Bitcoin Price Flashes ’Rarest Signal’ Ever—Could a 100% Rally Be Imminent?

Bitcoin just triggered its most elusive trading pattern—one that's historically preceded massive moves.

The Signal That Has Traders Buzzing

This isn't your typical bullish crossover. We're talking about a configuration that's appeared fewer than a handful of times in Bitcoin's entire history. Each previous occurrence kicked off a monumental rally.

Why This Time Feels Different

Market structure aligns perfectly with the signal. Liquidity's stacking on the bid side, open interest is climbing, and institutional wallets are accumulating rather than distributing. Retail hasn't even caught on yet.

The 100% Question

Could we really see a full doubling from current levels? History says yes—but then again, history also remembers Lehman Brothers. The math works if momentum sustains and macro conditions play along. Just don't bet your mortgage on it—unless you enjoy talking to bankruptcy attorneys.

Timing remains the wildcard. These signals tend to play out over weeks, not days. But when they fire? They don't just knock on the door—they kick it down.

Bitcoin Price Chart Flashes Golden Cross

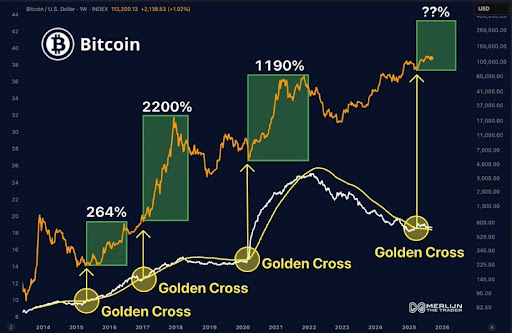

On Thursday, crypto analyst ‘Merlijn The Trader’ declared on X social media that Bitcoin has just flashed a Golden Cross, its rarest and most powerful technical signal. The analyst described this development as a historic moment that has only occurred three times since BTC’s inception. Each past occurrence has led to extraordinary price rallies, establishing the Golden Cross as a key signal that most traders and investors watch closely.

Sharing a detailed price chart, Merlijn outlined Bitcoin’s trajectory after each prior Golden Cross, pointing to returns that have left an indelible mark on the cryptocurrency’s history and the market as a whole. In 2016, the appearance of a Golden Cross set the stage for a bull rally of roughly 264%, a MOVE many saw as the opening act of BTC’s first major run into mainstream recognition.

A year later, the signal reemerged in 2017, coinciding with Bitcoin’s meteoric rise of over 2,200%, culminating in the unprecedented high between $17,000 and $27,000. The third Golden Cross formation came in 2020, when BTC surged more than 1,190%, climbing from a low between $4,600 and $7,000 to roughly $69,000 by late 2021. Each instance not only marked a breakout rally but also achieved a new all-time high for the cryptocurrency.

Now, in 2025, Bitcoin has reportedly triggered the Golden Cross signal for the fourth time in its history. Merlijn’s analysis highlights that this is not just a routine crossover but an ignition point. He noted that previous Golden Cross signals aligned with the start of Bitcoin’s most powerful bull phases. As a result, the current setup could prepare the cryptocurrency for another outsized rally to new ATHs.

Based on historical data, even a conservative repeat of past percentage gains suggests bitcoin could climb well beyond $200,000. A 100% rally from current levels above $115,000 could push the leading cryptocurrency well above $230,000. However, Merlijn’s chart points to an even greater move, projecting a potential surge to nearly $400,000.

Bitcoin Bull Market Support Bands Hold Firm

Crypto analyst Mags has also drawn attention to a different technical signal, reinforcing Bitcoin’s bullish case. According to him, BTC’s bull market support bands have acted as critical support zones in the past cycles, keeping the broader uptrend intact during temporary corrections.

Throughout this cycle, each time Bitcoin’s price tested the bull market support band, it managed to hold and rebound strongly. The most recent test saw the cryptocurrency bounce cleanly off the band, suggesting buyers are stepping in at these levels to defend support. Mags added that this consistent support has created a foundation for further gains in BTC’s price, indicating that the market is not overextended.