$35M Solana Time Capsule Cracked: Alameda Research’s Long-Dormant Stash Sparks Market Frenzy

After gathering dust for four years, Alameda Research's $35 million Solana vault just blinked awake—and the crypto world is bracing for impact.

The unlock triggers immediate questions: Will these coins flood the market, or is this a strategic play by the embattled firm's estate? Solana traders are already placing bets, with some anticipating a sell-off while others eye a potential supply shock.

Timing couldn't be more poetic—just as Solana regains its footing after the FTX collapse, its former biggest cheerleader's frozen assets thaw. The move reeks of that special crypto irony: 'locked' funds that always seem to escape when least expected.

One thing's certain: in crypto, even bankrupt entities move faster than traditional finance's wire transfers.

Alameda Research SOL Unstake Raises Questions

According to blockchain analytics platform Arkham Intelligence, the $35 million worth of solana recently unstaked from an Alameda Research account had an initial value of just $350,000 when it was locked in late 2020 — a remarkable 100x increase. This staggering growth in value underscores Solana’s meteoric rise over the past few years. Arkham raises an important question: Will these funds finally be returned to FTX creditors? While the answer remains uncertain, the move suggests that some activity is underway in the ongoing recovery and redistribution process tied to Alameda’s bankruptcy.

From a price action perspective, Solana has been consolidating below the $200 level since February, unable to break through this key resistance despite maintaining strong network activity. The sideways trend has kept SOL relatively quiet compared to other major cryptocurrencies. When compared with Ethereum, the contrast is notable — ethereum has seen stronger price momentum recently, leading some analysts to call the current market phase “Ethereum season.”

However, others argue that Solana’s quiet phase may be setting the stage for a breakout. Historically, large-cap altcoins like SOL often follow in the wake of Ethereum rallies, catching momentum once ETH’s surge begins to cool.

Solana Consolidates Below Key Resistance

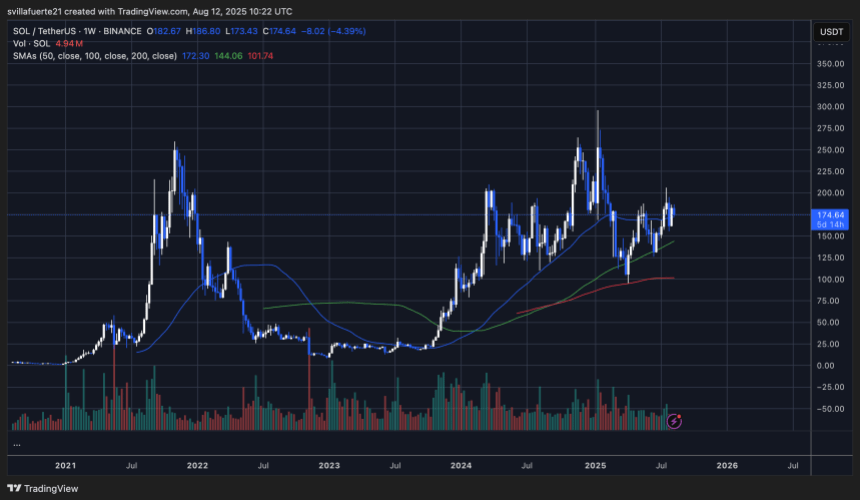

On the weekly chart, Solana (SOL) is trading at $174.64, down 4.39% in the latest session, as it continues a multi-month consolidation phase below the critical $200 resistance level. Since February 2025, SOL has repeatedly tested this psychological barrier without securing a sustained breakout, highlighting strong selling pressure at higher levels.

The 50-week simple moving average (SMA) at $172.30 is acting as immediate dynamic support, with the 100-week SMA ($144.06) and 200-week SMA ($101.74) positioned well below, reflecting a still-healthy longer-term uptrend. The current price structure shows SOL holding above both the 50-week and 100-week SMAs, a bullish signal that suggests buyers remain in control despite recent pullbacks.

However, trading volumes have not matched the peaks seen during prior rallies, indicating a more cautious market tone. A decisive breakout above $200 WOULD likely open the door to retests of the $250–$260 zone, while failure to clear resistance could extend the consolidation or lead to a retracement toward the 100-week SMA.

Featured image from Dall-E, chart from TradingView