Bitcoin Derivatives Flash Warning Signs as Binance Net Taker Volume Plunges Into Bear Territory

Crypto markets just got a gut check—derivatives data screams caution as Binance's net taker volume flips red. Is this the calm before the storm, or just another overleveraged whale getting liquidated?

Fear creeps into Bitcoin derivatives

The smart money's moving. Open interest ratios, funding rates—they're all whispering the same thing: traders are bracing for turbulence. No one's panicking yet, but the hedges are piling up like sandbags before a hurricane.

Binance's bearish flip

When the world's biggest crypto exchange sees net taker volume swing negative, even the moonboys pause their Lambo dreams. This isn't FUD—it's cold, hard order book dynamics. The last time this happened, BTC shed 15% in a week (but hey, past performance and all that regulatory fine print).

The cynical take? Wall Street's probably shorting retail again while collecting fat staking yields—the ultimate 'heads I win, tails you lose' play. Stay sharp out there.

Bitcoin Decline Wipes Out $500 Million In Open Interest

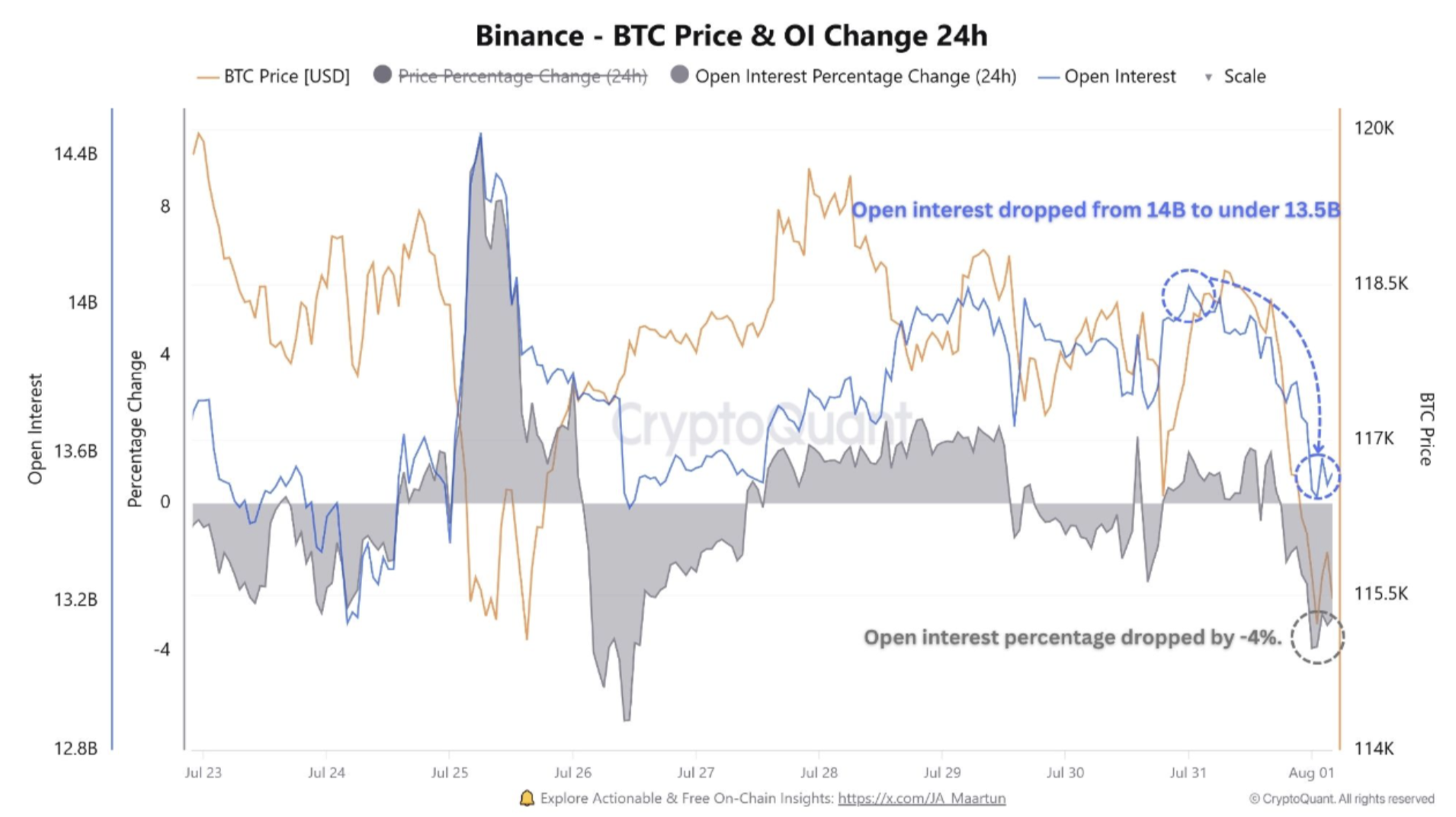

According to a Quicktake post on CryptoQuant by contributor Amr Taha, BTC’s drop below $115,000 led to a sharp decline in open interest on Binance, which fell from $14 billion to under $13.5 billion.

The following chart shows Binance open interest declining by nearly 4% in a single day – a MOVE typically associated with liquidation events. Supporting this, data from CoinGlass shows $760 million in liquidations over the past 24 hours.

To explain, such large-scale liquidation events typically occur when Leveraged traders face forced position closures – long or short – due to margin calls. The sharp BTC drop resulted in the liquidation of approximately 183,514 traders in just 24 hours.

