XRP Price Surge Ahead: 5 Critical Signals to Monitor in the 2025 Bull Market Frenzy

XRP's moment is now—bullish momentum builds as institutional interest collides with regulatory clarity. Here's what separates hype from reality.

1. Regulatory Green Lights: Watch for SEC settlement whispers or exchange relistings—nothing moves markets faster than bureaucrats changing their minds.

2. Whale Accumulation Patterns: When OTC desks start hoarding XRP like toilet paper in 2020, retail traders should pay attention.

3. Ripple's Liquidity Play: The company's escrow releases could flood the market—or strategically tighten supply like a Wall Street 'inventory adjustment'.

4. Bitcoin's Dominance Dance: If BTC stumbles, altcoins like XRP could steal the spotlight (and capital flows).

5. Payment Gateway Adoption: Real-world utility beats speculative froth—track which fintech firms actually integrate XRP beyond press releases.

Remember: In crypto, 'bull market' often means 'greater fool theory on steroids'. Trade accordingly.

Key Things To Watch Out For With XRP’s Price Action

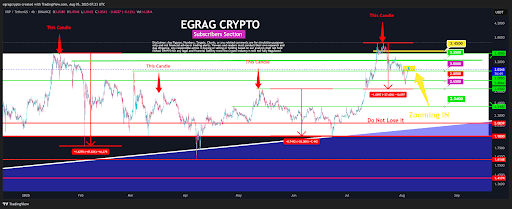

Currently trading just around the $3.00 psychological level, XRP’s price action is witnessing volatile candles across shorter timeframes. However, according to the technical outlook from EGRAG CRYPTO, XRP bulls appear to be defending key zones around $2.90, amidst the broader market sentiment remaining cautiously optimistic.

The first key thing to watch out for is bullish closings above $3. Zooming into the 4-hour timeframe, EGRAG’s first key observation is that XRP has managed to close multiple candlesticks above the $3.00 threshold. This level is not only psychological but also a strong confidence booster for traders looking for confirmation of bullish continuation.

Secondly, the charts show that most of the candle wicks are forming from the upside, a sign that while sellers are active, they have not overwhelmed the buying strength just yet.

However, the third key thing to watch out for is a possible correction. Particularly, EGRAG noted that a retest of the $2.96 to $2.93 price zone is possible in the NEAR term. This price range has been marked as a short-term support zone, where buyers could look to reload if XRP briefly dips.

That being said, the more critical level for bulls to protect is $2.80, which is the fourth key thing to watch out for. According to the analyst, closing below $2.80 again WOULD undermine the bullish structure and could cause downside momentum. As such, holding above this level is crucial for maintaining bullish momentum.

Price Target Goals

The fifth key thing to watch out for as the bull market unfolds is price targets that can confirm bullish momentum. In terms of price targets and resistances, EGRAG noted specific price levels that would reflect new bullish energy and possibly a breakout to new all-time highs.

The first milestone is a close above $3.185. This level previously acted as a rejection zone in late July. Therefore, breaching $3.185 with conviction would flip sentiment more decisively in favor of the bulls. Above that, the analyst highlighted $3.25 as the next key checkpoint, and surpassing it would put XRP in a strong technical position.

The resistance targets beyond that are $3.33 and $3.45, and these are breakout zones that could cause a new all-time high scenario. These targets align with the upper resistance blocks illustrated on EGRAG’s charts, and any solid close above $3.45 can be interpreted as a MOVE to at least $3.65.

At the time of writing, XRP is trading at $3, up by 2.4% in the past 24 hours.