Bitcoin and S&P 500 Lockstep Hits 80%—Crypto Now Moving Like Big-League Stocks

Wall Street’s favorite benchmark and Bitcoin are now dancing to the same tune—an 80% correlation that blurs the line between crypto and traditional markets.

From Rebel to Replica

Once the outsider, Bitcoin’s price action now mirrors the S&P 500 with eerie precision. Forget ‘uncorrelated assets’—this is full-on financial synchronization.

What’s Driving the Duet?

Macro forces are calling the shots: inflation fears, Fed policy whiplash, and that desperate hunt for yield. Even gold can’t compete with this new power couple.

The Institutional Effect

Hedge funds and ETFs turned Bitcoin into just another risk-on asset. So much for ‘digital gold’—now it trades like tech stocks on Red Bull.

A Cynic’s Take

Congratulations, crypto purists. Your decentralized revolution now rises and falls with Jamie Dimon’s breakfast order.

S&P 500 Correlation Strengthens Bitcoin’s Macro Link

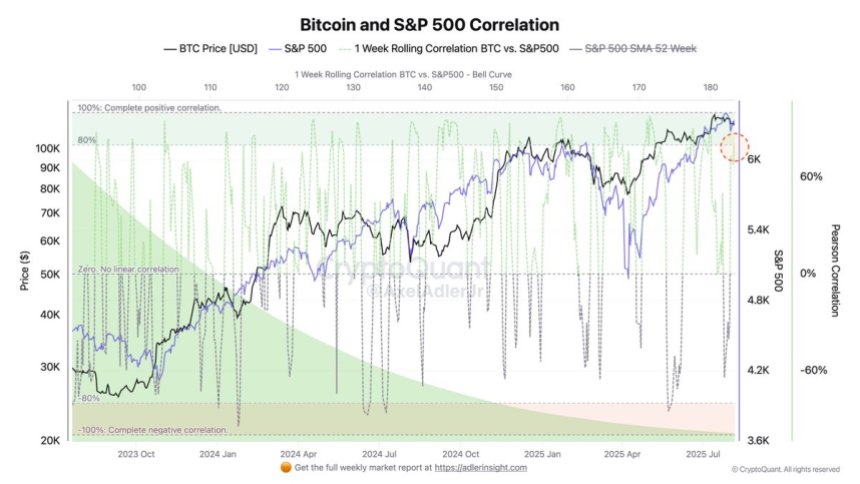

According to top analyst Axel Adler, the recent 80% correlation between bitcoin and the S&P 500 underscores how deeply macroeconomic forces are influencing the crypto market. In this environment, key drivers such as interest rate expectations, liquidity conditions, and the broader risk-on/risk-off sentiment are directly transmitted to BTC’s price action.

Under this regime, a sustained recovery in US equities will likely provide a supportive backdrop for Bitcoin. Conversely, if stock markets experience a downturn, the negative sentiment could quickly spill over into the crypto space, amplifying sell-offs and triggering broader market weakness.

Adler points out that the current reading is based on a 1-week rolling correlation metric, which is inherently volatile. Historically, such correlation spikes are rarely sustained for long periods. The present level, while significant, is unlikely to hold for more than a few weeks before reverting toward its mean.

Despite the short-term nature of this spike, the analyst emphasizes that the growth of crypto adoption in the US—from institutional products like ETFs to corporate treasury allocations—sets the stage for a bullish long-term outlook. Still, traders must remain mindful that macroeconomic downturns, tightening liquidity, or shifts in Federal Reserve policy could rapidly reverse market sentiment.

Bitcoin Price Analysis: Bulls Defend Key Support

Bitcoin (BTC) is trading around $116,565, holding steady after reclaiming the $115,724 support level, which coincides with a key horizontal zone from late July. On the 4-hour chart, BTC recently broke above the 50-day, 100-day, and 200-day SMAs, signaling short-term bullish momentum. These moving averages, now converging NEAR $116,000, could act as a strong support cluster if tested again.

The immediate upside target remains the $122,077 resistance, last tested in mid-July. However, BTC has faced selling pressure near $117,000, indicating short-term consolidation before a possible push higher. Volume has tapered slightly after the breakout, suggesting that buyers may need fresh momentum to sustain the move.

If BTC holds above $115,724 and the moving average cluster, bulls could attempt a breakout toward the $118,000–$122,000 zone. However, rejection might trigger a retest of $115,724, with a deeper pullback.

Featured image from Dall-E, chart from TradingView