Ethereum Exodus: 1M+ ETH Flees Exchanges in 14 Days – Is a Supply Shock Imminent?

The great Ethereum migration is underway. Over 1 million ETH vanished from exchanges in just two weeks—sparking fears of a looming supply crunch. Are whales hoarding for the next bull run, or is this just another case of 'not your keys, not your crypto' taken to extremes?

Exchange balances hit multi-year lows as Ethereum's deflationary mechanics start biting. With staking yields still juicy and institutional ETFs lurking, traders might soon find themselves paying Wall Street premiums for what retail sold at garage-sale prices.

Market makers shrug—liquidity's their problem, until it's yours. Welcome to decentralized finance, where the only thing scarcer than ETH is accountability.

Ethereum Bullish Accumulation Trend Continues

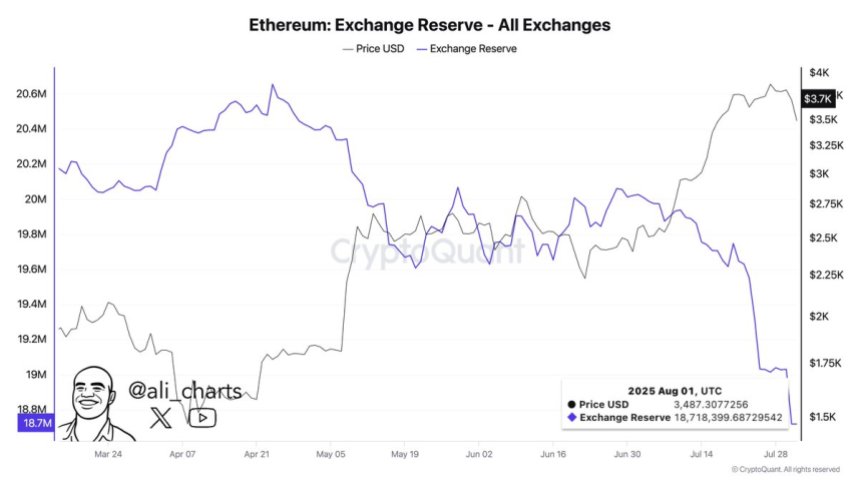

Analyst Ali Martinez has revealed that over 1 million Ethereum (ETH) have been withdrawn from exchanges in the past two weeks, signaling a strong accumulation trend among investors. This massive outflow reduces the liquid supply of ETH available for trading, which historically correlates with long-term bullish price action. Despite Ethereum facing a 13% correction from its recent high of $3,940, the consistent withdrawal of coins suggests that investors are positioning for the next leg up.

This accumulation trend mirrors the investor behavior seen in Bitcoin over the past year. BTC experienced a similar pattern of exchange outflows throughout 2024, which laid the groundwork for its massive bull cycle. Analysts now believe that Ethereum could follow a comparable trajectory, as the fundamentals supporting ETH remain robust, including its dominance in DeFi, stablecoins, and Real-World Asset (RWA) tokenization.

While the market sentiment remains broadly bullish, some risks persist. Recent US job data released on Friday sparked short-term panic, injecting volatility across crypto and traditional markets. However, many analysts view Ethereum’s current correction as a healthy retracement and an opportunity to accumulate ETH at a discount before the market resumes its upward trend.

ETH Testing Key Support After Sharp Correction

Ethereum (ETH) is currently trading around $3,391 after a sharp correction from its recent high of $3,940. The 12-hour chart reveals that ETH has broken below its short-term support and is now testing the 50-day SMA at $3,462, which could act as a near-term support level. If bulls fail to defend this zone, the next critical support is located around $2,852, a key level that previously acted as strong resistance in late June.

Volume spikes during the breakdown suggest increased selling pressure, which aligns with recent profit-taking activities by short-term holders. However, despite this drop, Ethereum’s price structure remains in an overall uptrend, with higher highs and higher lows intact on the broader timeframe.

The correction appears to be a retest of previous breakout levels, as ETH had surged over 85% since late June. Maintaining the $3,350-$3,450 range is crucial for bulls to regain control and attempt another MOVE toward the $3,860 resistance zone. Failure to hold could trigger a deeper correction towards the 100-day SMA at $2,972.

Featured image from Dall-E, chart from TradingView