SharpLink Gaming Doubles Down: $19.5M Ethereum Purchase Signals Unstoppable Institutional Demand

Another day, another nine-figure crypto bet by institutions playing catch-up.

SharpLink Gaming just dropped $19.5 million into Ethereum—because apparently traditional finance finally realized yield farming beats 0.1% savings accounts.

The move comes as ETH flirts with post-merge highs, proving once again that Wall Street's 'blockchain not Bitcoin' mantra now extends to 'blockchain and whatever makes us money this quarter.'

While retail traders obsess over memecoins, the smart money keeps stacking ETH like it's 2021. Only this time, they've got custodians—and probably better exit strategies.

Funny how institutions always discover volatility right when their balance sheets need it most.

The combination of strong price action, increasing corporate interest, and supportive on-chain metrics suggests that ethereum could be leading the next leg of the altcoin rally, especially if Bitcoin continues to consolidate and investors shift focus to undervalued opportunities across the ecosystem.

SharpLink Becomes Largest Corporate Holder Of Ethereum

SharpLink Gaming has officially become the largest corporate holder of Ethereum, with a total of 280,706 ETH now held in its treasury, valued at approximately $840 million at current market prices. The company’s aggressive accumulation strategy signals a new phase in institutional Ethereum adoption, reinforcing the growing perception of ETH as a long-term strategic asset.

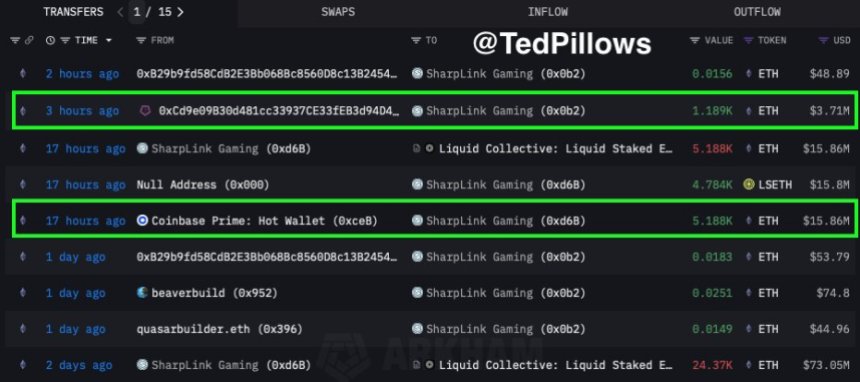

Top analyst Ted Pillows confirmed SharpLink’s latest purchase using on-chain data, which shows that the ETH was acquired through a Coinbase Prime hot wallet—a platform commonly used by institutions for large-scale crypto transactions. According to a press release, SharpLink raised $413 million through the issuance of over 24 million new shares between July 7 and July 11, capital it promptly deployed into the crypto market.

In total, the firm acquired 74,656 ETH over the past week at an average price of $2,852 per coin. This aggressive buying spree not only reflects SharpLink’s treasury strategy but also highlights a broader trend among institutional players of turning to ETH as a Core asset.

As traditional companies seek alternatives to cash and government bonds, Ethereum’s maturing ecosystem and growing staking participation make it an increasingly compelling option. SharpLink’s bold MOVE may inspire other public firms to explore ETH as a reserve asset.

ETH Weekly Chart Signals Trend Reversal

Ethereum is showing strong bullish momentum on the weekly chart. The price is currently trading at $3,155.21, up over 6% for the week. The breakout above the key resistance zone at $2,850 is now confirmed. Marking a significant shift in market structure after months of consolidation and bearish pressure. This move pushes ETH to its highest weekly close since early 2024.

Technically, Ethereum has reclaimed all major moving averages: the 50-week SMA ($2,645), 100-week SMA ($2,659), and 200-week SMA ($2,427). This alignment supports a longer-term bullish reversal and confirms that momentum has shifted in favor of buyers. The clean break above the previous resistance adds strength to the move. And sets the stage for a potential rally toward the $3,600–$3,800 range in the coming weeks.

The reclaim of $2,850—a zone that had acted as strong resistance for months—now flips into support. If Ethereum continues to hold this level on a weekly closing basis, it will likely attract more institutional attention.

Featured image from Dall-E, chart from TradingView