Bitcoin Braces for Volatility as Binance Miner Distributions Surge – Is a Correction Coming?

Bitcoin's bull run faces a critical stress test as miner outflows from Binance hit alarming levels. Analysts warn the sell-pressure spike could trigger a short-term pullback—just as institutional FOMO reaches a fever pitch.

The Miner Liquidity Timebomb

Blockchain sleuths spot unusual movement from dormant mining wallets to exchange hot wallets. When miners cash out en masse, history shows BTC price dips follow within 2-3 weeks. This time? The transfers coincide with Bitcoin hovering near all-time highs—classic 'sell the news' behavior.

Exchange Reserves Flash Red

Binance's BTC reserves ballooned by 18,000 coins last week alone. That’s $1.2 billion worth of sudden liquidity hitting the market. Meanwhile, derivatives traders keep levering up—funding rates suggest dangerous complacency.

The Silver Lining Playbook

Seasoned hodlers recognize this dance: Miner distributions often precede institutional accumulation. Wall Street’s algos will happily buy this dip—if one materializes. After all, what’s a 15% correction when you’re playing with other people’s retirement funds?

Bitcoin’s long-term thesis remains intact. But brace for turbulence—the miners just flipped the 'fasten seatbelts' sign.

Bitcoin Price Correction Upcoming?

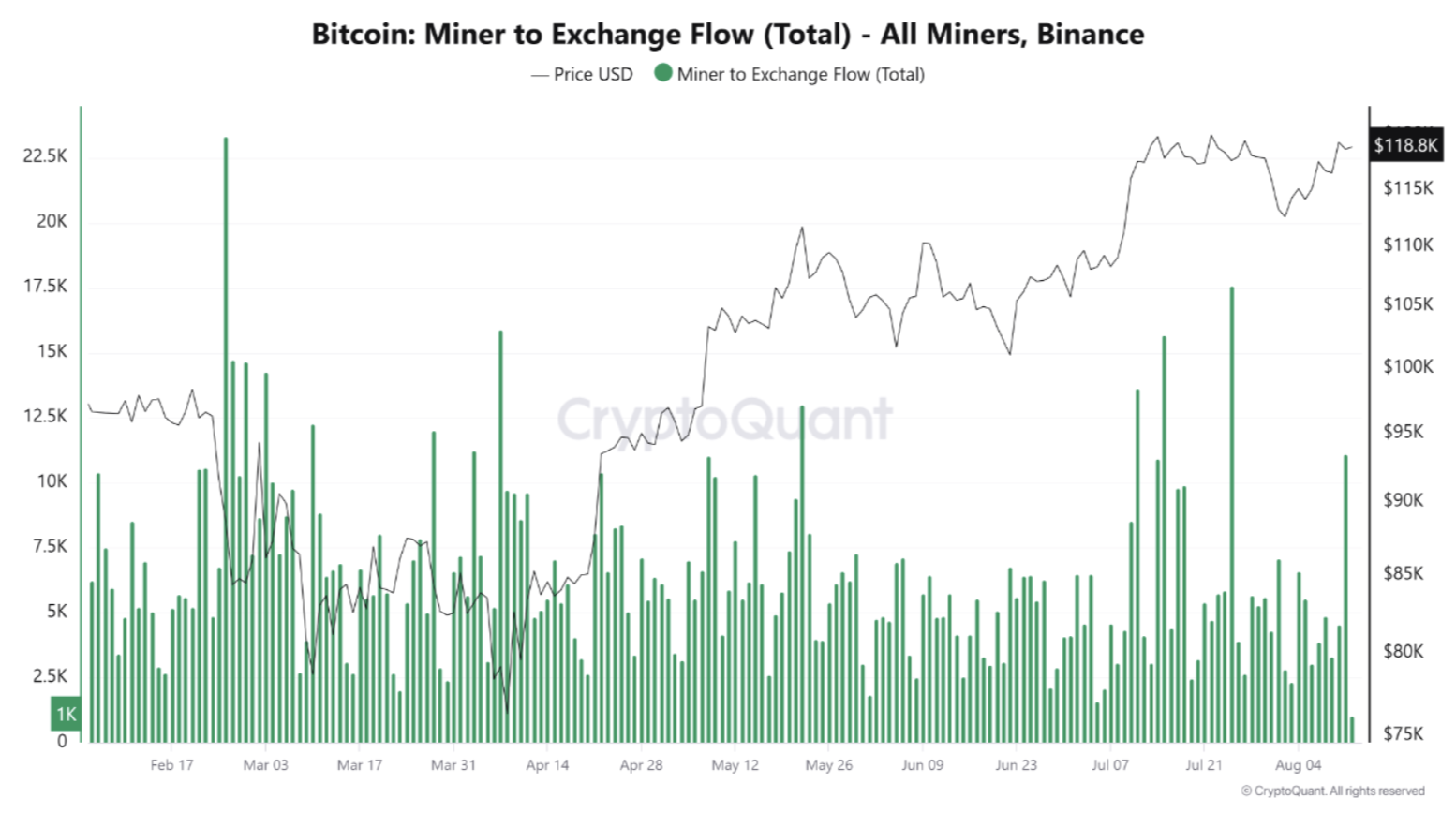

According to a CryptoQuant Quicktake post by contributor Arab Chain, there was a significant spike in BTC transfers from miners to Binance crypto exchange in late July – shown in the form of double tops in the following chart.

These spikes were followed by several days of above-average flows to the exchange. Early August saw another surge, with transfers ranging from several thousand BTC to more than 10,000 BTC at their peak.

This activity suggests that miners are continuing to distribute BTC to the exchange. The selling comes as the asset’s price remains close to its all-time high (ATH) of nearly $120,000.

Arab Chain noted that compared to the April–June period, the current miner activity resembles “stockpiling or hedging behavior” rather than typical low-noise patterns. The analyst shared several behavioral indicators to support this view.

For instance, sustained high inflows during elevated price levels suggest that miners are taking advantage of the rally to secure liquidity, cover operational costs, or manage post-halving treasury needs.

However, such large inflows are often linked to short-term resistance. The market must have sufficient buying liquidity to absorb this supply and prevent it from triggering a sharp price decline.

The high frequency of peaks over the past two weeks also indicates that this is not a one-off occurrence. Instead, it marks a phase of heightened activity among Binance miners, which increases Bitcoin’s price sensitivity to any drop in demand.

According to Arab Chain, if daily flows remain above the recent weekly average – roughly 5,000 to 7,000 BTC per day – it WOULD point to ongoing supply pressure. Conversely, a rapid drop back to lower levels would suggest that the distribution wave was temporary and has already been absorbed.

BTC May Be Preparing For A New ATH

Despite consolidating just under $120,000, recent on-chain data shows few signs of the Bitcoin market overheating. In addition, the average executed order size in the Bitcoin futures market has been steadily declining, indicating greater retail participation in the rally.

That said, a significant portion of short-term BTC holders have moved into profit, which could set the stage for a sell-off. At press time, BTC trades at $118,970, down 0.6% over the past 24 hours.