price respects this level, the trend remains constructive,” notes the analytics firm. “Losing this support has coincided with phases of contraction or pullbacks.”

BTC Price

At the time of writing, Bitcoin is floating around $116,200, up almost 5% over the last seven days.