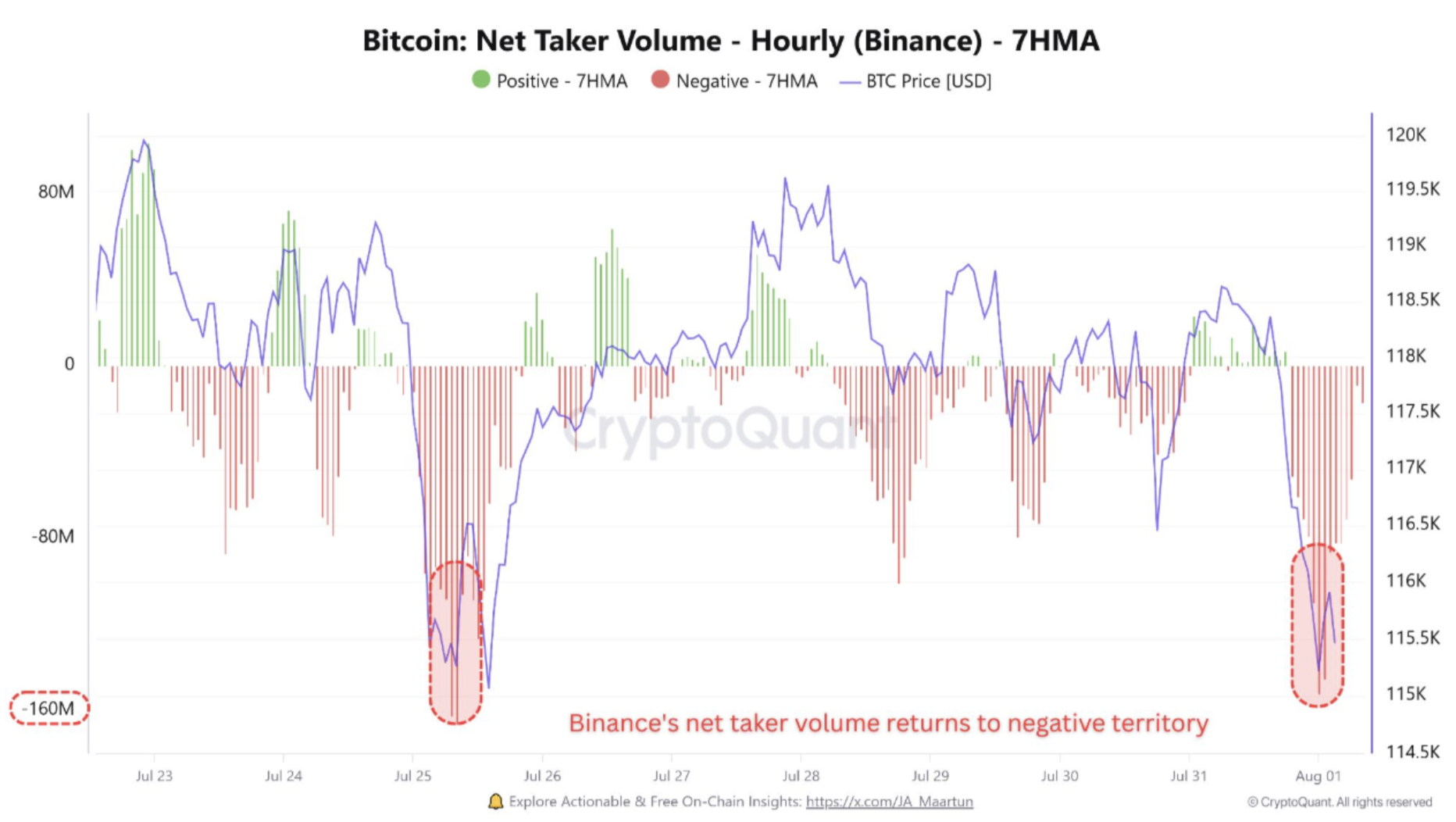

In addition to falling open interest and widespread long liquidations, Binance’s net taker volume also points to rising bearish sentiment. The metric plunged to -$160 million, underscoring aggressive selling pressure.

For context, Binance net taker volume measures the difference between market buy and sell orders initiated by takers. A positive value suggests dominant buying activity (bullish), while a negative value reflects dominant selling activity (bearish).

Binance net taker volume dropping into negative territory further reinforces bearish pressure on BTC. Since this net selling coincided with the decline in open interest, it indicates that many derivatives traders are panic-closing late long positions.

Will BTC Make Recovery?

Despite the falling price, shrinking open interest, and negative net taker volume, Taha suggests that these bearish indicators could paradoxically set the stage for a short-term rebound.

Bitcoin’s selling pressure may be nearing exhaustion, while short interest continues to rise. This combination could trigger a market rebalancing phase, potentially paving the way for price stabilization – or even a short squeeze-driven bounce.

However, on-chain data points to continued bearish momentum. The increasing share of new investors among BTC holders may lead to overheated market conditions in the NEAR term.

At the same time, exchange reserves are rising, which could contribute to more selling pressure. Long-term BTC holders also appear to be selling in significant volumes, suggesting potential rally exhaustion.

That said, BTC could still remain on track for its year-end target of $180,000 – but only if it holds key support at $110,000. At press time, bitcoin is trading at $115,310, down 2.1% over the past 24 hours.