Ethereum’s Rally Hits a Wall: Binance Spot and Perpetual Volumes Go Flat

Ethereum's bullish momentum just slammed into a brick wall. Trading activity on Binance—the world's largest crypto exchange—has flatlined, with both spot and perpetual volumes showing alarming signs of stagnation.

Volume Dries Up

Nothing kills a rally faster than fading interest. Traders are pulling back, leaving ETH's price action stuck in neutral. No big buys, no panic sells—just eerie calm.

Perpetuals Lose Their Bite

Even derivatives traders are sitting on their hands. Perpetual volumes—often the lifeblood of crypto volatility—are mirroring the spot market's coma. Where's the leverage? Where's the frenzy? Gone, for now.

Binance's Quiet Spell

When Binance sneezes, the whole market catches a cold. And right now, the exchange isn't just sneezing—it's napping. Volume shrinkage here signals a broader loss of conviction, no matter what the permabulls on Crypto Twitter claim.

So much for 'number go up' technology. Sometimes, number just sits there—especially when Wall Street's algo-traders are too busy chasing the next shiny thing to care about a little thing like, oh, the second-largest blockchain on earth.

Binance Ethereum Trading In Neutral Zone

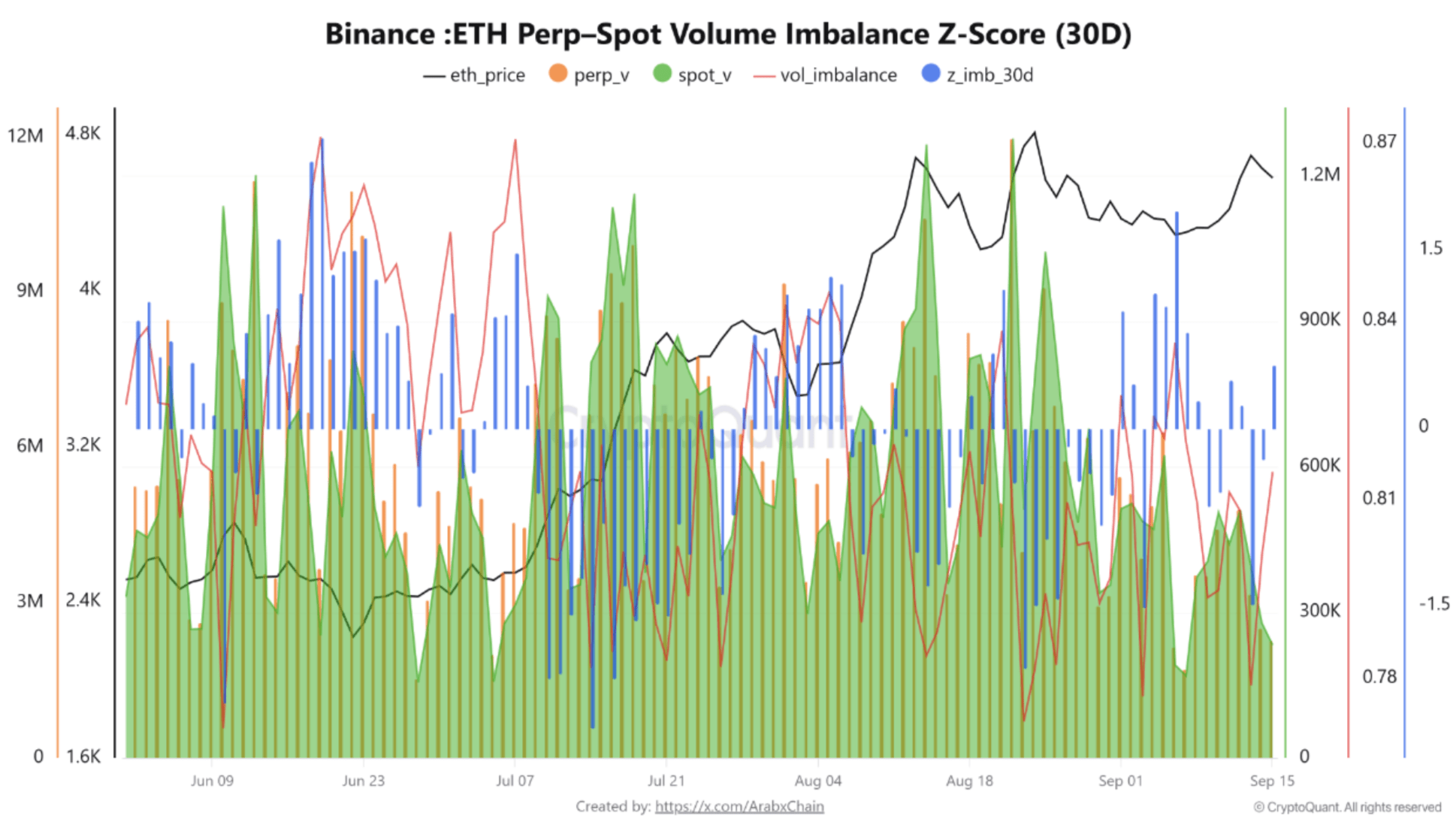

According to a CryptoQuant Quicktake post by contributor Arab Chain, ethereum trading on Binance during September 2025 is witnessing a period of relative calm compared to other months. Notably, there has been a decline in the imbalance between ETH spot and perpetual volumes.

Commenting on ETH’s recent price surge, which saw it jump from $2,127 on June 15 to around $4,500 at the time of writing, Arab Chain noted that this rally was not supported by strong momentum. Neither the spot market nor Leveraged speculators contributed to the price appreciation.

The CryptoQuant contributor brought attention to ETH’s Z-score, which has oscillated between 0.0 and -1.0 for most of September. Such a Z-score typically signifies the asset trading in a neutral zone, with a slight tilt toward the spot market.

For the uninitiated, a Z-score measures how far a data point is from the mean, expressed in units of standard deviation. In trading, it’s used to identify whether a value – like volume or price – is unusually high or low compared to its historical average.

In essence, ETH’s current Z-score means that perpetual contracts are slowly losing their dominance in trading volume. This could be due to multiple reasons, such as speculators exiting the market or due to increased dependence on real buy/sell orders from actual investors.

The decline in perpetual trading volume is significant compared to the period between June and August. As a result, the appetite for leveraged speculation has dwindled too, a sign of growing caution in the market. Arab Chain added:

Despite this decline, the spot market also showed limited strength, reflecting a general lack of investor engagement. Spot volume remained below the 500K–1M range, which is significantly lower than the peaks recorded in July and June.

The analyst cautioned that although the lack of strong imbalances between the spot and perpetual markets may seem positive at first, it could also mean there is heightened uncertainty and stagnation pertaining to the direction of ETH’s price.

Is ETH Preparing For A New Rally?

Although ETH appears to be stuck in limbo due to its sluggish price action, some analysts are confident that the digital asset is likely to resume its bullish trajectory in the NEAR term. For example, ETH reserves on exchanges continue to deplete at a rapid pace.

Similarly, institutional demand for ETH continues to be strong, with some analysts forecasting ETH to climb to $6,800 by the end of 2025. At press time, ETH trades at $4,439, down 1.6% in the past 24 hours.