$2 Billion Liquidity Tsunami: Why Bitcoin’s Next Rally Could Be Imminent

Brace for impact—Bitcoin's gearing up for another gravity-defying act.

Fresh liquidity injections are flooding the crypto markets, and analysts are betting big on BTC's next leg up. Here's why the smart money's positioning for a breakout.

The Liquidity Catalyst

A staggering $2 billion wave of capital is poised to hit crypto markets—the kind of fuel that's historically ignited parabolic moves. Market makers are already adjusting their order books, while OTC desks report surging institutional interest.

Technical Tailwinds

BTC's consolidating in a textbook continuation pattern after its last 30% surge. The $2 billion inflow could be the spark that turns consolidation into conquest—with liquidity gaps above current prices acting like magnetized price targets.

The Institutional Angle

Wall Street's latest 'discovery' of crypto (only a decade late) means these inflows carry more weight than 2017's retail frenzy. Though let's be real—most tradFi analysts still can't explain UTXOs without consulting their junior associates.

One thing's certain: When this much money moves, volatility follows. Whether you're stacking sats or trading the ranges, keep your seatbelt fastened.

Bitcoin To Benefit From Fresh Liquidity

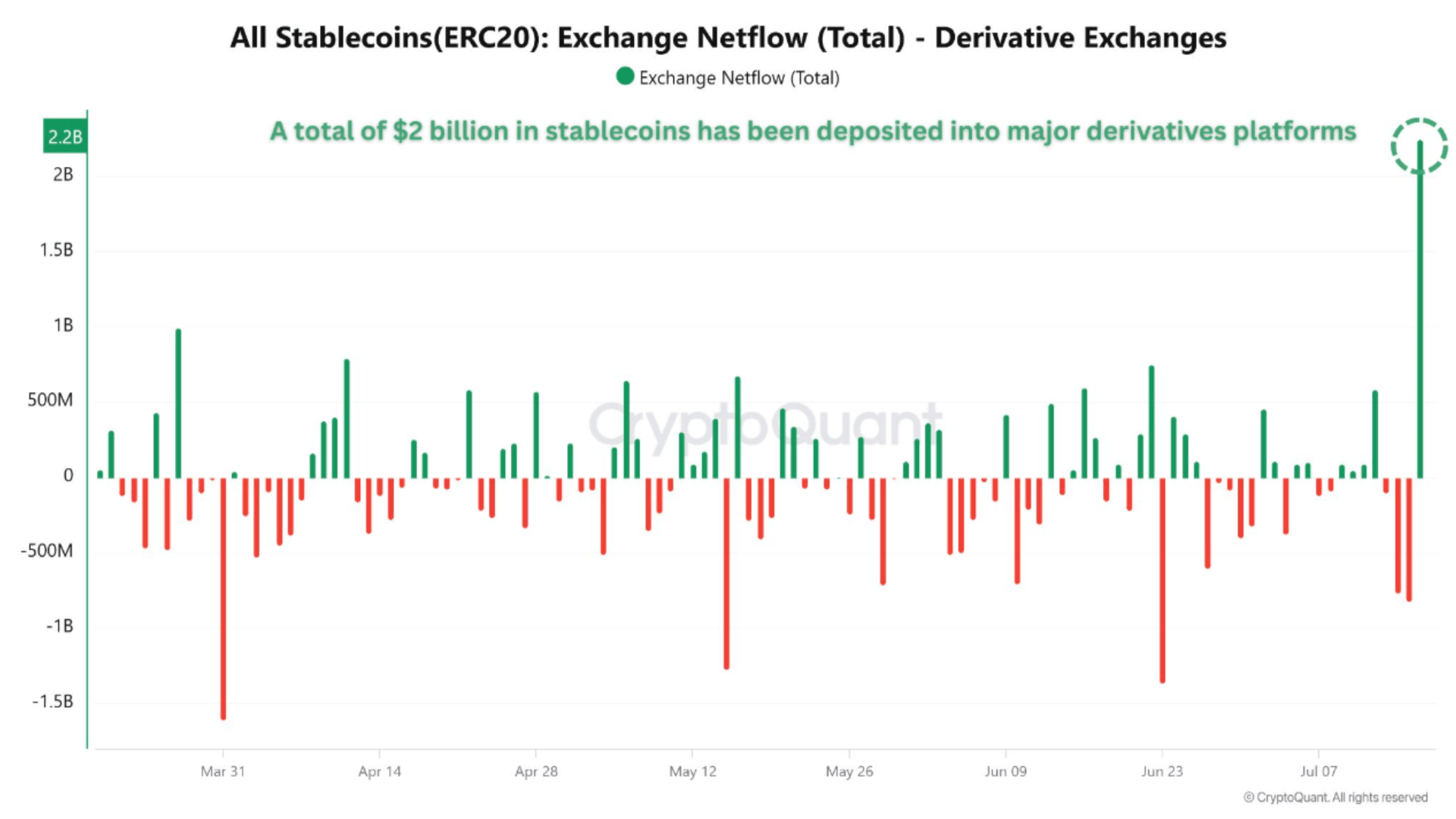

According to a CryptoQuant Quicktake post by contributor Amr Taha, more than $2 billion worth of stablecoins – primarily Tether (USDT) – were deposited into major derivatives trading platforms earlier today.

Taha believes that this surge in inflows signals increased appetite for Leveraged positions among seasoned traders, many of whom are anticipating a potential breakout in BTC’s price. Notably, this fresh batch of USDT was minted by Tether Treasury, suggesting institutional demand is driving the activity.

Historically, large-scale stablecoin inflows have preceded bullish market momentum, as traders often use them to open long positions on Bitcoin and altcoin futures and perpetual contracts. Rapid stablecoin deposits into derivatives exchanges often act as a leading indicator for major price rallies.

Meanwhile, fellow CryptoQuant contributor TraderOasis pointed to rising Open Interest, noting that it is increasing alongside BTC’s price – a classic signal of strong bullish sentiment.

To explain, rising open interest in tandem with a rising Bitcoin price typically signals increasing market participation and bullish sentiment, as more traders are opening positions expecting further upside. However, it can also indicate a buildup of leverage, which may lead to heightened volatility or a sharp correction if sentiment shifts.

The analyst also highlighted the Coinbase Premium Index, which remains above zero – a sign that US-based buyers are paying a premium over global spot prices. They added that the indicator is currently within a ‘Breaker’ structure, sharing the following chart for context.

TraderOasis noted that while BTC price is rising, the Coinbase Premium Index indicator has remained relatively flat. The analyst explained:

This suggests to me that major players are taking profits. If the descending trend structure I marked with an arrow is broken, the price is likely to rise much more strongly. On the other hand, if the indicator drops below the ‘0’ level, I may consider it a buying signal, as we are still in a macro bullish market.

Short-Term Pullback For BTC?

While the $2 billion stablecoin injection is likely to act as a bullish catalyst for BTC and the broader crypto market, some exchange data suggests a potential short-term pullback before the next leg up.

For instance, BTC deposits to exchanges spiked after the digital asset hit a recent high around $123,000 – a pattern that often precedes local tops and is typically followed by a price correction.

That said, despite recent profit-taking, BTC has not experienced a major price drop, pointing to robust underlying demand. At press time, BTC trades at $119,171, up 2.4% in the past 24 hours.