Tether Unleashes $1 Billion In New USDT As Crypto Market Recovers - Bullish Momentum Builds

Tether just dropped a billion-dollar bomb on the crypto markets—and timing couldn't be more perfect.

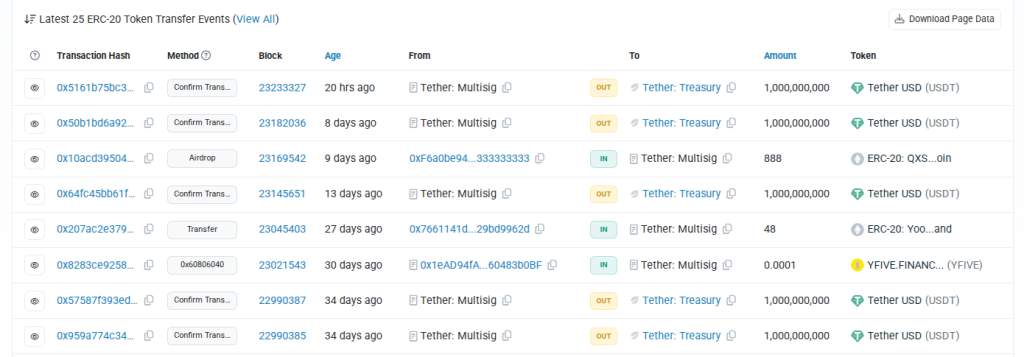

The stablecoin giant minted a fresh $1 billion USDT injection as digital assets stage their comeback tour. That's not just pocket change—it's rocket fuel for the next leg up.

Market makers are loading up, exchanges are stacking liquidity, and traders are positioning for what comes next. When Tether prints, the market listens.

Remember when critics called stablecoins 'the shadow banking system of crypto'? Well, shadows tend to get longer when there's more light—and right now, everything's looking brighter.

Another day, another billion—because who needs traditional banking when you can just mint your own dollars?

Tether Minting Sparks Liquidity Flows

New USDT issuance is frequently used to fund purchases, and the 1 billion issuance was flagged by on-chain trackers as a likely source of fresh buying power.

Santiment and other trackers show that the number of addresses holding at least 1,000 BTC ROSE by 13 to about 2,085 since the start of August. At the same time, wallets holding at least 10,000 ETH increased by 48 to roughly 1,27.

On August 26, US spot ether ETFs recorded about $450 million in net cash inflow, led by BlackRock’s ETHE with roughly $320 million that day.

That pushed cumulative inflows into spot ether ETFs to near $13.30 billion, while US spot Bitcoin ETFs took in about $88 million with BlackRock’s IBIT posting roughly $45 million.

The freshly minted USDT could be used by traders and desks to buy into Ether and other altcoins, matching the observable rotation from bitcoin into alternative assets and ETF-linked demand.

Whale Accumulation Intensifies

Large holders were not the only sign of demand. Trading volumes and price moves showed altcoins gaining traction, but it was the FLOW of stablecoins that underpinned the story.

When stablecoin supply rises, it lowers the friction for big buys: money can be moved to exchanges and executed faster than waiting for bank transfers.

That operational detail helps explain why a billion mint draws attention even when headline prices are already climbing.

The immediate effect of the mint was to give traders extra readily available cash. But liquidity injections are a two-sided event. They can push prices higher if buyers are aggressive, while concentrated buying and later profit-taking can cause sharp swings.

What Tether Minting Could Mean For MarketsMarket observers are watching liquidity, whale wallets, and ETF flows together because the mix determines whether a sustained capital rotation into altcoins will follow or if gains will be short lived.

Tether’s 1 billion USDT mint was the clearest single signal of added spending power during Wednesday’s rebound.

That supply, paired with heavy inflows into Ether ETFs and signs of whale accumulation, creates a setup where altcoin demand can grow quickly.

Featured image from Meta, chart from TradingView