Another Short-Lived Solana Rally? Here’s Why This Time Could Be Different

Solana's latest surge has traders wondering—is this just another flash in the pan or the real deal?

Network upgrades finally delivering

Previous rallies crumbled under technical pressure. This time? SOL's infrastructure handles volume spikes without breaking a sweat—no more network clogging during peak demand.

Developer activity hits unprecedented levels

Builders aren't just watching—they're deploying. New projects launch weekly, and established protocols expand functionality. The ecosystem's breathing fire instead of gasping for air.

Institutional money whispers

Traditional finance players dip toes where they once feared to tread. Maybe they finally realized yield beats treasury bonds—even with crypto's volatility.

Market structure shifts beneath the surface

Short positions get squeezed while long-term holders dig in. This isn't speculative froth—it's structural momentum building through actual utility.

Sure, Wall Street still thinks 'blockchain' is a buzzword for PowerPoint presentations, but SOL's proving real-world use cases trump empty buzz. This rally's built on code, not hype.

Solana Breaks Out Of Triangle Pattern

On Thursday, Solana hit a six-month high of $216 after breaking out of one of its most crucial resistance zones. The cryptocurrency bounced 16% from Monday’s lows and reclaimed the $200 barrier as support on Wednesday, closing the day above this area.

SOL briefly reclaimed this level during the early August breakout, but the recent market corrections dragged its price to the $175-$195 area. Amid Thursday’s rally, market watcher Daan crypto Trades highlighted its performance, asserting that it is “at an interesting spot.”

The trader explained that solana is trading in a multi-month rising wedge pattern, currently nearing the resistance level that has held over the months. Notably, the cryptocurrency has been rejected from the pattern’s upper boundary multiple times since July, retesting the ascending support line on each occasion.

Supporting SOL’s case, Daan argued that it has “been strong on the back of treasury vehicles being spun up and potential upcoming buying + frontrunning,” noting that “rising wedges are generally leaning bearish but in bull markets it’s nothing new for these to break towards the upside instead.” Based on this and the cryptocurrency’s recent performance, he forecasted that it WOULD reach higher levels later this year.

Similarly, analyst Ali Martinez pointed out a six-month ascending triangle pattern on the altcoin’s chart, which targets the $360 area. Solana retested the pattern’s resistance three times over the past month and a half, but ultimately failed to turn the $205-$207 zone into support.

As the altcoin pushed past the $210 mark, the analyst raised the question of whether the ongoing breakout attempt will be successful or if SOL’s rally would be short-lived for the fourth time.

Fourth Time’s The Charm?

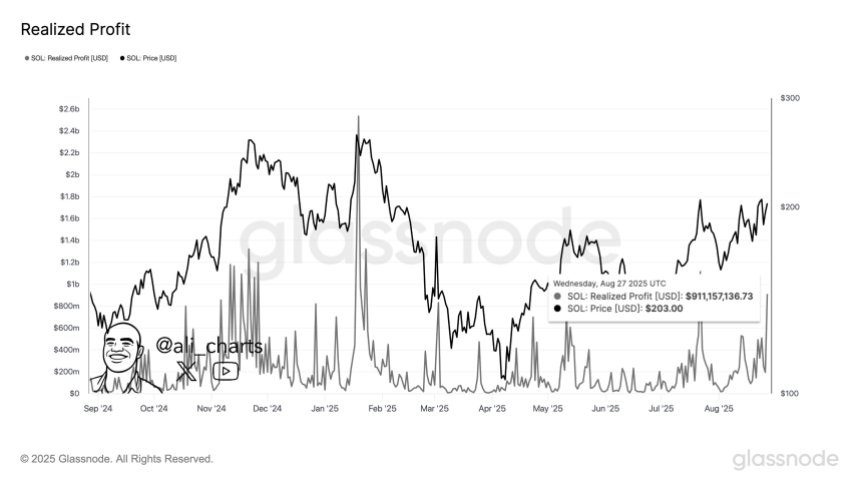

Martinez shared multiple technical indicators that suggest Solana could finally break out of this pattern and aim for the long-awaited $300 barrier. The analyst explained that the backdrop of social sentiment and on-chain positioning differentiate the current price MOVE from the previous attempts.

Unlike the previous breakout attempts, sentiment across the community is more subdued. “Historically, euphoric sentiment above the ‘230’ index level coincided with local tops, as excessive Optimism preceded retracements,” he detailed. According to the analyst’s chart, sentiment is muted this time, which suggests “skepticism rather than crowded bullish positioning.”

Additionally, around $1 billion in realized profits have been booked after the surge to $212, signaling that some traders likely remain unconvinced that momentum will hold during this attempt.

He also highlighted that there are significant accumulation zones below $207, with multiple support zones between $165 and $206, providing a strong base to continue rallying, which contrasts with the lack of resistance above the $212 area.

“If buying pressure builds, the path toward $300 is comparatively less obstructed,” Martinez affirmed, adding that Solana’s fundamentals, including the proposed Alpenglow consensus upgrade, may also add fuel to the breakout.

“With skepticism still present, strong accumulation below $207, and little resistance overhead, this attempt has a higher probability of succeeding compared to prior failures. A confirmed breakout above $212–$215 on sustained volume would shift focus to the $300 target zone,” he concluded.

As of this writing, Solana is trading at $212, a 17% increase in the weekly timeframe.