Ethereum’s Make-or-Break Moment: Retail Exodus as ATH Looms

Ethereum's gearing up for a high-stakes retest of its all-time high—but this time, retail traders are hitting the exits instead of piling in. The smart money's watching to see if this is the calm before the storm or a classic 'buy the rumor, sell the news' setup.

Retail traders ditch ETH as institutional FOMO builds

While mom-and-pop investors cash out—probably to chase the next shiny meme coin—Ethereum's fundamentals haven't looked this strong since the last bull run. Layer-2 adoption's exploding, and the network's actually making gas fees somewhat tolerable (for now).

The irony? Just as Wall Street starts treating crypto like a 'real asset,' the little guys who held through crypto winter are paper-handing at the worst possible time. Typical retail—always late to the party and first to leave when things get interesting.

Retail Sentiment Misfires: Lessons From Past Greed And Corrections

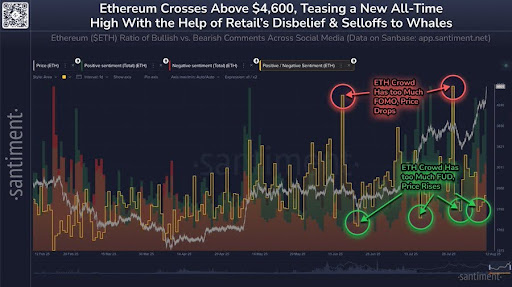

Santiment, a popular platform in on-chain and market analytics, recently highlighted in a post that ethereum is now within striking distance of a historic milestone — just 6.4% away from its all-time high of $4,891 set on November 16, 2021.

This approach toward record territory has been accompanied by a surprising trend: retail traders are consistently selling off their holdings even as the second-largest cryptocurrency by market cap pushes higher. The divergence between price action and retail sentiment is becoming increasingly notable in this rally.

When smaller market participants become overly optimistic, prices tend to cool off; conversely, when fear and skepticism prevail, the market often continues its upward march. This pattern has played out multiple times in the past, making the current wave of selling from retail traders a potentially bullish signal.

Santiment also pointed to previous scenarios to support this observation. On June 16, 2025, and again on July 30, 2025, Ethereum experienced periods of extreme retail greed, which were followed by sharp corrections as the market recalibrated. These historical instances underline the contrarian nature of market psychology, where excessive Optimism can precede pullbacks, while disbelief and hesitation can pave the way for price growth.

In the current rally, retail sentiment has been marked by FUD (fear, uncertainty, and doubt) and disbelief. Despite Ethereum consistently printing higher highs, many traders remain convinced that the move is unsustainable.

Loose Coins Changing Hands as Ethereum Eyes Historic Breakout

This emotional disconnect between sentiment and price action may be providing fuel for Ethereum’s continued ascent, as stronger hands — particularly institutional players and large-scale investors — absorb the supply being offloaded by smaller traders. If the current dynamics persist, a break above $4,891 could happen sooner than many expect, potentially marking a significant chapter in Ethereum’s market history

The platform further noted that major stakeholders have been actively accumulating Ethereum, taking advantage of the coins that smaller traders are currently willing to sell. This quiet but steady accumulation suggests that larger players are positioning themselves for a potential breakout.

With minimal sentiment-based resistance in the market, prices appear well-positioned to push higher. If this trend continues, Ethereum could break through its previous all-time high and set new records in the NEAR future, marking a historic moment for the asset.