🚨 Bitcoin Bull Run in Danger? Binance Whale Dump Sparks Correction Fears

Whales are making moves—and the market's sweating. A surge in Bitcoin transfers from big wallets to Binance has traders bracing for impact. Is this the pullback before the next leg up, or the start of something uglier?

The Whale Watch Is On

When crypto's 1% start parking assets on exchanges, it usually means one thing: sell orders incoming. The last time flows spiked like this, BTC dipped 12% in a week. History doesn't repeat, but it sure loves to rhyme.

Liquidity Games

Exchanges are casinos where whales hold the dice. These deposits could signal profit-taking before key resistance levels—or just some old-fashioned leverage reloading. Either way, retail bags are looking heavier by the minute.

The Cynic's Take

Meanwhile, Wall Street's 'experts' who called Bitcoin dead at $30k are now revising their 'measured outlooks' upward. Funny how price predictions improve after bonuses clear.

Buckle up. Volatility season just got an adrenaline shot.

Is Bitcoin Losing Its Bullish Momentum?

According to a recent CryptoQuant Quicktake post by contributor Arab Chain, fresh data from the Binance Whale-to-Exchange FLOW indicator suggests that BTC may soon experience additional downside pressure.

The analyst noted that despite growing retail participation in the BTC market, persistently high whale inflows into Binance – combined with a declining Bitcoin price – signal that the market could be entering a technical correction phase.

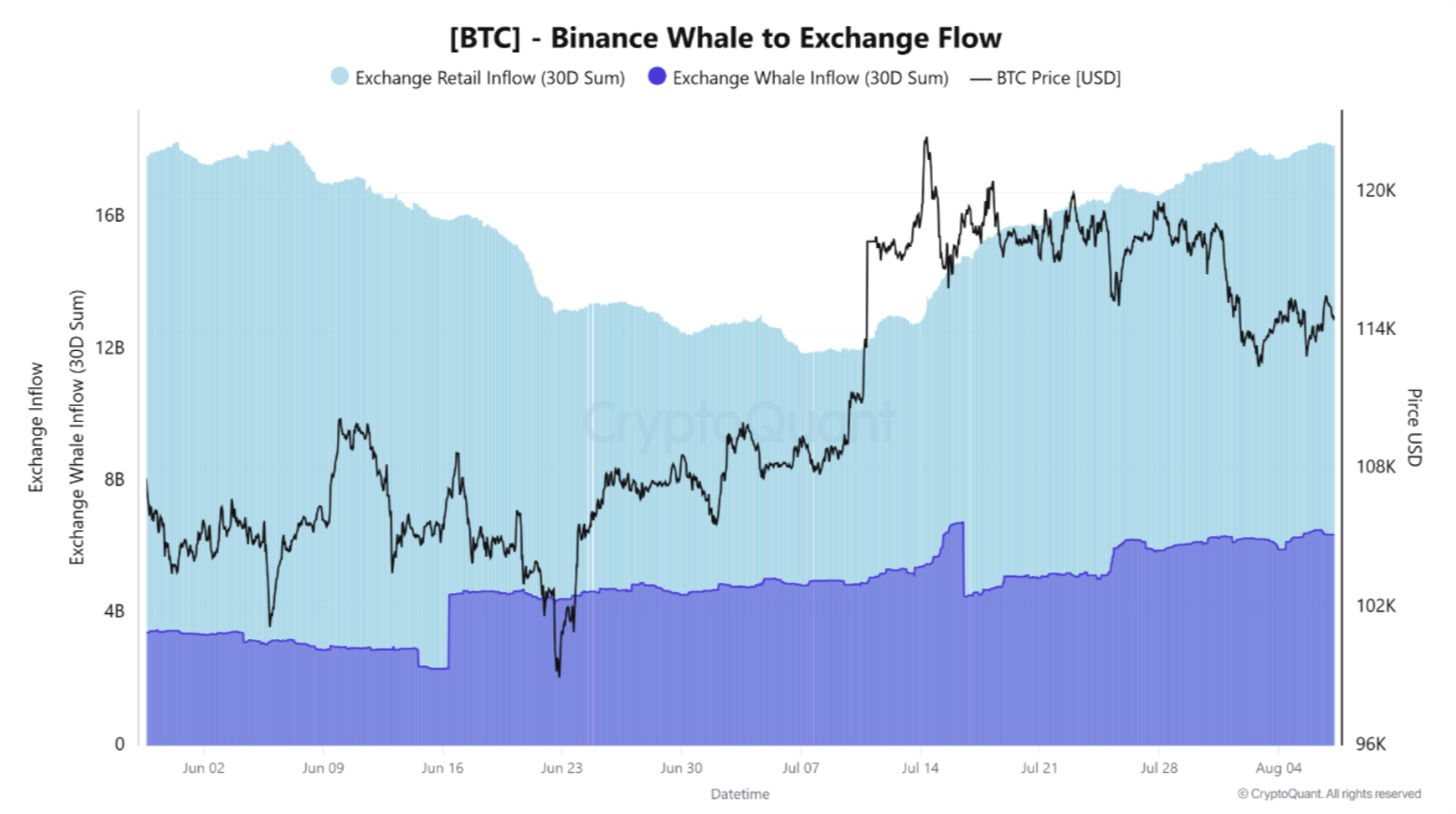

Arab Chain shared the following chart, where the purple zone shows that whale inflows to Binance remained consistently high throughout July and early August. At the same time, the drop in BTC price reflects a distribution pattern, where whales begin unloading BTC on exchanges following a sharp rally.

Although there were no extreme spikes, whale inflows into Binance stayed elevated in the $4 billion to $5 billion range, indicating that these large holders are actively moving BTC onto the exchange – often a precursor to major sell-offs.

The fact that these inflows remain high on Binance despite the drop in BTC price suggests that either whales are still selling their holdings on the exchange, or they are waiting for a price rebound to exit the market.

Similarly, the light blue area in the chart shows a notable increase in retail inflows to Binance during late July and early August. Historically, such late-stage retail participation often marks the final phase of a bullish cycle, providing exit liquidity for whales. The analyst concluded:

Despite the rise in retail participation, the market shows signs of internal weakness, with sustained whale inflows to Binance and loss of upward momentum. If this behavior continues, the market may be entering a medium-term correction phase.

Investors Still Optimistic About BTC

While signals suggest the current BTC rally may be overextended, some investors remain confident, employing strategies like Smart Dollar-Cost Averaging (DCA) to accumulate BTC in anticipation of further price gains.

Fellow CryptoQuant analyst Oinonen noted that while the recent pullback in BTC price may have raised concerns about further declines, the asset’s historical Q4 performance could propel it to a new all-time high of $200,000 by the end of 2025.

After hitting a recent low around $111,800, BTC has recovered part of its losses and is now trading NEAR $116,500. Still, some analysts caution investors against “excessive optimism.” At press time, BTC was trading at $116,501, up 0.2% over the past 24 hours.