Bitcoin Long-Term Holders Start Dumping—Eerie Echo of Fall 2024 Market Cycle

Bitcoin's diamond hands are cracking. Long-term holders—the crypto equivalent of Warren Buffett wannabes—have begun offloading their stacks in a move that mirrors the distribution phase of late 2024.

When the OGs sell, markets listen. This isn't panic selling... yet. But when wallets holding BTC for 3+ years start moving coins to exchanges, it's the blockchain equivalent of hedge funds quietly exiting through the fire escape.

The real question? Whether this is smart money taking profits or the first domino in a larger unwind. Either way, it's a stark reminder: in crypto, even the most devout 'HODL' sermons eventually meet their 'sell the news' moment.

(And let's be real—if Wall Street did this much 'distribution,' they'd call it insider trading.)

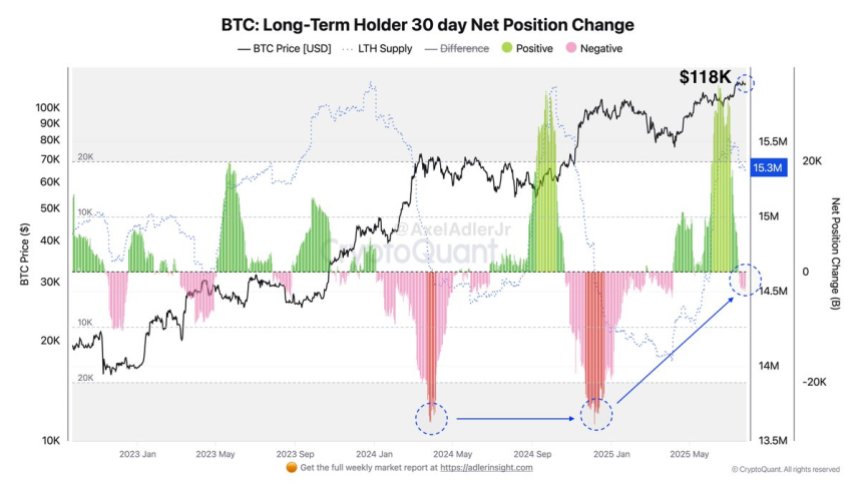

LTH Distribution Begins As Bitcoin Mirrors Fall 2024 Pattern

Top analyst Axel Adler has highlighted a key development in Bitcoin’s current structure. According to Adler, LTH supply has declined by 52,000 BTC so far, marking a significant shift in behavior. These holders, typically seen as the market’s most patient participants, are now beginning to reduce their exposure—just as bitcoin remains locked in a tight consolidation range.

This shift from accumulation to distribution closely mirrors the LTH behavior seen during fall 2024, when Bitcoin climbed from $65,000 to $100,000. In that period, long-term investors steadily sold into strength as the market pushed higher, locking in profits as late-stage momentum kicked in. Adler suggests that if the current trend continues, the distribution phase will intensify with each price leg up—just as it did in previous macro cycles.

The timing of this transition is critical. Bitcoin continues to hover just below all-time highs, while altcoins have begun to show signs of increased volatility. As ethereum and other major assets begin to move more aggressively, capital rotation may accelerate. Whether this benefits or pressures Bitcoin remains to be seen.

BTC Holds Steady As Tight Range Continues

Bitcoin remains in a tight consolidation range between $115,724 and $122,077, with the 4-hour chart showing price currently hovering around $118,817. After bouncing from the lower boundary last week, BTC has managed to recover and now trades above the 50 SMA ($118,175), 100 SMA ($118,228), and well above the 200 SMA ($113,777). These moving averages have flattened, reflecting the ongoing equilibrium between buyers and sellers.

Despite several tests of the $118K zone, BTC continues to respect the key support levels, showing resilience as selling pressure remains muted. Volume, however, remains low—suggesting that traders are still in wait-and-see mode, looking for a decisive breakout before committing to larger positions.

The upper resistance at $122K remains untouched since mid-July, and each approach has been met with rejection. A clean break above this level with volume confirmation WOULD signal a continuation of the broader uptrend and could trigger a move toward new all-time highs. On the downside, a break below $115K would invalidate the current structure and likely lead to increased volatility.

Featured image from Dall-E, chart from TradingView