Asset Entities Merges with Strive to Form $1.5B Bitcoin Treasury – Why Bitcoin Hyper Could Soar Next

Two giants just shook the crypto world—Asset Entities and Strive merge into a $1.5 billion Bitcoin treasury powerhouse.

Why This Merger Changes Everything

Forget small-time hodling. This isn't your cousin's crypto portfolio. We're talking institutional-grade accumulation—the kind that makes traditional finance sweat through its suit.

Bitcoin Hyper: The Real Winner?

While Wall Street still debates whether Bitcoin is an asset or a currency, this move screams confidence. A $1.5 billion bet isn't a dip—it's a tidal wave. And when whales move, the whole ocean follows.

What’s Next for the Market?

Expect volatility—but also validation. When companies commit this hard, it forces even the most skeptical fund managers to recalc their spreadsheets. Maybe add a crypto column.

One cynical take? Traditional finance will call it reckless right up until they quietly allocate 2% of their own funds. Classic.

Asset Entities’ 52% Stock Surge and What It Means for Bitcoin

Asset Entities shares were already up 17.8% in the hours before the announcement. But when news of the shareholders’ approval hit the headlines, shares skyrocketed to over 52% during after-hours trading.

Currently, more than 180 publicly traded Bitcoin treasury companies hold $BTC reserves, accounting for approximately 5.1% of the circulating Bitcoin supply.

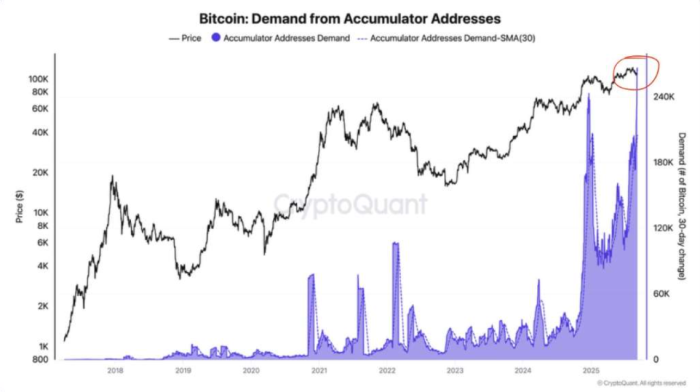

This corporate adoption trend, initiated by Strategy (which currently holds 638,460 $BTC), is rapidly transforming Bitcoin into a mainstream institutional asset.

Along with legitimizing Bitcoin’s use, this trend is reshaping corporate finance norms and fueling increased demand, thereby enhancing Bitcoin’s long-term price appreciation and stability.

What’s The Buzz About This Bitcoin Treasury Deal?

Strive Inc’s plan to establish a $1.5 billion Bitcoin treasury has fueled the prevailing bullish market sentiment, driving $BTC prices further upward.

Retail investors are also set to gain indirect exposure to Bitcoin’s price and treasury management by owning shares in the new entity.

Not to mention, mergers like this could structurally alter the liquidity and risk profile for retail investors, as they increase Bitcoin scarcity and create new financial opportunities in public markets.

Also, increased corporate adoption and treasury accumulation boost investor trust, benefiting crypto projects tied to Bitcoin’s ecosystem, such as Bitcoin Hyper ($HYPER) .Why Investors Are Looking To Bitcoin Hyper

is an innovative Layer-2 solution for Bitcoin, designed to eliminate Bitcoin’s pain points. And there certainly are a few of them. Bitcoin is renowned for its top-notch security. But when it comes to transaction speeds – never mind the costs – Bitcoin leaves a lot to be desired.

Bitcoin is also limited in terms of smart contract execution, leaving DeFi, staking, dApps, and co out of the equation. But that’s where Bitcoin Hyper steps up to the plate, with an innovative Layer-2.Powered by its native token, $HYPER, the Layer-2 integrates a Canonical Bridge that lets you send your $BTC to a dedicated wallet. Once verified, your $BTC will be minted on the Hyper Layer-2 as wrapped $BTC.

There, you can use your tokens for instant payments, DeFi, and dApps.

Perhaps best of all, the Layer-2 also integrates the Solana VIRTUAL Machine. That means faster, cheaper transactions that are more on par with Solana’s 65K max theoretical transactions per second rate compared to Bitcoin’s dismal seven.

In a nutshell, Bitcoin Hyper has a lot going for it, and investors are taking note. Want to discover more about $HYPER? Our complete guide to $HYPER’s features and potential explains it all.

Is $HYPER Set To Soar?

Thepresale has already raised $14.8M+ and there are no signs of it slowing anytime soon.

Whales have also joined in on the action – last month alone saw two significant whale buys of $161.3K and $100.6K. So, is $HYPER set to soar? It certainly looks like it.

We’re not surprised, though. Bitcoin Hyper’s Layer-2 has the potential to be a market game-changer. $HYPER also positions itself as a project where early investors stand to benefit a lot.

$HYPER is currently priced at $0.012885, and you can stake it for 75% APY. However, our analysts predict that $HYPER could end the year at $0.02595 – and potentially reach $0.253 in 2030. That’s an ROI of 1,863%.Find out how to buy $HYPER in our step-by-step guide.

The Bitcoin Hyper presale is running on a tiered pricing model, with the next price increase scheduled for tomorrow. This means you have a limited window to secure your $HYPER tokens at the current bargain price.

Ready to jump in? Head to the officialpresale website now.

Potential Gains for Early Investors

The merger between Asset Entities and Strive Enterprises marks a milestone in Bitcoin’s corporate adoption, as the newly formed company aims to establish one of the largest publicly traded Bitcoin treasuries.

This not only validates Bitcoin’s legitimacy as a mainstream institutional asset but also sets a powerful example for both retail and institutional investors.Furthermore, it has also reinforced Bitcoin’s role as a trusted treasury asset, amplifying confidence across the broader crypto ecosystem.

As the Ripple effect naturally extends to emerging projects, now’s the time to leverage this momentum and benefit from early opportunities, such as thepresale.

$HYPER presents a brilliant opportunity to become part of Bitcoin’s evolving financial ecosystem and position yourself at the forefront of Layer-2 scalability and innovation.

The crypto market is highly volatile and carries significant risks. Always conduct your own research before making any investment decisions.