Ethereum Whale Demand Explodes on Binance as $5,000 Price Target Looms

Whales are going all-in on Ethereum as it approaches the psychological $5,000 barrier—Binance's order books are flashing massive buy-side pressure that suggests institutional players aren't just watching, they're accumulating.

Big Money Bets

While retail traders nervously eye resistance levels, deep-pocketed investors are stacking ETH like it's going out of style. The surge in large-volume transactions signals confidence that this rally has legs—and that $5,000 might be a stepping stone, not a ceiling.

Market Momentum Builds

Ethereum's push toward $5,000 isn't happening in a vacuum. Network upgrades, growing DeFi activity, and the looming ETF landscape are creating a perfect storm of bullish sentiment. Even traditional finance skeptics are starting to pay attention—though they'll probably call it a 'speculative frenzy' right up until they FOMO in.

Just another day in crypto—where 'whale watching' means tracking million-dollar trades instead of vacation photos.

Binance Whales Accumulate Ethereum

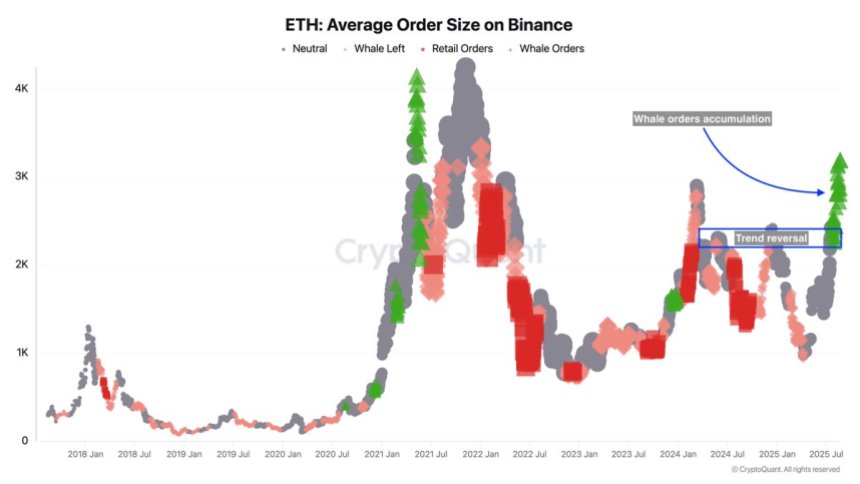

According to top analyst Darkfost, Ethereum’s Average Order Size on Binance chart provides clear insight into the behavior of different cohorts, distinguishing between retail investors and whales. Since July, a significant shift has taken place: whale activity on Binance has surged. This reflects a growing trend of large-scale accumulation, with whale-sized spot and futures orders continuing to FLOW into the market as ETH edges closer to the $5,000 mark.

What makes this trend particularly noteworthy is the timing of whale participation. Unlike retail investors, who often try to buy early and ride potential upside, whales tend to prefer entering once a bullish trend has been confirmed.

Darkfost highlights that this pattern is evident now, as whale orders began accelerating only after ethereum reversed its earlier downtrend and regained strong bullish momentum. This validates the idea that large players seek reduced risk and clearer confirmation before allocating capital at scale.

With both retail and institutional participants aligning, the coming weeks could be decisive in determining whether ETH firmly breaks into new price discovery. If whales continue to buy at this pace, Ethereum’s rally could extend far beyond its 2021 highs.

Testing Critical Support LevelEthereum (ETH) is currently trading around $4,598 after a sharp retracement from its new all-time high NEAR $4,900. On the 4-hour chart, the structure shows that ETH is still maintaining a bullish trend, although momentum has cooled after last week’s explosive rally.

The 50 SMA ($4,455) and 100 SMA ($4,435) are now converging just below current price levels, acting as immediate dynamic support. This cluster strengthens the bullish outlook as long as ETH can remain above it. A deeper drop toward the 200 SMA ($4,068) WOULD signal a broader correction phase and potentially extend the consolidation before another push higher.

The recent pullback shows that sellers are active near the $4,900–$5,000 region, which now forms a critical resistance. A breakout above this level would open the path to uncharted territory and likely accelerate momentum, with targets potentially stretching toward $5,200 and beyond.

On the downside, failure to hold the $4,450–$4,400 support area could shift sentiment bearish in the short term, with traders eyeing $4,200 as the next key demand zone.

Featured image from Dall-E, chart from TradingView