Bitcoin Miners Face Harder Work, Lower Rewards as Price Plunges to $113K

Bitcoin mining just got tougher—and less profitable. As the price crashes to $113K, miners are digging deeper for shrinking returns. Here's why the math no longer adds up.

Hashrate hits new highs, rewards hit new lows

The network's difficulty adjustment has turned the screws on miners. More machines chasing fewer coins means operations are getting squeezed from both sides—just as Wall Street expected when they shorted your mining stocks last quarter.

When hodling beats hashing

With electricity costs eating 60% of revenues at current prices, some rigs are already powering down. The irony? Buying BTC outright would've outperformed most mining ops this year—but where's the fun in that?

This is what happens when 'number go up' meets basic arithmetic. The halving was just the warm-up act.

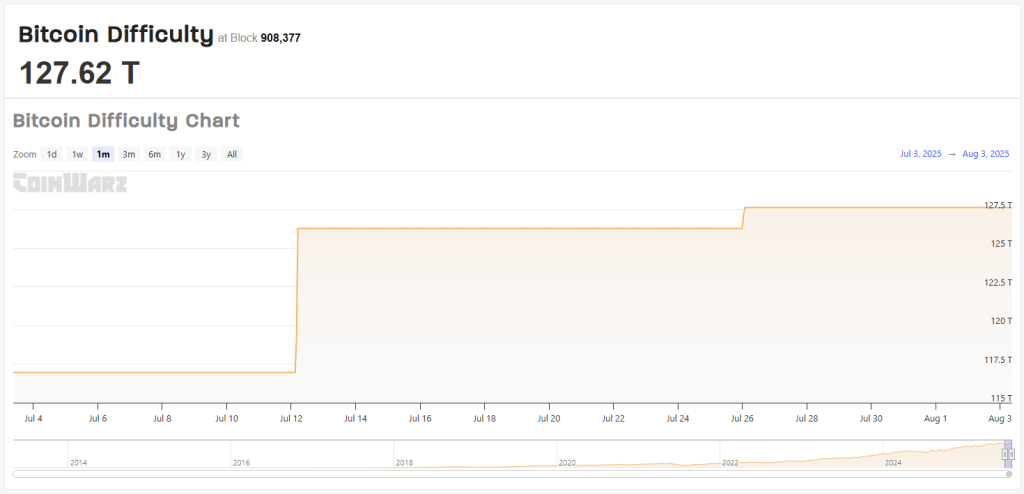

Mining Difficulty Hits All-Time High

Based on analysis, difficulty will drop by roughly 3% on August 9, bringing it down to nearly 124 trillion. That adjustment follows a routine cycle every 2,016 blocks, or about two weeks, where the protocol tweaks how hard it is to mine a block. Difficulty makes sure blocks come out at a pace the system can handle.

The challenge is tied to how much computing power, or hashrate, miners pour into the network. When more machines join, difficulty goes up. When some stop hashing, it comes down. In June, the difficulty slid to a low of 117 trillion, but it bounced back in late July and has been climbing since.

At the moment, blocks are taking about 10 minutes and 20 seconds each on average, a bit slower than the 10-minute goal. When times drift too far off, the next adjustment nudges difficulty up or down to reel block times back toward 10 minutes.

Miners Feel The Squeeze

Higher difficulty means miners need more energy and better gear just to break even. With Bitcoin’s price under pressure, some older or less efficient operations could face real losses. Reports have disclosed that only the sharpest setups will likely stay in business if this pairing of high difficulty and low prices lasts.

Mining firms track their costs closely. If electricity, hardware and maintenance bills outpace what they earn from block rewards, they may have to switch off rigs. The upcoming 3% ease in difficulty might let a few marginal players stick around a bit longer. Still, margins will be thin until the next major price move.

Price Tumbles And Recovers SlightlyBased on data, bitcoin slipped to $113,005—a 3% drop—before finding some buying at lower levels. By early evening, it had rebounded to $113,250.

That quick swing highlights how mining and market moves feed off each other. When hopes of easier mining fade, price can wobble. When price dips, miners feel squeezed and may power down, which in turn can lead to easier difficulty again.

Featured image from Pexels, chart from TradingView