Ethereum’s Explosive Rally Ignited by Massive Binance Orders, Analyst Reveals

Whale movements on Binance just sent Ethereum soaring—again.

The Mechanics Behind the Pump

Large-scale orders flooded the world's biggest crypto exchange, triggering algorithmic responses and retail FOMO in equal measure. Liquidity vanished faster than a trader's patience during a flash crash.

Traders scrambled while ETH ripped through resistance levels—no fancy fundamentals required, just pure order book dominance.

Market Irony Alert

Another day, another rally fueled by exchange flows rather than actual utility. Because nothing says 'decentralized future' like a handful of whales moving markets on a centralized platform—classic crypto.

Ethereum Rally Driven By Large-Scale Binance Orders

According to a CryptoQuant Quicktake post by contributor Crazzyblockk, Ethereum whales are now dominating order flows on the Binance exchange. The analyst highlighted the average ETH order size on the platform as evidence.

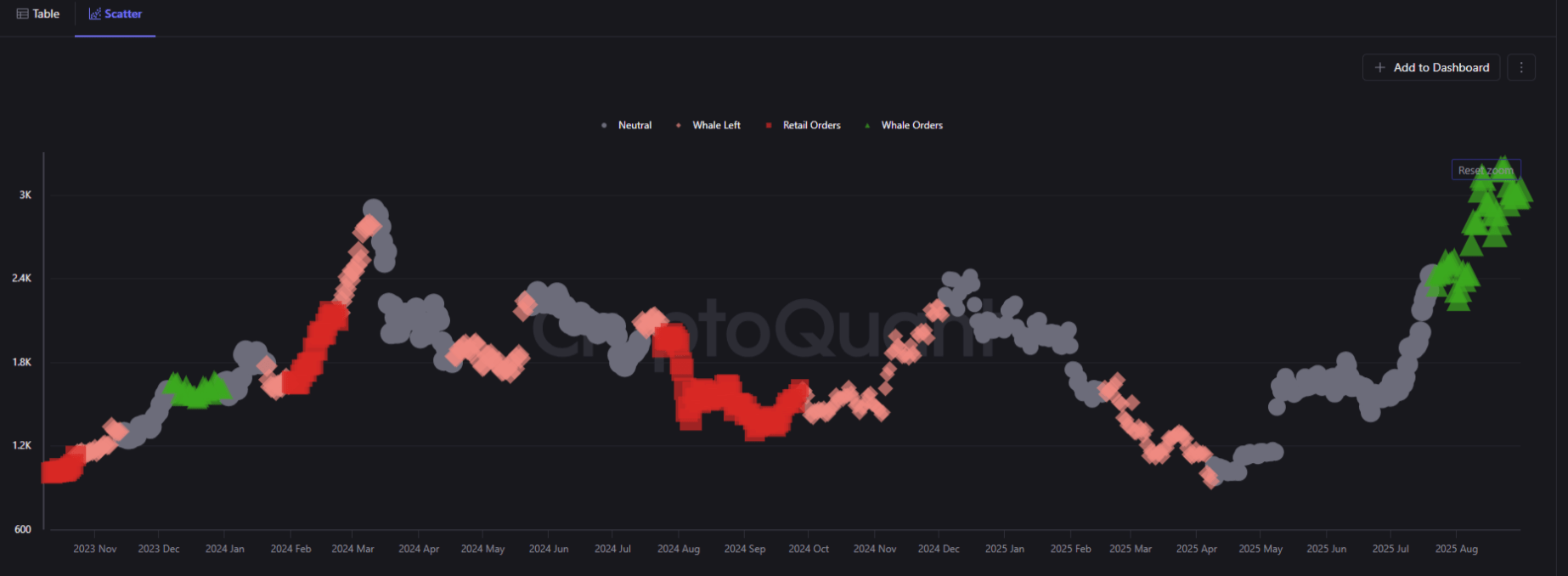

Crazzyblockk shared the following chart showing different phases of average ETH order size on Binance. Retail-driven phases, highlighted in red, dominated much of 2023–24, when small orders drove up ETH’s price but left it vulnerable to corrections.

These retail-driven periods were followed by neutral phases, shown in gray, which reflected indecision among ETH investors. This phase was characterized by fragmented participation and sideways trading behavior.

Fast-forward to mid-2025, whale orders – highlighted in green – are firmly in control. Average order sizes have now surged past $3,000 per trade, signaling accumulation by institutional and large-scale investors.

The CryptoQuant analyst noted that this whale dominance reflects renewed institutional confidence in ETH, aligning with its rapid price appreciation in recent months. Larger average orders suggest fewer fragmented trades and stronger directional conviction.

Binance was chosen for the analysis not only as the world’s largest exchange but also because it is the “epicenter of ETH capital flow.” Crazzyblockk concluded:

ETH’s latest rally isn’t just retail speculation – it’s being powered by whales on Binance. With large-scale players setting the tone, Ethereum’s market structure looks increasingly robust, and Binance remains the hub where these decisive flows shape price performance.

Is ETH Getting Ready For A Rally?

While Bitcoin (BTC) has tumbled 4.1% over the past 30 days, ETH is up 23.4% in the same period, indicating that large-scale investors may be in the middle of capital rotation from BTC to ETH over the past month.

Analysts predict ETH may have further room to grow for the remainder of 2025. Ethereum contracts are seeing a sharp resurgence in 2025, setting the stage for a potential rally to a new all-time high (ATH) of $5,000 towards the end of the year.

Ethereum fundamentals are also strengthening, with as much as 36 million ETH staked on the blockchain, raising the possibility of a supply crunch. That said, despite whale accumulation, some analysts caution that ETH could dip to $4,000. At press time, ETH trades at $4,316, down 2.8% in the past 24 hours.