Bitcoin to $250K, Ethereum to $10K by December? Arthur Hayes Drops Bombshell Prediction

Crypto's bull whisperer just lit the fuse.

Arthur Hayes—BitMEX co-founder and perpetual crypto bull—thinks Bitcoin could 5x and Ethereum could triple before New Year's Eve. No caveats, no 'maybe-if-the-Fed-pivots.' Just raw, unfiltered conviction.

The case for melt-up

Institutional FOMO meets supply shock. Spot ETFs hoovered up coins while miners held tight post-halving. Retail’s still sidelined—until they’re not.

Ethereum’s stealth play

While Bitcoin grabs headlines, ETH’s deflationary mechanics are doing the dirty work. Real yield meets meme coin degeneracy. A beautiful catastrophe.

Wall Street’s worst nightmare: a market that ignores their 'carefully calibrated' targets. Again.

Why Bitcoin And Crypto Is The Bubble Of Choice

Hayes’ historical analogy is China’s 1990s–2020s property boom, where a five‑thousand‑percent expansion of M2 forced households into apartments, inflating land values and local‑government coffers. In the United States, he contends, the socially acceptable pressure valve will be digital assets.

Two policy shifts underpin that call. First, retirement plans—an $8.7 trillion pool—may now allocate to crypto under a recent executive order. Second, the Trump campaign’s floated proposal to eliminate capital‑gains tax on digital assets could, in Hayes’ words, provide “insane war‑driven credit growth” with “no fucking taxes.” The broader attraction for politicians, he claims, is demographic: younger and more diverse investors own crypto in greater proportions than they own equities, so a bull market would “create a broader, more diverse set of people who are pleased with the ruling party’s economic platform.”

Even a credit‑fuelled boom must find an audience for the mounting federal deficit. Hayes’ solution is the stablecoin sector, which already places most of its assets under custody in US Treasury bills. On-chain data, he notes, suggest that roughly nine cents of every new dollar in total crypto market value migrates into stablecoins. “Let’s assume that Trump propels the total crypto market cap to $100 trillion by 2028,” he writes; “that would create roughly $9 trillion in T‑bill purchasing power.”

The mechanism recalls World War II financing, when the Treasury skewed issuance toward short‑term bills. In Hayes’ view, a self‑reinforcing loop emerges: wartime procurement fuels credit expansion, higher credit lifts crypto, larger crypto capitalization feeds stablecoin demand for T‑bills, and those purchases backstop further deficits.

Trading Tactics—And The Year‑End Call

Against that macro backdrop Hayes declares his investment vehicle, Maelstrom, “fully invested,” and explains why: “It’s pretty simple: Maelstrom is fully invested. Because we are degens, the shitcoin space offers amazing opportunities to outperform Bitcoin, the crypto reserve asset. […] Ether has been the most hated large-cap crypto. No more; the Western institutional investor class, whose chief cheerleader is Tom Lee, loves Ether. Buy first, ask questions later.”

His numerical convictions are explicit: Bitcoin $250,000 and Ether $10,000 by 31 December 2025. The Western credit geyser is, he writes, “about to tear the market a new asshole.” Yet he repeatedly reminds readers that these are personal views, not investment advice.

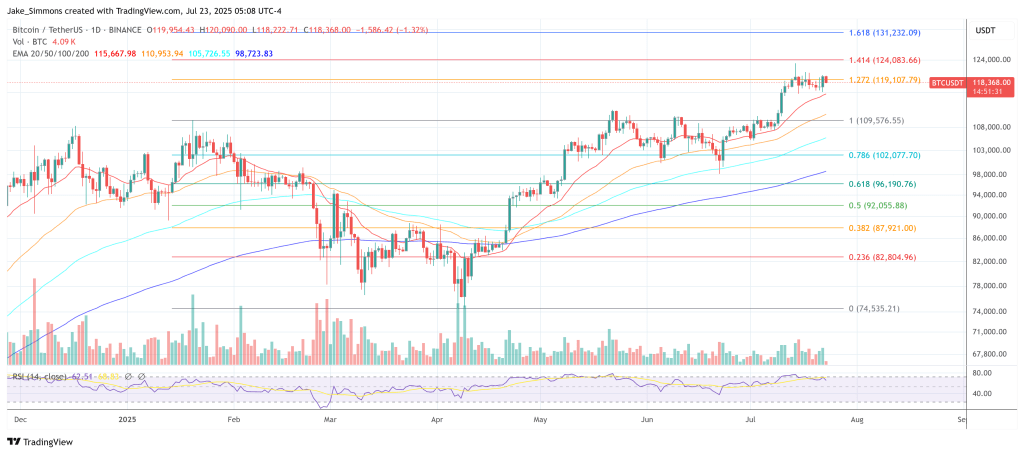

At press time, bitcoin traded at $118,368.