XRP Price Set to Soar as Japanese Gaming Titan Pumps 2.5-B Yen Investment

XRP just scored a major power-up from Japan's gaming elite.

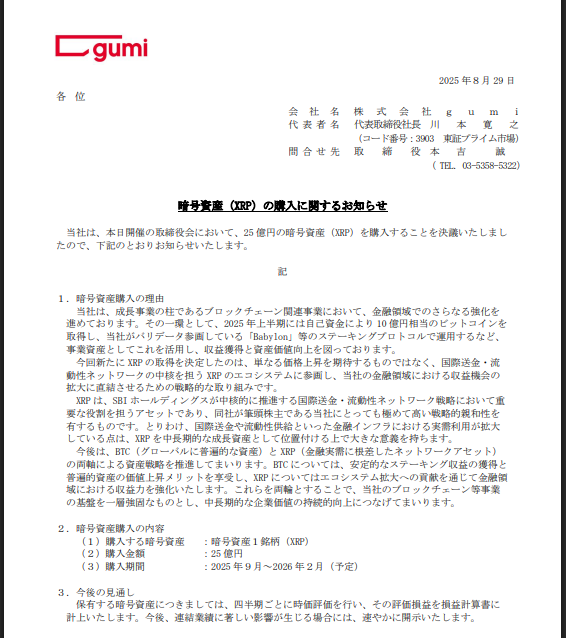

The 2.5-B Yen Catalyst

A undisclosed Japanese gaming heavyweight drops a staggering 2.5 billion yen into XRP—igniting speculation of a corporate crypto pivot. That kind of capital doesn't move quietly. Markets notice.

Gaming Meets Crypto—Seriously

This isn't play money. It's a strategic bet on blockchain utility beyond hype—liquidity, cross-border settlements, maybe even in-game economies. Traditional finance scrambles to keep up—as usual.

Price Action Ahead

Watch for volatility. Big money moves markets, and this injection could push XRP past recent resistance. Bulls already scent blood. Another 'sure thing'? Maybe. But in crypto, even sure things like to keep you guessing.

Accumulation Over Several Months

According to a press release, the acquisition will not be a single purchase. Instead, Gumi will buy XRP gradually from September 2025 through February 2026.

By spreading out its spending, the company appears to be aiming at lowering risk from sudden price changes in the market.

XRP Price Could See Boost

Analysts say Gumi’s steady, large-scale commitment could act as a price catalyst. With 2.5 billion yen entering the market over several months, consistent buying pressure might create upward momentum — especially if other institutions keep adding XRP to their treasuries.

The MOVE also sends a signal: a gaming organization tied to SBI Holdings is backing XRP’s role in cross-border payments and liquidity solutions. That confidence could draw extra investor attention to the token’s long-term utility.

The company explained the move as part of its effort to get involved with XRP’s ecosystem. It highlighted XRP’s role in global remittances and its expanding use in financial services.

Ripple’s close ties with SBI Holdings, Gumi’s major shareholder, were also pointed out as an important factor in the decision.

Before this XRP announcement, Gumi had already added Bitcoin to its balance sheet. Earlier this year, the company spent 1 billion yen, around $6.7 million, to acquire BTC.

That investment didn’t just sit idle. The bitcoin was staked on Babylon, a protocol that allows holders to earn rewards while waiting for possible price gains.

With that strategy already in motion, the company is now set to run a two-pronged approach: Bitcoin will be used to generate steady income through staking, while XRP will be held as a long-term asset tied to its growing utility in payments and liquidity management.

Rising Institutional Interest In XRPThe Japanese gaming giant’s latest move comes at a time when a growing number of institutions are welcoming XRP into their balance sheets. Over recent months, several entities have disclosed their treasury game plans that include the top altcoin. Their aim, similar to Gumi’s, is to position ahead of potential gains if adoption pushes the price higher.

For Gumi, this is more than a financial experiment. Executives believe Bitcoin and XRP together can provide a base for its blockchain-related business. They say the two assets will support growth in revenue while helping the company build lasting value.

Featured image from Unsplash, chart from TradingView