Ethereum Treasury Explosion Ignites Market Frenzy: Is The Crypto Ecosystem Ready For The Incoming Tsunami?

Ethereum's treasury reserves are hitting unprecedented levels, sending shockwaves through the digital asset markets and triggering massive institutional accumulation.

The Demand Avalanche

Major corporations and sovereign wealth funds are scrambling to secure ETH positions, creating supply squeezes that push prices toward record territory. Trading volumes surge as traditional finance players finally acknowledge what crypto natives knew years ago.

Infrastructure Stress Test

Network congestion spikes as transactions flood the blockchain. Gas fees hit eye-watering levels while validators struggle to keep pace with the explosion in staking demand. The very scalability solutions meant to solve these problems now face their ultimate trial by fire.

Regulatory Whiplash

Watchdogs scramble to respond as pension funds and retirement accounts suddenly want crypto exposure. The same regulators who spent years warning about digital assets now face pressure to approve ETH ETFs faster than you can say 'hypocrisy.'

Because nothing makes bureaucrats move faster than the scent of new tax revenue and the fear of missing the next financial revolution. The market might handle the risks better than traditional finance handles its own relevance.

Ethereum: Treasury Concentration And Leverage Risks

According to CryptoQuant’s analysis, Ethereum’s recent treasury adoption trend carries both opportunities and risks. On one hand, institutional treasuries have locked away billions in ETH, reducing available supply on the market.

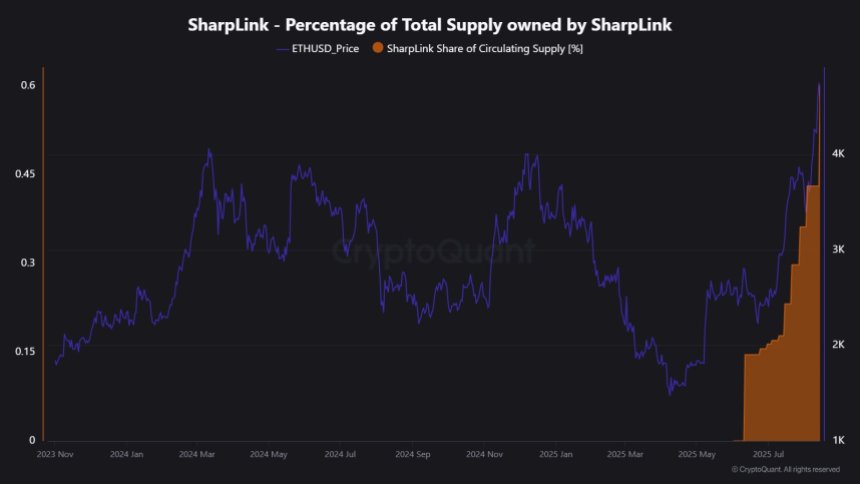

However, the structure of these holdings also presents concentration risks. For example, BitMine Immersion Technologies, which has openly stated its goal of controlling 5% of all ETH, currently holds just 0.7%. The next largest holder, SharpLink Gaming, manages only 0.6%. This means treasury adoption is still concentrated among a few players. If one or two large holders were to offload their reserves, the market could face sharp price shocks.

Beyond spot accumulation, leverage is another growing factor. CryptoQuant highlights that ETH futures open interest has climbed to around $38 billion. This level of leverage means that large swings in price can trigger cascading liquidations. In crypto markets, leverage is synonymous with volatility.

The fragility of this setup was evident on August 14, when a wipeout of just $2 billion in open interest led to $290 million in forced liquidations and a 7% drop in ETH’s price. This event underlines how quickly things can spiral when liquidity is thin and leverage is high. Spot selling alone isn’t driving volatility—leveraged positions magnify every move. In this context, Ethereum’s treasury adoption may secure long-term demand, but concentrated holdings and growing leverage remain key vulnerabilities.

ETH Testing Critical Liquidity LevelsEthereum’s price action on the 3-day chart shows that after rallying to a local high NEAR $4,790, ETH entered a correction phase but remains well above key moving averages. Currently trading around $4,227, the price has retraced from its peak but is still holding the broader bullish structure.

The 50-day SMA ($2,687), 100-day SMA ($2,838), and 200-day SMA ($2,912) are all trending upward, reflecting strong underlying momentum. Importantly, ETH is trading significantly above these long-term averages, confirming that the bullish trend remains intact despite the pullback. The strong bounce from below $3,000 earlier in the summer marked a decisive reversal after months of consolidation, setting the foundation for the latest breakout.

If bulls manage to hold the $4,200–$4,100 support zone, ETH could retest resistance near $4,790 and potentially MOVE into price discovery. Conversely, failure to maintain this level could see a retest of the $3,800–$3,600 range. The coming sessions will be critical in confirming whether Ethereum resumes its uptrend or enters a deeper correction.

Featured image from Dall-E, chart from TradingView