TRON Surges Past Ethereum in Fee Revenue – TRX Burn Rate Hits Overdrive

Move over, Ethereum—TRON’s heating up the fee market. The blockchain’s revenue from transaction fees just flipped ETH’s, and its accelerated TRX burn mechanism is turning heads.

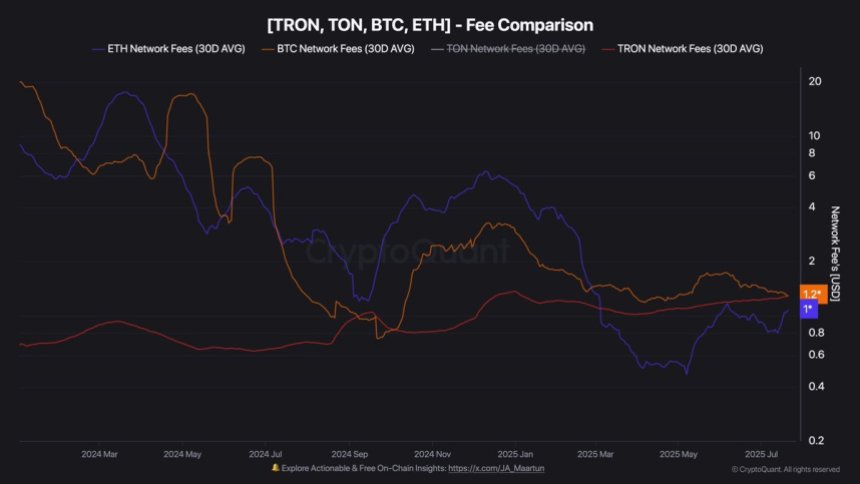

Fee Wars Heat Up

While Ethereum’s network creaks under legacy bloat, TRON’s leaner architecture is cashing in. More transactions, lower costs—basic math even Wall Street ‘geniuses’ could grasp.

Burn Notice

Every surge in network activity fuels TRX’s deflationary mechanism. The faster it processes, the more tokens get torched—a self-reinforcing cycle that’s got traders whispering ‘supply shock.’

Ethereum’s got the brand recognition, but TRON’s playing chess while others check gas prices. Whether this is sustainable or just crypto’s latest game of musical chairs? Place your bets.

Rising Fees and Explosive On-Chain Activity Fuel Tron Burn Rate

According to top analyst Darkfost, the surge in Tron’s network fees is not solely the result of recent protocol-level adjustments. Instead, it’s being reinforced by a steady and significant rise in on-chain activity. Tron has now processed more than 14 billion cumulative transactions — a staggering figure that underscores the network’s consistent utility. On a monthly basis, the network averages around 8.5 million transactions, signaling not just speculative interest but actual demand and adoption across a range of applications.

What’s remarkable is that despite the increase in transaction costs, user activity continues to climb. This resilience points to Tron’s growing relevance in sectors like stablecoins, gaming, and DeFi, where low-cost, high-throughput performance is essential. The uptick in usage isn’t just a bullish signal on its own — it also has direct implications for tokenomics.

Each transaction on Tron burns a small amount of TRX, meaning that rising activity naturally accelerates the burn rate. This creates a powerful positive feedback loop: increased usage leads to more TRX being burned, gradually reducing the circulating supply. As demand stays strong and supply decreases, the underlying value of TRX finds structural support. This deflationary mechanism, combined with growing adoption, positions Tron as one of the more resilient altcoins in today’s competitive market landscape.

TRX Price Action Holds Strong Despite Minor Pullback

Tron (TRX) is showing strong technical resilience after reaching a yearly high of $0.3344 last Friday. As of now, TRX is trading at $0.3137, following a modest pullback, but the broader trend remains clearly bullish. The chart reveals a well-formed ascending structure supported by the 50-day moving average (blue), which has acted as dynamic support throughout the uptrend since March.

Importantly, TRX is still holding well above the $0.30 psychological level, a critical support zone aligned with the recent breakout area. This suggests that the current MOVE is likely a healthy consolidation after a strong multi-week rally, rather than the beginning of a reversal.

The slope of the 100-day and 200-day moving averages (green and red) has started to turn upward, confirming the shift in momentum. If bulls manage to maintain control and defend the $0.30 level, TRX could soon retest its recent highs and potentially push toward the $0.35–$0.36 region.

Featured image from Dall-E, chart from TradingView