Abraxas Capital Bleeds $100M on $800M Crypto Short Bet – Here’s Why It Backfired

Crypto shorts just got shorter—and painfuller. Abraxas Capital’s massive bearish gamble is now underwater to the tune of nine figures.

When the market zigs, hedge funds zag… straight into a wall. The firm’s $800 million crypto short position has racked up $100 million in unrealized losses as digital assets defy gravity yet again. Guess someone forgot Bitcoin’s golden rule: never fight the trend.

Wall Street’s latest ‘smart money’ play now looks about as clever as a leveraged ape NFT. Meanwhile, retail hodlers keep stacking sats—and profits—while the suits learn the hard way. Shorting crypto? More like shorting your own foot.

Abraxas Capital Faces Mounting Losses On $800M Crypto Shorts

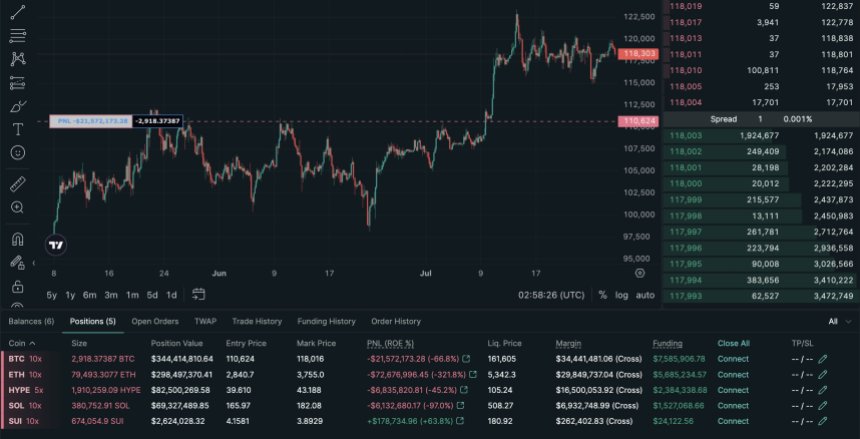

According to Arkham Intelligence, Abraxas Capital currently holds nearly $800 million in short positions across Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and HYPE on the Hyperliquid platform. Notably, the largest BTC and ETH shorts on Hyperliquid belong to Abraxas, with data revealing a current unrealized loss (uPnL) of approximately $106.3 million on their account.

These positions reflect a high-stakes strategy that may serve as a hedge against spot holdings or other long-term crypto exposures. However, this hedge is becoming increasingly costly as market conditions remain bullish. Bitcoin continues to consolidate near all-time highs, and any breakout above the $122K–$123K range could push prices toward the $150K–$160K zone—close to Abraxas’ BTC liquidation level at $156,000.

As volatility returns to the market and altcoins start gaining momentum, these Leveraged short positions face growing risk. If BTC and ETH break to new highs, unrealized losses on Abraxas’ account could accelerate sharply. While some analysts still expect a market correction, especially given the failure to set new highs in recent weeks, others see the consolidation as a bullish continuation pattern.

Bitcoin Consolidates Between Key Levels

The 12-hour chart shows bitcoin locked in a tight range between $115,724 and $122,077, with the price currently trading at $118,497. After a sharp rally earlier in July, BTC has entered a consolidation phase, forming a sideways structure with diminishing volume—a typical sign of market indecision.

Despite the lack of breakout, the price remains above all major moving averages: the 50 SMA at $115,943, the 100 SMA at $111,170, and the 200 SMA at $106,348. This alignment supports a bullish trend, with buyers still in control of the broader structure.

However, momentum has stalled. Each attempt to break above $122,000 has been met with resistance, while dips toward $116K have been absorbed quickly. The narrowing price action and falling volume suggest a breakout—or breakdown—is approaching. If bulls manage to clear the $122K level with strong volume, a new rally toward all-time highs could follow. On the flip side, a close below $115K WOULD break the structure and potentially trigger a deeper correction.

Featured image from Dall-E, chart from TradingView