Bitcoin Bullish Surge: Sharks & Whales Are Gobbling Up The Dip - Here’s Why It Matters

Major crypto players just flashed their biggest buy signal yet.

While retail investors panic-sell, the ocean's heaviest hitters are loading up on discounted BTC. These aren't your average traders—these are entities moving eight-figure positions while everyone else watches charts.

The Accumulation Pattern

Wallet activity doesn't lie. When addresses holding 100-10,000 BTC start accumulating during price drops, it's not coincidence—it's calculated positioning. They're not buying for next week's gains; they're building for the next cycle.

Market Mechanics at Play

This isn't blind optimism. Institutional frameworks, regulatory clarity, and macroeconomic pressures create perfect storm conditions for smart money moves. Traditional finance might still call it 'speculative' while missing the entire point of asymmetric opportunities.

Timing Versus Time In

The whales understand what retail rarely grasps: trying to time perfect entries gets slaughtered by simply accumulating at reasonable levels. Their strategy? Consistent accumulation beats frantic market timing every single cycle.

Watch what they do, not what they say—especially when Wall Street analysts who couldn't code a smart contract if their bonus depended on it start issuing price targets.

Bitcoin Sharks & Whales Have Bought Over 20,000 BTC In This Dip

In a new post on X, on-chain analytics firm Santiment has shared how some of Bitcoin’s key investors have been reacting to the latest volatility in the cryptocurrency’s price.

The holders in question are those carrying a wallet balance in the range of 10 to 10,000 BTC. At the current exchange rate of the asset, the former bound converts to $1.1 million and the latter one to $1.1 billion. Thus, the only addresses that WOULD qualify for the range would be the ones owned by the large investors.

Such entities can carry some influence in the market due to the size of their holdings, which can make their behavior worth keeping an eye on. These key holders are generally divided into two cohorts: sharks and whales. The whales are much larger than the other, so they hold the most power on the network.

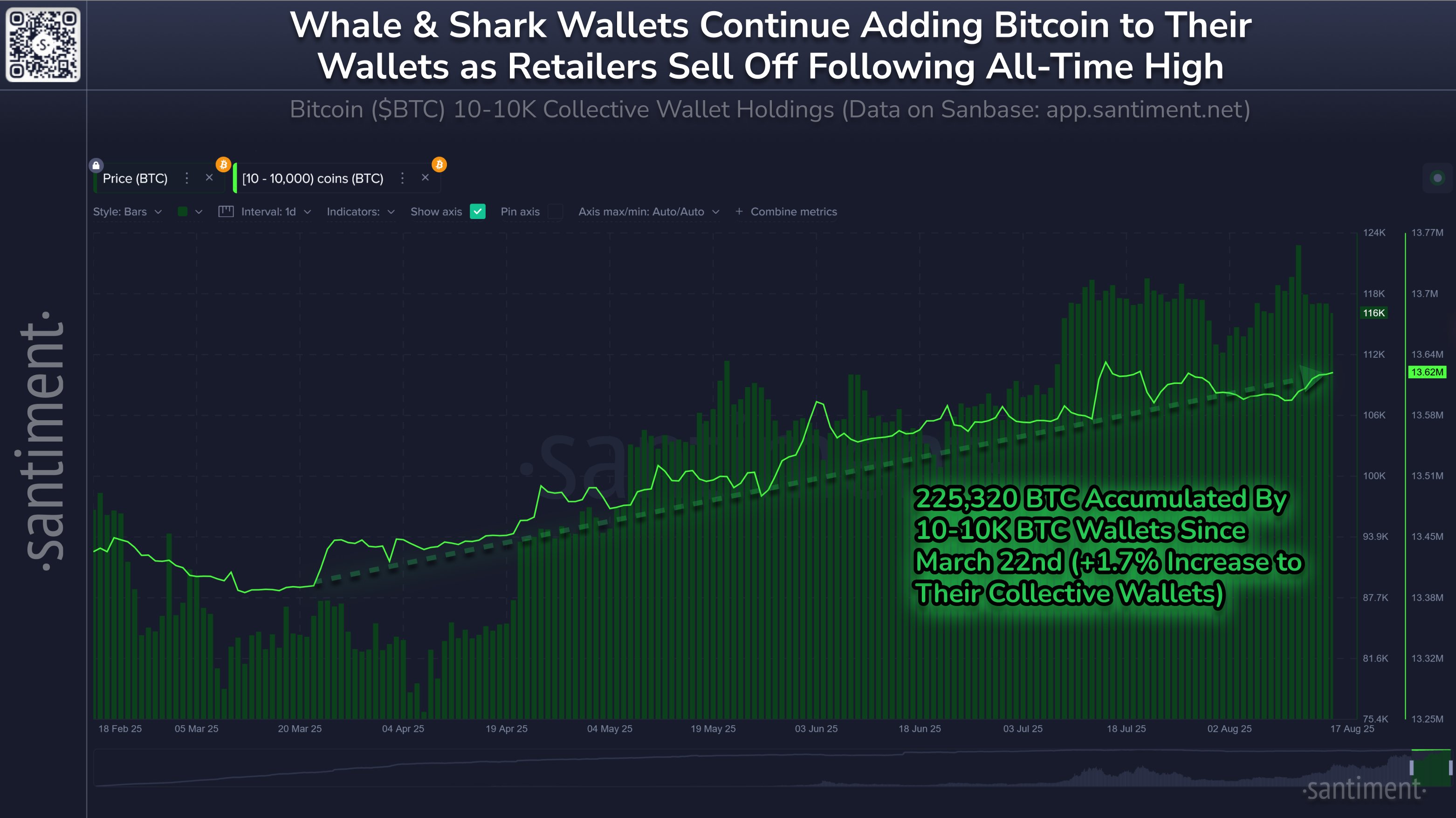

Now, here is the chart shared by Santiment that shows the trend in the combined supply of these bitcoin groups over the last few months:

As displayed in the above graph, the Bitcoin supply held by the sharks and whales saw a decline in July, suggesting some of the key investors sold at price levels NEAR the all-time high (ATH).

After bottoming a few days ago when BTC set its new ATH above $124,000, however, the metric has found a reversal, suggesting that the sharks and whales have been buying during the price drawdown that has followed.

In total, investors falling inside this range have loaded up on 20,061 BTC (worth $2.3 billion) since August 13th. On a long-term scale, the two cohorts have bought a combined 225,320 BTC ($26.1 billion) since March 22nd.

“There has been notable correlation between this group’s holdings and the direction of future price movement for the majority of the past five years,” explains the analytics firm. It now remains to be seen whether the same would hold true this time as well, with the shark and whale accumulation potentially leading to another price surge.

In some other news, the number of Bitcoin treasury buyers has been falling since its peak earlier in the year, as Capriole Investments founder Charles Edwards has pointed out in an X post.

“The number of Bitcoin treasury company buyers continues to fall, now at 2.8 per day despite price hitting ATHs,” notes Edwards. “Is the tradfi cap-raising world reaching saturation, or is this just a dip?”

BTC Price

At the time of writing, Bitcoin is floating around $115,500, down 3% over the last seven days.