XRP Primed for Record-Breaking Rally—Here’s What’s Fueling the Surge

XRP is flashing bullish signals that could catapult it past previous all-time highs. A perfect storm of technical, regulatory, and market factors is brewing—and traders are taking notice.

The regulatory overhang lifts

With the SEC lawsuit finally in the rearview mirror, institutional money is flowing back into Ripple's digital asset. The clarity came just as traditional finance started dabbling in crypto again—how convenient.

Liquidity tsunami hits crypto

As the Fed reverses course on quantitative tightening, risk assets across the board are soaking up cheap money. XRP's high liquidity makes it a prime beneficiary when the monetary spigots open wide.

Network activity spikes

Daily transactions on the XRP Ledger have doubled since Q2, while new wallet creations suggest growing retail interest. The blockchain doesn't lie—even if some balance sheets do.

Will this be the run that finally delivers on XRP's perennial promise? The charts say maybe. The fundamentals say possibly. And the hedge funds? They're already placing their bets.

Institutional Growth And Expanding Adoption

One of the strongest arguments supporting XRP’s ability to register a new all-time high very soon is the steady growth in its institutional presence. David_kml noted that XRP is now being used by leading banks and global payment companies through the XRP Ledger, a development that points to real-world demand for XRP beyond retail speculation. The token’s steady price above the $3.10 price level highlights this strengthening foundation, but the larger story lies in the expanding number of Ripple partnerships and fintech integrations of the XRP Ledger.

Speaking of fintech integration, Ripple’s advancements in the past few months have seen the XRP Ledger infrastructure for cross-border settlements growing massively. Ripple CEO Brad Garlinghouse has noted that the company is focused on developing the XRP Ledger to the point where it rivals that of the traditional SWIFT system and grabbing a huge chunk of its userbase.

At the time of writing, many financial institutions are starting to test and adopt XRP’s network for their payment flows, building confidence that the asset is on track for long-term relevance in global finance. This, in turn, is continuously boosting XRP’s chance of steadily exploding to new price highs, especially now that the global financial sector is gradually warming to blockchain technology.

Breakout Pattern On Weekly Timeframe

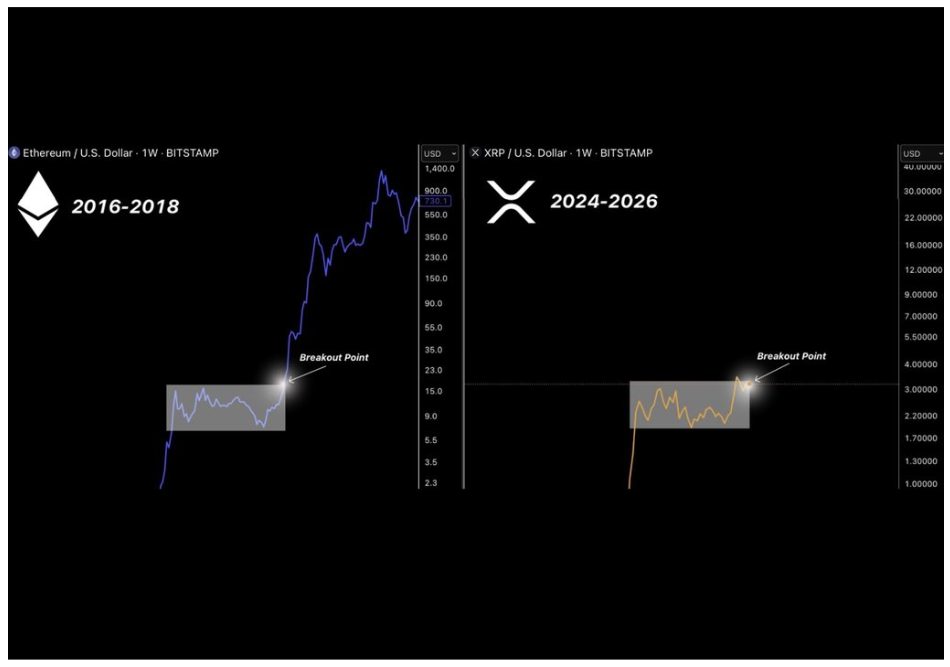

Another factor that lends the voice to XRP’s potential of new all-time highs is the increase in transaction volumes. Interestingly, the technical picture for XRP also complements the bullish case made by fundamentals. In his post, David_kml shared a chart that places XRP’s current price behavior alongside Ethereum’s price action between 2016 and 2018.

During that period, ethereum traded within a prolonged consolidation range before breaking out. This was a move that started one of the most dramatic rallies in Ethereum’s price history, as it carried its price from under $15 to well over $1,000.

XRP’s weekly chart now shows a similar setup. XRP has been consolidating in a range NEAR $3, and the breakout point is forming just above $3.25. This structure suggests that XRP could be on the cusp of a powerful surge that has the ability to mimic that of Ethereum’s run in 2018.

Analysts such as Dark Defender and Egrag Crypto have previously pointed to this kind of fractal pattern by pointing out the fact that XRP is building momentum independent of Bitcoin and Ethereum. If this plays out well, XRP’s breakout could extend beyond its most recent peak of $3.65 and set the stage for new all-time highs in the coming weeks and months.

Featured image from Unsplash, chart from TradingView