BlackRock Bets Big: Ethereum Holdings Dwarf Bitcoin by 4x in Bold Crypto Move

Wall Street's trillion-dollar whale just made a seismic shift in crypto waters—and it's all about ETH.

BlackRock's Ethereum Gambit

The asset manager's latest filings reveal a staggering 4:1 ratio favoring ETH over BTC. No timid diversification play here—this is a concentrated wager on Ethereum's smart contract dominance while Bitcoin plays digital gold.

Institutional Crypto Goes Full DeFi

That 4x allocation difference screams institutional conviction in programmable money over static stores of value. TradFi giants finally grasping what degens knew years ago? Cue the 'we told you so' from crypto Twitter.

Bonus Finance Jab: Somewhere in Manhattan, a hedge fund manager just discovered gas fees.

BlackRock’s Ethereum Allocation Signals Growing Institutional Shift

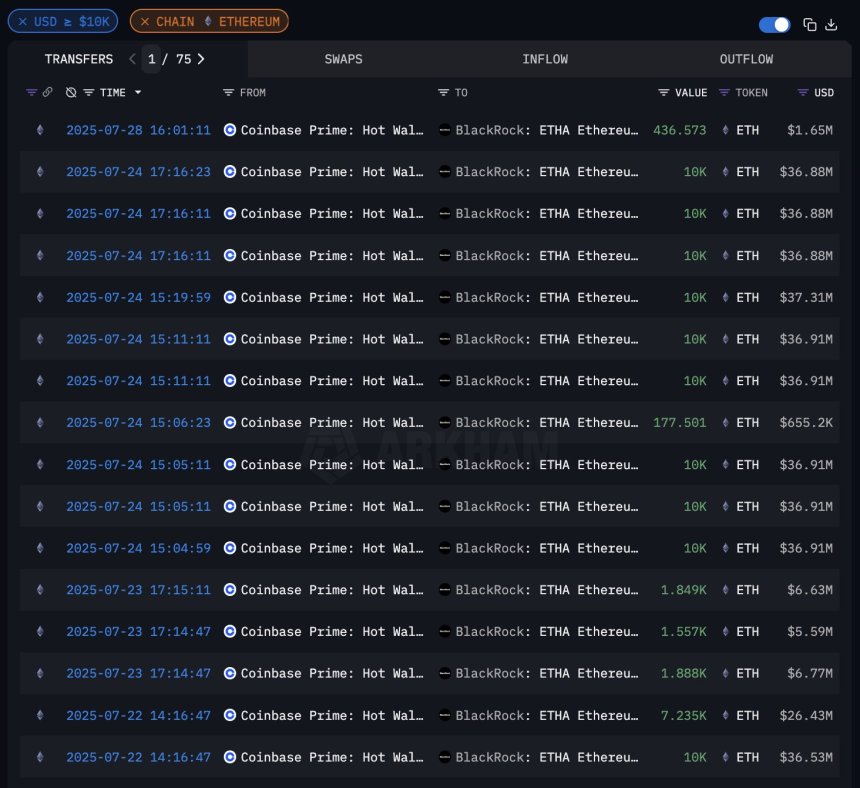

Arkham data has revealed a significant development in institutional crypto allocation: BlackRock purchased over $1.2 billion worth of Ethereum last week, compared to just $267 million in Bitcoin. This 4.5x disparity signals a decisive shift in institutional strategy, with capital now flowing more aggressively into ETH than BTC. For many in the market, this is what true institutional Ethereum adoption looks like—massive inflows that reshape market dynamics.

This shift didn’t start overnight. Institutional interest in Ethereum began building back in April, when ETH hit a cycle low NEAR $1,380. Since then, a combination of legal clarity, progress around ETF approval, and Ethereum’s maturing role in the financial ecosystem has fueled a steady wave of accumulation from large players. BlackRock’s latest allocation is simply the most visible and significant confirmation of that trend.

As the broader crypto market heats up, Ethereum appears well-positioned to continue its upward trajectory. However, not everything is straightforward. ETH is now struggling to break through resistance around the $3,800 level, and the failure to reclaim new highs is beginning to stir uncertainty. Some analysts warn that the current rally may lose steam without a breakout, and fear of a short-term correction is growing.

ETH Faces Key Resistance After Parabolic Rally

Ethereum has staged an impressive rally over the past few weeks, surging from sub-$2,000 levels to a current price of $3,782.61. The weekly chart shows a strong bullish breakout from the $2,852.16 resistance zone, with ETH now approaching a critical barrier near $3,860.80. Price briefly reached a high of $3,941.86 before pulling back, signaling potential short-term exhaustion after an aggressive upside move.

Volume has increased significantly during this breakout, confirming strong buying interest. The 50, 100, and 200-week SMAs—all converging around $2,700–$2,850—now serve as key support, reinforcing the strength of the breakout. As long as ETH remains above the $2,850 level, the broader structure remains bullish.

However, the current pause below $3,860 suggests indecision as bulls encounter historical resistance. A clean weekly close above this level could open the door to a continuation toward $4,200–$4,400. On the downside, a rejection followed by a drop below $3,500 may trigger a short-term correction as traders secure profits.

Featured image from Dall-E, chart from TradingView