Ethereum’s Bullish Fundamentals Collide With Short-Term Leverage Dangers – A High-Stakes Tug of War

Ethereum's long-term value proposition just got sharper—but traders playing with leverage might get cut.

The Bull Case: More Than Just Hype

Institutional adoption, protocol upgrades, and a deflationary supply model keep ETH's fundamentals rock-solid. This isn’t your 2021 meme coin.

Leverage Landmines Ahead

Futures markets show excessive long positions—classic contrarian signal. When the herd piles in, smart money starts unloading.

The Bottom Line

ETH’s tech deserves its premium, but Wall Street’s casino mentality could trigger a nasty squeeze. As always, the dumb money pays for the champagne.

Ethereum Mid-Term Outlook: Institutional Flows and Network Strength

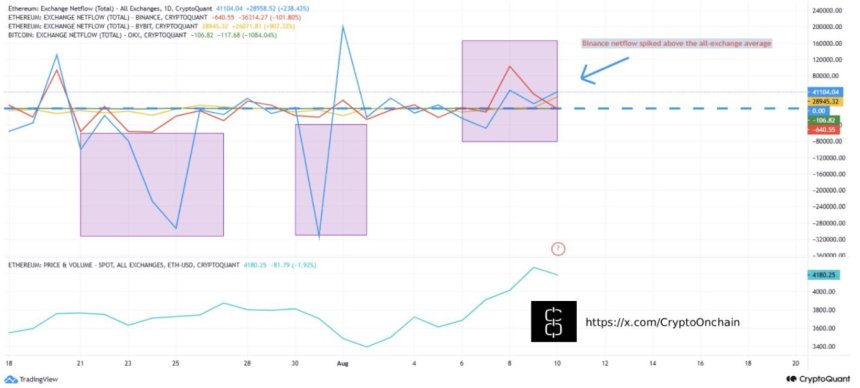

According to Crypto Onchain, a CryptoQuant analyst, Ethereum’s mid-term fundamentals remain strongly bullish despite short-term caution signals. Institutional demand is surging, with US Spot ethereum ETFs recording a record $726.6 million in daily net inflows, driven by giants like BlackRock and Fidelity. This has pushed total ETF holdings above 5 million ETH (valued at approximately $20.3 billion), a milestone that underscores Ethereum’s growing role in institutional portfolios.

Beyond ETFs, major players are increasing direct exposure. Ark Invest purchased 30,755 ETH worth $108.57 million, while Fundamental Global allocated $200 million to ETH as part of its treasury strategy. This wave of accumulation reflects deepening confidence in Ethereum’s long-term utility and value proposition.

On-chain metrics also paint a bullish picture. Transaction volumes are hitting new highs, and staking participation continues to expand, locking up more ETH and reducing circulating supply. Regulatory clarity—such as the SEC closing investigations into liquid staking—has further strengthened structural demand for ETH. Upcoming network upgrades, including Pectra and Fusaka, are set to boost scalability and lower costs. This will enhance Ethereum’s appeal to both developers and enterprises.

In the short term, high leverage, key resistance levels, and concentrated exchange inflows pose a risk of sharp volatility. However, the mid-term outlook remains intact, supported by sustained institutional inflows, robust network growth, and technological advancements. Even if near-term corrections occur, these factors should help cap downside pressure and maintain Ethereum’s broader bullish trajectory.

Price Action Details: Setting Fresh highs

Ethereum’s 4-hour chart shows a strong breakout above the key resistance at $3,860, which had capped price action in late July. Following this decisive move, ETH surged past the $4,300 level, marking its highest point since November 2021. This rally was supported by strong bullish momentum, as seen in the steep incline of the 50-period SMA (blue) and the price holding well above the 100-period (green) and 200-period (red) SMAs.

Currently, ETH is consolidating just below its recent peak, around $4,240, signaling a potential pause before the next move. This consolidation at elevated levels, rather than a sharp retracement, suggests that bulls remain in control. The $3,860–$3,900 zone now acts as a critical support, and a retest could provide a healthy setup for continuation.

Volume spikes during the breakout indicate strong buying interest, but the reduced volume in the latest candles suggests the market is waiting for fresh catalysts. A sustained move above $4,300 could open the door toward the $4,450–$4,500 zone, while a breakdown below $3,860 WOULD weaken the bullish structure.

Featured image from Dall-E, chart from TradingView